Pound Sterling Rally Undercut by Falling Stocks

- Written by: Gary Howes

Image © Adobe Images

The British Pound rose in the wake of the Bank of England's May interest rate hike and guidance but soon retreated as investors booked profit on the rally and turned cautious amidst a selloff in global stock markets.

The Dollar rallied over the course of the past 24 hours and could be set for a further advance should investors demand the safety of the world's most liquid financial asset amidst falling stock markets.

The Pound is meanwhile typically assessed by analysts to be sensitive to equity market selloffs, particularly given the recent rally leaves it relatively expensive in the short term.

Analysts say stocks came under renewed pressure on renewed fears for mid-tier U.S. Banks and an earnings miss suffered by Disney.

U.S. banks lead markets lower after PacWest Bancorp reported a drop in deposits last week and pledged an additional $5.1 billion of its loans to the central bank.

Disney meanwhile fell 6.0% after it reported a fall in subscriber growth that heralds an impending slowdown in U.S. economic activity.

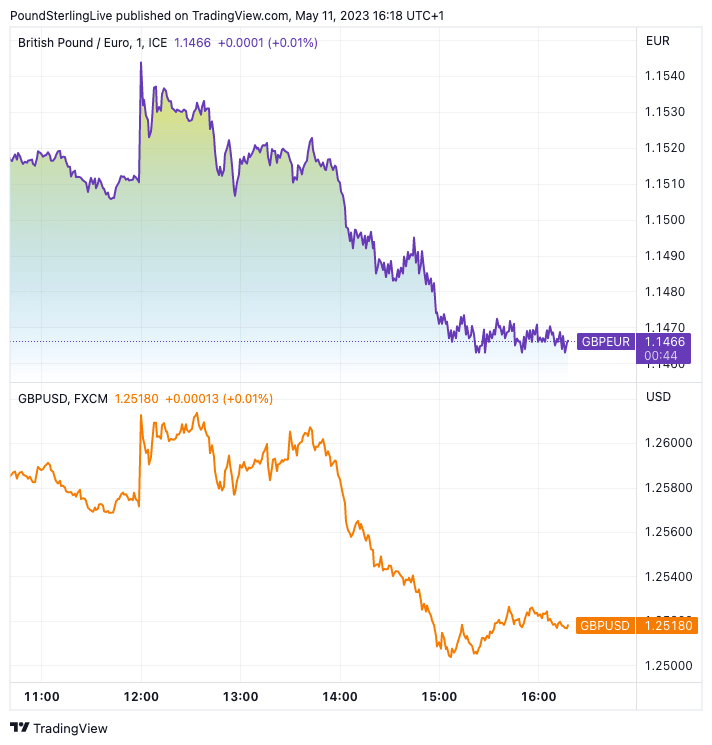

The Pound to Euro exchange rate (GBPEUR) spiked to 1.1544 in the wake of the Bank of England before retreating to 1.1488 as risk-off conditions took hold.

The Pound to Dollar exchange rate (GBPUSD) rose to 1.2610 before declining to 1.2500 after demand for the Greenback increased through the U.S. trading session.

U.S. market jitters come at the tail-end of a solid run for the Pound which is 2023's top-performing major currency that leaves it particularly exposed to position-squaring.

"A lot of the domestic good news for the UK is now in the price" of the Pound, says Shreyas Gopal, Strategist at Deutsche Bank. "Having been bullish on the pound since the start of the year, we no longer think the pound presents attractive risk-reward in the short term."

"The recent GBP rally in FX spot vs the USD and EUR has exceeded the improvement in its relative fundamentals," says Valentin Marinov, head of FX research and strategy at Crédit Agricole.

But the downside for the currency could be limited as the Bank of England ultimately validated the market's current expectations for further hikes.

The 2022 Bank of England playbook saw policymakers consistently warn investors that they were expecting too much by way of hikes, a message that inevitably resulted in GBP weakness.

Above: GBP/EUR (top) and GBP/USD showing post-BoE price action.

But the Bank changed its tone in March by simplifying its message to say it was now entirely data dependent, resulting in a rally in the Pound.

This message remains in place in May.

"The door to further rate hikes remains open, should inflation pressures persist. The MPC didn’t push back against the recent upward shift in the OIS curve," says Stefan Koopman, Senior Macro Strategist at Rabobank.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

For the Pound, therefore, the overall flavour of the Bank's guidance is supportive and for now, any weakness might be shallow (provided global equity markets don't suffer significant falls from here).

"We believe a 'baker's dozen' is in the making when the MPC meets again in June and forecast a thirteenth move towards 4.75%. We might then see a pause, but risks are to the upside," says Koopman.

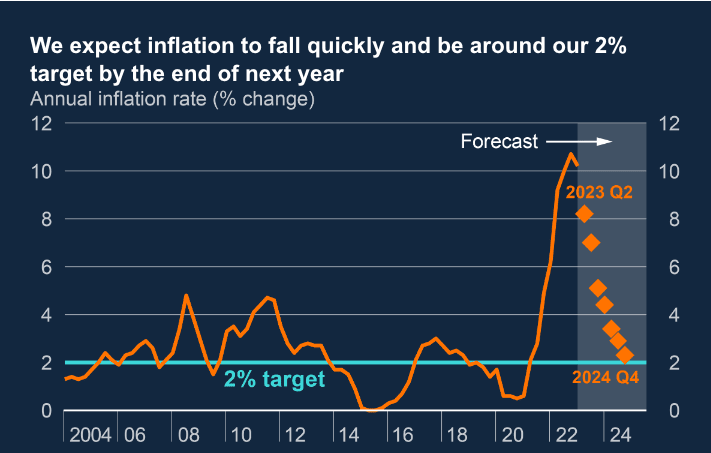

Indeed, the Bank of England said "the path of demand is likely to be materially stronger than expected" and inflation risks are still "skewed significantly to the upside".

Governor Bailey was even more outspoken in the press conference saying, "second-round effects are unlikely to go away".

Above: BoE inflation forecasts show policy makers still expect a sharp fall in prices.

Such language on inflationary risks was absent in the March statement and guidance owing to banking sector uncertainty.

According to the Bank of England's forecasts, the UK economy is now expected to escape a recession thanks to stronger global growth, lower energy prices, fiscal support and a resilient labour market.

In fact, the Bank issued the largest GDP upgrade in its history: the economy is expected to grow 0.25% this year (vs. -0.5% forecast in February) and 0.75% in 2024 and 2025 (vs. -0.25% and +0.25% respectively).

Analysts at Goldman Sachs say May's update forms a significant change in the Bank's outlook, one that is consistent with the significant fall in gas prices and tighter labour market.

However, analysts at the Wall Street bank say the update also comes with a less dramatic adjustment in the Bank's policy approach (the statement was noncommittal about further tightening, for example).

"Nevertheless, we continue to believe that factors that acted as a headwind on Sterling in 2022 are turning more supportive, including monetary policy," says Michael Cahill, G10 FX Strategist at Goldman Sachs.

Cahill says the Bank's May decision and guidance meet his team's expectations and factors that led them last week to upgrade their GBP view and issue a short EUR/GBP trade recommendation.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes