Pound Sterling Will Suffer in the Bank of England's Battle for Credibility

- Written by: Gary Howes

- Bank must keep hiking

- To stave off inflation

- Even if it results in recession

- And the GBP will bear the cost

Image © Adobe Images

The Bank of England has to keep hiking enough to defend its credibility, even if the UK economy is headed for recession say analysts at an international investment bank.

And according to a new research note from Bank of America Merrill Lynch (BofA) the British Pound will bear the cost of such a policy choice.

They say the Bank of England (BoE) has little choice but to hike until unemployment starts to rise, creating what economists refer to as an 'output gap'.

Raising interest rates until unemployment starts rising leaves policy makers at Threadneedle Street in an unenviable position, but BofA's economists see little other choice for the central bank whose credibility on fighting inflation is now at stake.

"The Bank of England simply needs to reinforce credibility," says Robert Wood, UK Economist at Bank of America Merrill Lynch in London.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Economists and the market are unanimous in their expectation for the BoE to raise inflation forecasts for the near term but cut growth and medium-term inflation forecasts.

For the Pound, these forecast changes promise to be one of the more important elements of Thursday's policy decision and Monetary Policy Report release.

In the past the Bank could step back from raising interest rates and delivering 'hawkish' guidance whenever the economy signalled it was slowing.

But this time is different because inflation has not been this high in more than 30 years.

"We expect it to keep hiking until unemployment rises and inflation slows," says Wood

The Bank could also announce Quantitative Tightening (QT) whereby it will start selling off the bonds it purchased under its quantitative easing programme, which was restarted during the Covid crisis to help support the economy.

Selling bonds would contribute to 'tighter' monetary conditions in the UK and work in tandem with higher interest rates in a fight against surging inflation.

But tighter financial conditions also mean the economy will slow as the cost of financing investments and expenditure rises alongside personal borrowing rates and mortgages.

BofA says announcing QT might be one tool to strengthen the message that the BoE will bring inflation back to target.

They expect the BoE to hike 25 basis points this week with an 8-1 vote in favour, with one dissenter preferring a 50bp hike.

They look for the BoE to signal that it will begin active QT in the summer, initially at £5BN a month rising to £9BN in November.

Above: Market implied interest rate expectations held by investors. Source: Goldman Sachs.

BofA meanwhile look for three more 25bp rate hikes in June, August and November after this week's meeting.

The reason for the ongoing series of rate hikes is a recognition that inflation running around 8.0% until October risks "de-anchoring".

This is where inflation created by external events (Covid lockdowns, supply chain squeezes, war in Ukraine) starts to initiate inflationary practices domestically.

This includes higher wage demands by workers and businesses pushing up the cost of their goods and services.

The BoE would hope that by raising rates and initiating QT it is signalling it will get on top of inflation, thereby preventing inflation de-anchoring.

"The BoE, in a fight for its inflation credibility, has to put even more weight on inflation stabilization and impose larger costs on output," says Wood.

He says the BoE will keep hiking until inflation starts slowing and unemployment is decisively rising.

"This is not a 'good news' economic outlook unfortunately, so the BoE will be reluctant, we suspect, to describe it plainly," says Wood.

Wood says communication can be as vital as action and the BoE needs to break its recent run of providing little guidance and "explain that a recession may result from the policies it needs to follow to return inflation durably to the target".

"You have to put more weight on inflation stabilisation when you're worried it might get engrained," says Wood.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The Pound Will Bear the Cost

Any BoE policy that is "not good news" for the economy - as per Wood's description - is understandably "not good news" for the Pound.

"Fulfilling its primary mandate is important for credibility and signalling, but it will come at a cost and, we believe, the adjustment will primarily be felt through a weaker GBP," says Kamal Sharma, a foreign exchange strategist at BoFA.

Sharma notes Pound exchange rates have disappointed in the wake of previous BoE rate hikes as the BoE found it difficult to spin a positive message.

"That is unlikely to change," says Sharma. "May is historically a poor month for risk and for sterling, so further stress can be expected."

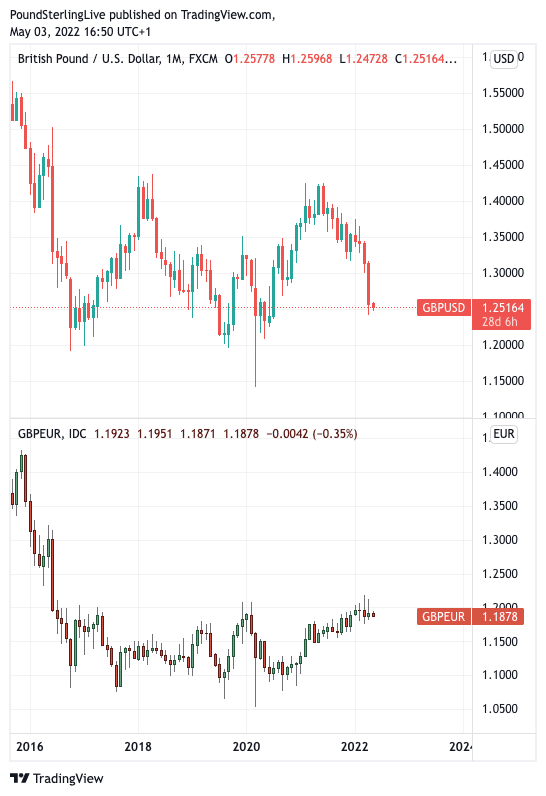

The Pound rose 0.45% against the Euro in April and the Pound to Euro exchange rate remains remarkably range-bound, not having closed above 1.1958 or below 1.1867 during 2022.

Most foreign exchange strategists we follow anticipate the Pound and Euro to remain around current levels for the foreseeable future.

However, some anticipate the Pound would come under pressure against its Eurozone peer when the European Central Bank begins to raise interest rates, which could occur as soon as July.

Above: GBP/USD (top) and GBP/EUR (bottom) at monthly intervals.

The Pound fell 4.30% against the Dollar in April, traditionally a strong month for the Pound, making for its worst monthly performance since October 2016.

Most foreign exchange analysts we follow anticipate ongoing U.S. Dollar strength in line with expectations for as many as 240 basis points of hikes to be delivered by the Federal Reserve over the remainder of 2022.

This is more than at most developed market central banks, which should offer U.S. bond yields support and the Dollar.

Furthermore, ongoing war in Ukraine and fears of a Covid-induced economic slowdown in China are tipped to keep markets under pressure.

This tends to suit the anti cyclical 'safe haven' Dollar.