Pound Sterling: Lengthy Leadership Contest Presents Risks, Watching Gas Prices for Near-term Direction

- Written by: Gary Howes

- UK GDP beats expectations

- Gas supply issues dominate near-term

- Restricted flows leave GBP & EUR weak vs. USD

- But battle for next UK PM matters medium-term

Image © Adobe Stock

The British Pound is advancing against the Euro and Dollar amidst benign global market sentiment and a consensus-beating UK GDP data release out on Wednesday.

But the currency is likely to ultimately track developments in crisis-hit gas markets over coming days and the longer-term outlook could well depend on the policies of the next Prime Minister.

Sterling was at one stage deep in the red against all major currencies on Tuesday as investors digested news gas deliveries from Norway were to be severely reduced owing to a technical shutdown in a major gas production facility but a stabilisation in gas prices into the midweek session saw the currency retrace losses.

Any further blow-outs in gas prices could rapidly undermine the post-GDP release. gains made by the Pound at the time of writing.

UK gas contracts were trading up to 27% higher on the day at one stage on news of a shutdown of the Sleipner field, which was far higher than the 5.0% gain in equivalent European contracts.

The UK sources relatively little gas from Russia when compared to the Eurozone, but it is highly reliant on Norway.

News of the Norwegian outages come just a day after Eurozone gas prices spiked after senior German and French politicians warned the key Nordstream 1 gas pipeline from Russia to Germany might not reopen following its scheduled 10 day maintenance shutdown.

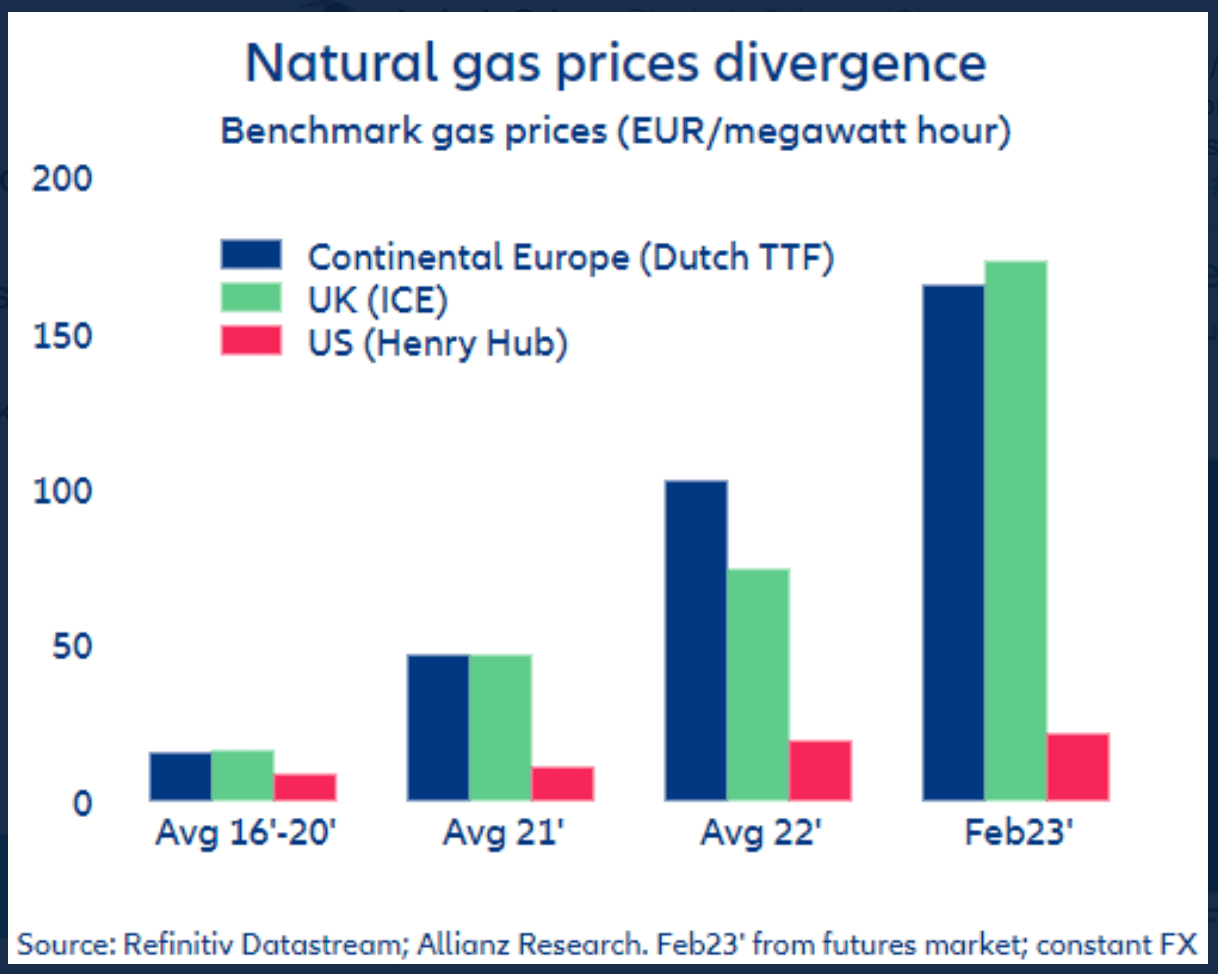

Image courtesy of @Ludovic_Subran, Chief economist at Allianz.

This greased the way for the Euro to fall to parity against the Dollar for the first time in over 20 years on Tuesday.

Gas market developments are therefore a key near-term driver for currency markets and headlines should be closely monitored.

The Pound to Euro exchange rate is looking to hold levels above 1.18 and the Pound to Dollar exchange rate remains under pressure at 1.19.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

While near-term focus falls on energy markets, the leadership contest for the UK's next Prime Minister will be watched by foreign exchange markets as the outcome could hold medium- to longer-term implications for the Pound.

Foreign exchange analysts at Goldman Sachs say in a regular weekly currency research note downside risks are once again building for the UK currency.

"The case for underperformance is building again," says Zach Pandl, Co-head of Currency Strategy at Goldman Sachs.

"We think the case for Sterling underperformance is strengthening again, mostly because of the anticipated policy response to recent events. Political uncertainty increased in the UK ... after PM Johnson’s resignation," he adds.

The Pound rose against the Euro in the week Prime Minister Boris Johnson said he would step aside once a new Conservative Party leader has been elected. (Set your FX rate alert here).

"FX markets initially traded this as a positive development for GBP, presumably on the prospect for more expansionary fiscal policy in the near term and possibly a more moderate trade policy in the medium term. But, the recent sharp deterioration in the European growth outlook complicates matters, in our view," says Pandl.

Above: GBP/USD at weekly intervals.

Goldman Sachs says government changeover could hinder a quick legislative response to fresh cost pressures.

Currency strategists at some of the UK's large high street banks agree.

"A drawn out leadership contest would most likely see early strength fade more quickly, given it would probably mean a delayed policy response at a very difficult time for the economy," says Paul Robson, a foreign exchange strategist at NatWest Markets.

Analysis from Barclays says the new Prime Minister should see limited scope for an adjustment of fiscal outlook given the large deficit from COVID-19 era, fiscal plans in 2023 could vary.

They say the next government's fiscal stance will likely affect the Bank of England's terminal rate (where the Bank ends its rate hikes).

"Where less expansive fiscal policy should be met with lower terminal rate while more expansive fiscal policy would likely trigger higher rate," says Barclays.

"At the margin, the more conservative fiscal approach may be negative to GBP in the near term, as it would imply a lower interest rate differential between GBP and other core currencies," they add.

The Pound is already down 12% in 2022, while the UK currency is largely unchanged (-0.40%) against the Euro at the half-way point of the year.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes