BoE: Pound Sterling Risks Decline vs. Euro & Dollar on 25bp Hike Surprise

- Written by: Gary Howes

- GBP priced for 50bp hike

- Anything less could result in declines

- Some economists 25bp more likely

- Posing GBP downside risks Thursday

Image © Adobe Images

The British Pound started August with solid gains against both the Euro and Dollar but risks decline later this week if the Bank of England underwhelms and delivers a 25 basis point interest rate hike on Thursday.

Money market pricing shows investors are fully positioned for a 50 bp hike from the Bank's Monetary Policy Committee as it hardens its response to rising UK inflation and inflation expectations amongst consumers and businesses.

But some prominent economists warn a 50bp hike is not yet a done deal and there are reasons to expect the Bank to maintain its preference to move in 25bp increments, suggesting downside risks to the Pound.

"YouGov's measure of households' expectations for inflation in 5-10 years' time fell again in July, to 3.8%, from 4.0% in June. Year-ahead expectations also fell to 6.0%, from 6.1%. Balance of data developments since the MPC's June meeting suggests 25bp hike more likely than 50bp," says Samuel Tombs, UK Chief Economist at Pantheon Macroeconomics.

Tombs is consistently one of the UK's most accurate economic forecasters according to quarterly Bloomberg and Reuters polls.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Inflation expectations for 12 months' time edged down to 6.0% from 6.1%, the same survey cited by Tombs showed.

The Bank of England is particularly attuned to inflation expectations as they can be swayed by changes in interest rates.

Although inflation expectations as measured by Citi and YouGov appear to have peaked, they are still well above the Bank of England's 2.0% target, meaning most economists don't expect the data to way the Bank.

This alone will maintain the odds of a 50bp hike.

"Our expectation is that the MPC meeting (Thursday) will join its peers in accelerating the pace of its rate rises by delivering a 50bp increase in Bank Rate to take it to 1.75% amid firming domestic inflationary pressures," says Alvin T. Tan, FX Strategist at RBC Capital Markets.

But because the market is so heavily invested in a 50bp bet, Pound Sterling could be at risk of decline should the Bank disappoint against these expectations on Thursday.

Further risks come in the form of a 50bp hike but the Bank signals a downbeat outlook, lowering medium-term growth and inflation forecasts and suggesting a slowdown in the rate hiking cycle beckons.

This is exactly what the Reserve Bank of Australia did on Tuesday, sending the Australian dollar lower by a percent.

"Heading into this week’s MPC decision, markets are skewed toward a 50bp hike (47bp priced) and although this is the most likely outcome, risk-reward favours positioning for a majority vote for 25bp," says Adam Cole, Chief Currency Strategist at RBC Capital Markets.

Cole has this week made selling GBP/CHF his trade of the week as he anticipates further Franc outperformance and an unsupportive Bank of England.

The Pound to Euro exchange rate rose 2.5% through the course of July, in part buoyed by expectations for a more proactive Bank of England. The pair is back above 1.1950 at the time of writing with bank accounts offering rates at around 1.1710 for euro payments and FX specialists offering rates around 1.1910.

The Pound to Dollar exchange rate has recovered above 1.20 again and is at 1.2280 at the time of writing, meaning banks are offering payments at around 1.2040 and FX specialists are offering around 1.2210.

Viraj Patel, Strategist at Vanda Research says the reasons for the Bank to stick with a 25bps hike this week outweigh any need to raise the tempo with a 50bp hike.

"Given the macro/political uncertainty & weaker forward-looking UK data... now is precisely the wrong time for BoE to change gear," says Patel.

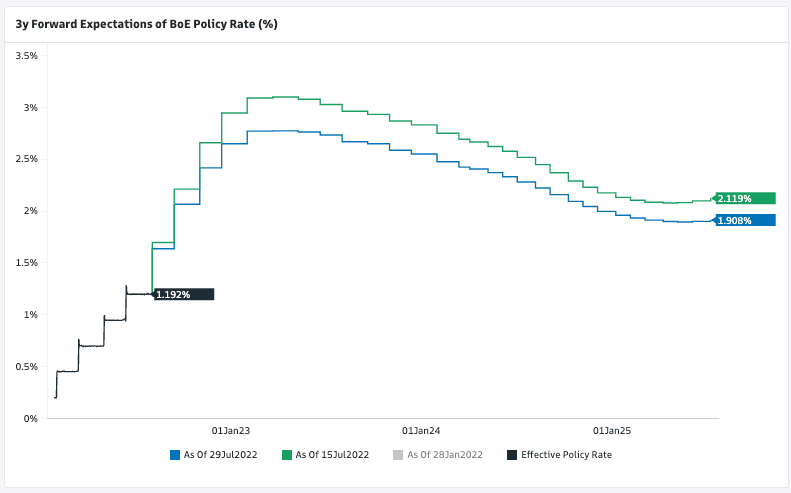

Above: Investor rate hike expectations, chart courtesy of Goldman Sachs.

"The macro backdrop remains challenging, as the economy remains at risk from the dramatic lift in energy costs. The view of a recession due to the higher cost of living, and compression of real incomes remains a significant headwind," says Joe Bond, Head of FX Sales at Citi in London.

Currency analysts at Citi hold a negative view on the UK economy and British Pound heading into this week's Bank of England event.

Citi highlights the risks of hiking base rates into an economic slowdown against a backdrop of multi-decade high inflation.

"Politics is a sideshow for GBP, as the economic backdrop provides minimal room to manoeuvre for the new Conservative leader. As the leadership contest moves forward, the areas of contention remain immigration, spending and tax," says Bond.

Analysts say a larger fiscal support package from the new Prime Minister would ease the hard landing of the UK economy, however it is at a time of higher borrowing costs.

"In the near term the UK economy remains vulnerable and rallies in GBP are an opportunity to reduce exposure," says Bond.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks