Pound Sterling: Bank of England Could Trigger Another Sell-off against Euro and Dollar

- Written by: Gary Howes

- 50bp hike would be initial GBP disappointment

- ING sees 5 reasons for a 50bp move

- But could falling rate hike expectations now be supportive?

- Forecasts and guidance also a key risk

- As was the case in August

Above: File image of Andrew Bailey. Edited from original @ Association of British Insurers, reproduced under Creative Commons Licensing.

The British Pound will react to the Bank of England's interest rate decision at 12PM and should remain volatile over the following hours as investors digest the Bank's latest forecasts and guidance contained in the Monetary Policy Report (MPR).

The market is prepared for a 75 basis point hike as the Bank fights to bring double-digit inflation back down to 2.0%.

"The Bank of England’s modest 0.5% interest rate hike in October probably contributed to the market chaos caused by Liz Truss’ catastrophic mini-budget. It's unlikely the Bank of England will repeat the mistake, and we expect rates to rise by at least the 0.75% the market is expecting," says Nicholas Hyett, Investment Analyst at Wealth Club.

The initial risk for the Pound is the Bank underwhelms and goes with a 50bp move, such a disappointment would be in keeping with the Bank's recent form: the Monetary Policy Committee has tended to underwhelm against market expectations since it first hiked in late 2021.

(If you are looking to secure your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

"The overall economic picture is probably better now than it was a month ago. The bank may well feel it can ease its foot off the gas going forwards – with rates rising slower and ending lower than we might have thought even a few weeks ago," says Hyett.

Analysts at various UK forex brokers say the Pound would likely fall if the Bank underwhelms with a 50bp hike.

"Fiscal Policy is expected to be a lot tighter now as well than September, so could the Bank only hike by 0.5%? If so, we could see the pound weaken following the meeting," says Thanim Islam, Dealer Manager at Equals Money.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

George Vessey, currency analyst at Western Union Business Solutions, is also on the lookout for a smaller hike and the downside risks this poses to the Pound.

"The Bank of England is expected to raise its key Bank Rate by 75 basis points this Thursday – which would be the biggest UK rate hike since 1989. Money markets have pared back UK rate hike expectations lately, but arguably not enough – and the pound will be at risk of depreciating if the BoE delivers a smaller-than-expected hike," says Vessey.

Ahead of the decision the Pound to Euro exchange rate trades at 1.1620 having risen through October, with euro payment rates at high-street banks at approximately 1.1386 and those quoted at independent payment providers at 1.1580.

The Pound to Dollar exchange rate is quoted at 1.1480 following a near-3.0% recovery in October, with banks now quoting payment rates at around 1.1250 and independent providers around 1.1450.

Beyond the initial rate hike, the market will react to the release of crucial economic forecasts from the Bank's economists as well as broader guidance from Bank Governor Andrew Bailey.

These are arguably more important for the Pound, as was proven by the enduring downside reaction to August's Monetary Policy Report which surprised on account of its pessimism regarding the economic outlook.

"We expect a further acceleration of the rate-hike process (we see the bank rate rising by 75bp hike to 3.00%), but the message the UK central bank delivers on its policy intentions will probably be even more sensitive. We expect another hike to 4.00% in December with the bank rate remaining unchanged thereafter, which is not a great prospect for sterling," says Roberto Mialich, FX Strategist at UniCredit.

In August the Bank forecasted a five-quarter recession on account of the market's expectation for Bank Rate to rise to a peak of 3.0%.

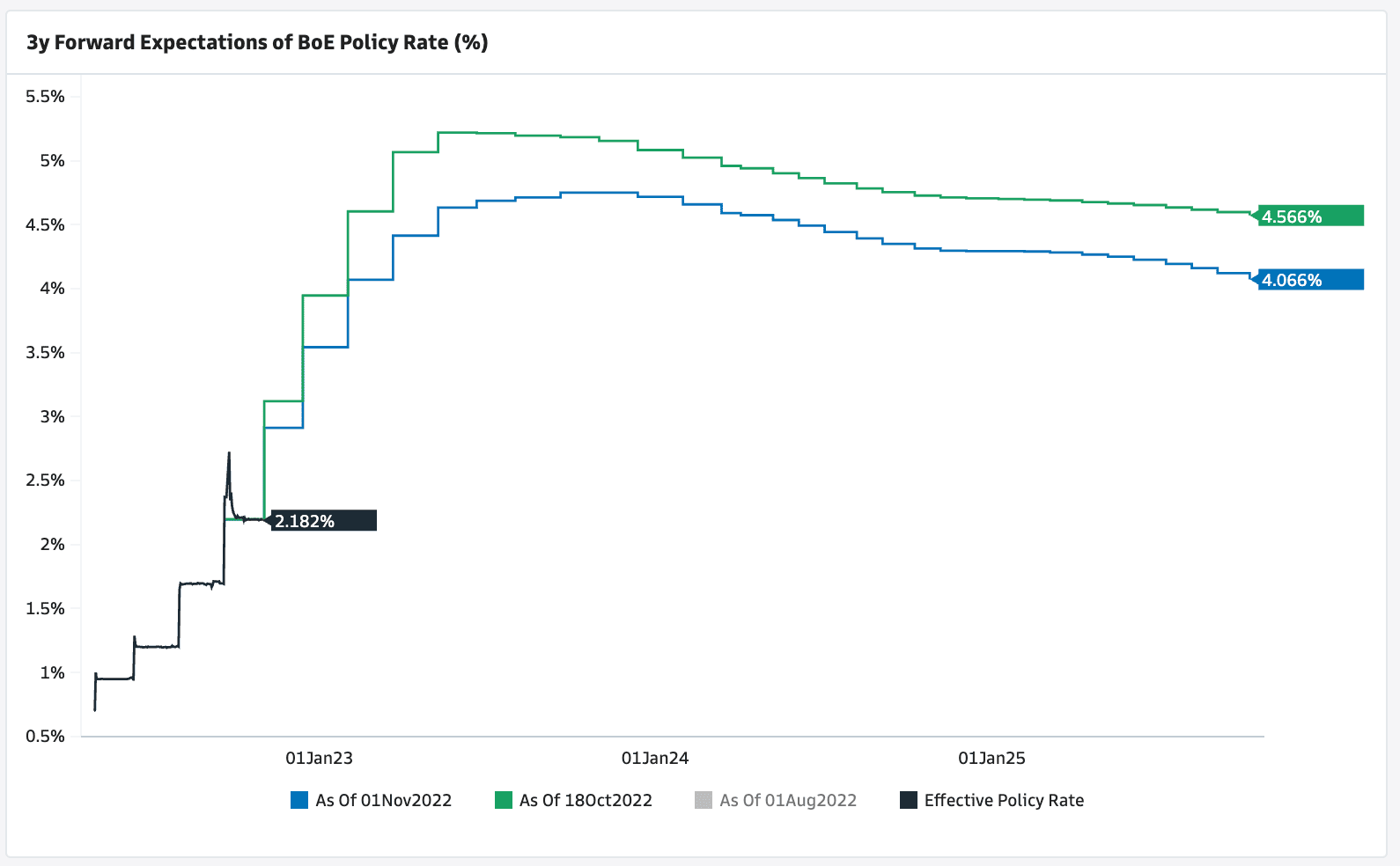

Markets now anticipate a peak of approximately 5.0% creating a risk the Bank releases an even more dire set of economic forecasts that spooks the market and sends Sterling lower.

The Bank will therefore likely push back at current market expectations, even though they have come down substantially since the volatile days of the September 'mini budget' and its ensuing fall-out.

Above: Terminal Bank Rate expectations have shifted lower, without detriment to the Pound.

Even Catherine Mann, one of the most hawkish members of the MPC, has said markets are "too aggressively priced".

"That frames the messaging we can expect from Thursday’s meeting," says James Smith, Developed Markets Economist at ING Bank.

ING says it is unlikely Bank Rate will go above 4%.

Any adjustment lower in market expectations could drag on the Pound, as was the case in August.

But the surge in UK interest rate yields and Bank Rate hike expectations through September did little to bolster the Pound, in fact, the opposite happened as the currency plumbed record lows against the Dollar.

By contrast, October's recovery by the Pound was correlated with a pullback in UK bond yields and interest rate expectations.

Therefore, it is not entirely unlikely that the Pound proves ambivalent to paring back in rate hike expectations.

Indeed it could even benefit as a lower terminal rate implies less damage to the economy going forward.

This therefore makes the November policy update an interesting one for investors and promises volatility in Pound exchange rates as the Bank's message is digested over the coming days.

ING: 5 Reasons to Expect a 50bp Hike

Analysts at ING say they would not be surprised if the Bank goes for a 50bp hike. Economist James Smith cites five reasons to expect such an outcome:

- the fact that we’re essentially back to square one on the mini-budget also reduces the pressure for a jumbo hike.

- the economic dataflow doesn't provide a clear enough justification for more aggressive tightening

- trade-weighted sterling is actually now stronger than it was at the time of the September meeting

- the Bank will be acutely aware that hiking by 75bp sets a precedent

- the committee is divided. While three members voted for a 75bp hike in September, one rate-setter – Swati Dhingra – voted for just 25bp. We think other committee members will remain reluctant to step up the pace of rate rises this late into its hiking cycle.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes