British Pound Higher on Earnings and Jobs Data

The British pound is the outperformer on global currency markets on the back of some strong economic data.

Labour-led Government = Higher Rates Sooner according to new research reports.

Ahead of the weekend the UK currency is pushing higher against the euro, US dollar, Aussie dollar, Kiwi dollar, SA Rand and other key units.

It was revealed by the UK’s official statistics body that the number of people in jumped by its biggest amount in almost a year in the three months to February.

The unemployment rate fell to its lowest in nearly seven years.

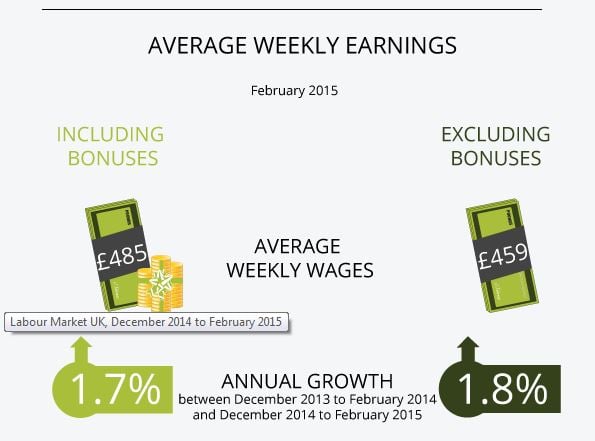

Importantly for the currency it was shown wages were on the increase. This is key as this is one component of the economic picture that the Bank of England is focussed on.

Essentially the Bank will be more open to raising interest rates once wage increases are shown to be in an established upward trajectory.

The general golden rule for currencies at this time is that higher interest rates = a higher currency.

Rate Hike in November say Danke Bank

On the topic of the all-important central bank decision-making agenda we hear the Bank of England will raise interest rates in November.

This is according to the latest note to clients issued by Signe Roed-Frederiksen, Senior Analyst at Danske Bank:

“While our expectations for today’s figures do not deviate substantially from market consensus we still look for a general improvement in economic data in the coming months to support our call for an earlier-than-market-priced time of rate hike take-off: we expect the Fed to hike in September and BoE to hike in November”.

Labour Government = Higher Rates Sooner

Politics is never far from the economic and currency discussion at present.

We maintain a view that there is a tendency for many commentators to over-egg the impact the election is having on markets at the present time.

It is often easier to just explain away GBP moves using the now overused phrase ‘election uncertainty’ than dig deeper and explain to audiences what the real drivers are.

We have no doubt that volatility will eventually be seen in coming weeks, but as of now evidence that the elections are driving the UK unit is sparse.

With that in mind we find the latest news from AXA Investment Management and BlackRock as being eye-opening.

AXA Investment Managers to Blackrock Inc. say a Labour-led government could put pressure on Bank of England officials to increase interest rates earlier than markets expect.

From where we are sitting this looks like a positive for the pound sterling, over a one to two year timeframe at least.

“We see the fiscal relaxation expected with a Labour-led coalition majority or alliance with the SNP as providing a short-run boost to GDP,” said David Page at AXA.

AXA expect such an initial boost to GDP to result in a quicker tightening of monetary policy, and rising gilt yields and sterling to reduce the initial boost to GDP in the latter stages of the parliament.

“On that basis you would think that given the strength in the economy, given the fact the central bank would see this as a slight change, you would expect the BOE to go a little bit quicker,” adds Ian Winship at BlackRock.