Pound Sterling Passes 1.21 euros Amidst Fears War in Ukraine will Widen

- Written by: Gary Howes

- EUR slumps on heightened Ukrain tensions

- Blinken warns NATO ready to defend

- EUR forecasts downgraded at UniCredit

- Says GBP/EUR can go to 1.23

Above: NATO Secretary General Jens Stoltenberg and a video conferencing link with Dmytro Kuleba (Minister of Foreign Affairs, Ukraine). Source: NATO.

The Pound to Euro exchange rate surpassed the 1.21 level amidst fears the war in Ukraine was close to escalating significantly and analysts reduced their forecasts for the European currency.

The Euro was sold widely and safe haven currencies such as the Dollar and Franc were bought following overnight news of an attack by Russia on Europe's largest nuclear power station at Zaporizhzhia, resulting in a fire.

The Pound was also sold against the Dollar, Yen, Franc and antipodean dollars, however it outperformed the Euro and Eastern European currencies.

The International Atomic Energy Agency (IAEA) said Ukraine informed them Russian forces had taken control of the site of the country’s Zaporizhzhia Nuclear Power Plant (NPP), but that it continued to be operated by its regular staff and there had been no release of radioactive material.

The attack on the power station represents a significant escalation in the week-old conflict and served as a signal to investors of a severe deterioration in the global financial and economic outlook.

"The Russia-Ukraine conflict has intensified. In the FX market safe-havens remain on bid, mostly to the detriment of high-beta currencies," says Roberto Mialich, a foreign exchange strategist at UniCredit Bank who has said he has today cut his forecasts for the Euro.

"The euro may be more vulnerable than other currencies to a cut of the natural-gas supply to the eurozone," says Mialich.

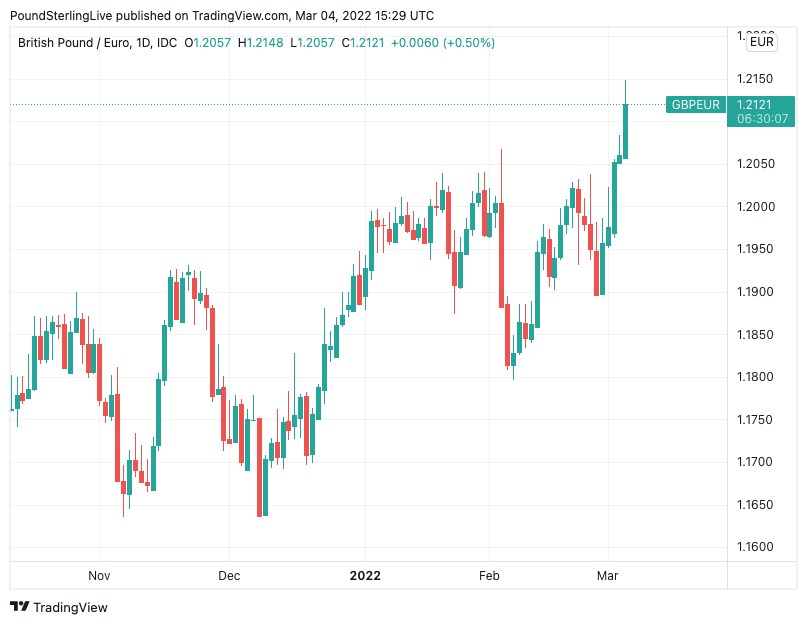

Above: GBP/EUR at daily intervals.

- Reference rates at publication:

GBP to EUR: 1.2122 - High street bank rates (indicative): 1.1798 - 1.1883

- Payment specialist rates (indicative): 1.2013 - 1.2060

- Find out more about specialist rates and service, here

- Set up an exchange rate alert, here

U.S. Secretary of State Anthony Blinken warned on Friday that the threat of escalation into a wider conflict was now very real.

"Ours is a defensive alliance. We seek no conflict. But if conflict comes to us we are ready for it and we will defend every inch of NATO territory," Blinken told reporters.

Separately NATO Secretary Jens Stoltenberg says there is evidence Russian President Vladimir Putin had deployed illegal weaponry in the attack.

"The Russian invasion of Ukraine is a blatant violation of international law. And we have seen the use of cluster bombs," said Stoltenberg.

Euro exchange rates came under significant pressure on a day global markets sold off, with European stock markets leading losses.

Germany's DAX was down over 3.0% while the Euro to Dollar exchange rate slumped by 1.4% as it went below 1.10.

The Euro to Pound exchange rate fell two-thirds of a percent to its lowest level since the EU referendum of 2016 at 0.8253, ensuring Pound-Euro crossed 1.21.

Members of the European Central Bank's (ECB) Governing Council have this week expressed caution on the Eurozone economic outlook given geopolitical events, prompting investors to push back their expectations of the timing and scale of interest rate hikes from the central bank.

"The latest events have made it more problematic for the ECB to accelerate its exit from stimulus," says Marco Valli, Global Head of Research and Chief European Economist at UniCredit Bank in Milan.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

How high the Pound-Euro exchange rate rises rests with how far the situation concerning Russia and Ukraine deteriorates.

This is a headline driven market and the headlines don't make for comfortable reading right now.

"The EU and Nato need to prepare for the (almost) unimaginable," says Professor, former head of the war studies department at King's College London and now a deputy vice-chancellor at the University of Wollongong in Australia.

In 2018 Russia was accused of using a chlorine-based chemical weapon to attack a rebel stronghold in a suburb of Damascus, the Syrian capital, killing 40 people, and the US has warned that it may resort to similar tactics in Ukraine.

The Telegraph reports there are growing concerns Russia might use chemical weapons in Ukraine after Russia's Foreign Minister Sergei Lavrov referenced alleged U.S. biological sites in the country.

The fear is that this is a 'red flag' precursor to the deployment of chemical weapons.

For now however NATO and its members maintain they are unwilling deploy forces in support of Ukraine, rejecting Ukraine's demand for no-fly zones.

"We have a responsibility as NATO allies to prevent this war from escalating beyond Ukraine because that would be even more dangerous, more devastating and would cause even more human suffering," said Stoltenberg.

Economists at UniCredit Bank join peers in reducing their economic growth forecasts for the Eurozone from 3.7% to 3.1%, and that for 2023 to 2.5% from 2.8%.

They have meanwhile revised lower their forecasts for the Euro-Dollar exchange rate to 1.07 by the second quarter of 2022.

Their Euro-Pound forecast is now at 0.81 for the second quarter, which gives a Pound-Euro target of 1.2350.

The Euro could nevertheless register a sharp rally if there were any signs of improvement in Ukraine, with one potential source of relief being the announcement of a ceasefire.

Expect the market to sharply reverse recent moves if this were to happen.

However there is absolutely nothing to suggests Putin is willing to change his position and relief will remain fleeting.