British Pound Boosted as UK Economic Growth Powers Ahead

The British pound has rallied higher once more thanks to better-than-expected UK economic growth data.

It was shown on the final day of March that the UK economy grew 3% over the course of the previous year – well ahead of predictions for 2.7% and well ahead of the Eurozone.

Looking at the 2014 period (as opposed to the year to March), the economy grew 2.8%, revised up from a previous estimate of 2.6%, marking the biggest expansion since 2006.

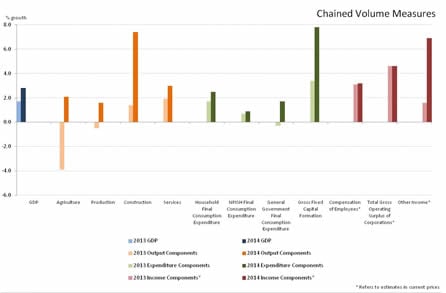

As we can see the growth came from right across the economy which will encourage the Bank of England who want to see a balanced economic growth profile:

The pound sterling strengthened across the board on the back of the data.

“Sterling hit a day high of 1.3750 against the euro which was weakened by news of a German lender needing rescuing, and 1.4790 against the dollar following the GDP release,” says Andy Scott from HiFX.

The data comes as the UK heads into an uncertain political period with pundits calling the tightest election in decades.

The strong data should theoretically provide a boost to the incumbent Conservative/Lib Deb alliance. However, the political premium that would normally be expected from a growing economy has thus far failed to translate into increased polling support for the Government.

Dennis de Jong, managing director at UFX.com says:

“With Parliament dissolved, all eyes are on May’s general election and today’s impressive UK GDP figures will provide David Cameron with some much-needed ammunition ahead of Thursday’s live party leaders’ debate.

“The figures mask domestic problems such as zero-hour contracts, soaring rents and the North-South divide, as well as larger geopolitical concerns in the Middle East and economic woes in the Eurozone.

“But the fact remains that Britain's economy is growing faster than that of every other major developed country.”

While the GDP data has heled the UK exchange rate complex we do hasten to point out that we are entering a new month that brings with it new data.

This shortened week will see the release of Manufacturing PMI out on Wednesday which will give some insights into the immediate state of the UK economy.

Look out for further PMI readings next week while the pound v US dollar will be exposed to US Non-Farm Payroll figures on Friday.