Pound Sterling, Euro Sell-off Looks Overdone says Investment Banking Analyst

- Written by: Gary Howes

- GBP can recover if Russia-Ukraine tensions ease

- This according to Barclays

- Says GBP, EUR oversold relative to risk models

- Oxford Economics says UK growth outlook has deteriorated

- Posing headwinds to GBP outlook

Image © Adobe Images

The British Pound and Euro are looking oversold relative to the U.S. Dollar and can recover if investor fears concerning the Russia-Ukraine conflict begin to ease, says a UK high-street lender and global investment bank.

Both the Pound and Euro joined equity markets in staging a recovery on February 28 after negotiators from Russia and Ukraine ended talks in Belarus and committed to holding further talks.

Any hope that the conflict might at some point be resolved could offer support to stocks and various risk-associated currencies.

Research from Barclays finds the Pound has struggled since Russia invaded its neighbour last week but that there is "significant" recovery potential if market fears ease.

"The sell-off was also larger for the GBP, EUR, TRY, INR and THB, suggesting that oil importers were particularly affected," says Marek Raczko, FX Strategist at Barclays.

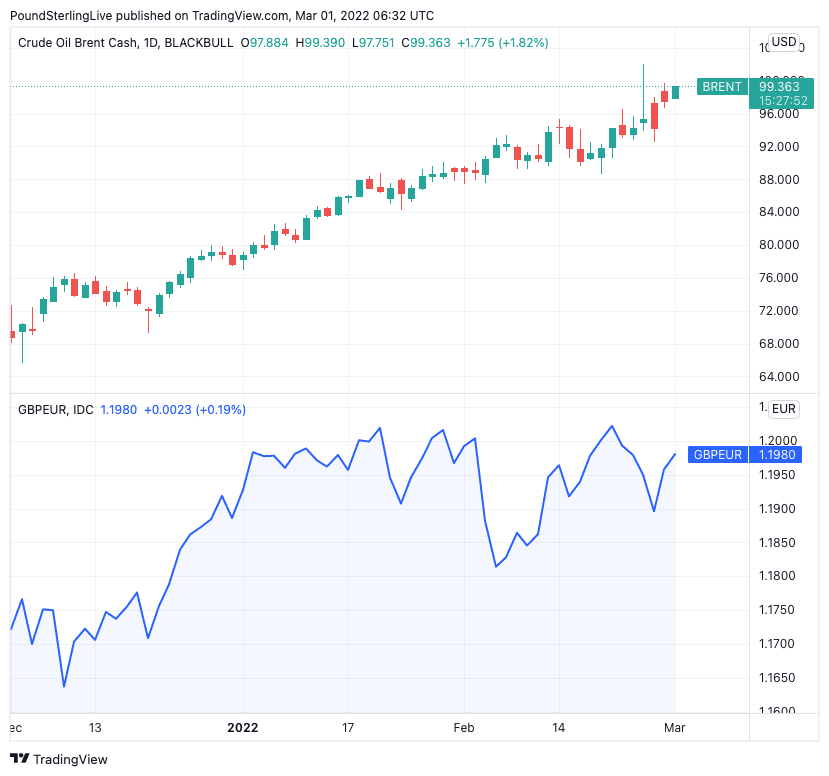

Above: Brent crude prices (top), GBP/EUR daily chart (bottom).

Research conducted by Barclays shows the Pound and Euro are two currencies that are particularly susceptible to higher oil prices driven by supply-side shocks.

Oil prices crossed $100 a barrel last week as fears mounted over the ongoing availability of Russian oil.

Prices at UK fuel stations meanwhile reached a record on Sunday, according to the motoring association the RAC.

Nevertheless markets are forward looking by nature and tend to discount worst-case scenarios well ahead of time and 'peak anxiety' could soon pass, particularly if there is evidence Russia and Ukraine are negotiating.

"All in all, our analysis suggest that the moves in CEE FX, the GBP and EUR seem overdone," says Raczko.

Above: "FX response to the recent risk-off" - Barclays.

- Reference rates at publication:

Pound to Euro: 1.1984 \ Pound to Dollar: 1.3421 - High street bank rates (indicative): 1.1748 \ 1.3145

- Payment specialist rates (indicative): 1.1924 \ 1.3327

- Find out more about specialist rates and service, here

- Set up an exchange rate alert, here

"Just as sterling has depreciated significantly from the Russia-Ukraine situation, it has significant room to appreciate as markets increasingly see this conflict as localised and global risk has begun to rebound," says Raczko.

However he adds it might take a stabilisation in oil prices before a recovery shapes up and like other investment banks Barclays does not expect a significant reversal in oil prices.

RBC Capital Markets says it holds a high conviction that oil prices are in the midst of a super cycle, underpinned by solid fundamentals and further rises are coming.

"To be clear, geopolitical tensions help to ignite the bull view, but this thesis is purely fundamentally driven," says Michael Tran, Global Energy Strategist at RBC Capital.

"Global inflation is set to increase due to supply chain disruptions. In particular, oil prices broke through the USD 100/bbl level on 25 February and we believe that there is scope for these to continue rising towards the USD 150–170/bbl range," says Carlos Casanova, Senior Economist Asia at UBP.

For the British Pound, how the Bank of England reacts to recent events will remain a major concern going forward.

"The pound continues to draw underlying support from expectations for the Bank of England to raise rates for a third consecutive meeting on March 17," says Joe Manimbo, Senior FX Analyst at Western Union Business Solutions.

Economists are widely in agreement that the Russia-Ukraine crisis poses upside risks to inflation, which central banks typically react to by hiking interest rates.

"The prospect of higher inflation will stoke the MPC’s fears that a wage-price spiral will develop," says Andrew Goodwin, Chief UK Economist at Oxford economics. "The main impact on the UK economy of Russia’s invasion of Ukraine is likely to be energy prices staying higher for longer."

But Oxford Economics also warns that ongoing developments might in fact prompt the Bank of England to cool their approach to raising interest rates later in 2022.

They now see only two 25 basis point rate hikes this year, in March and May, rather than the three that had been expecting heading into the Russia-Ukraine crisis.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

But investors are positioned for for far more, with OIS markets showing expectations for up to 130 basis points of interest rate hikes coming over the duration of 2022.

A repricing lower in these market expectations would pose an obvious downside risk for the Pound in 2022.

Barclays' Raczko says while rates markets pared expectations for most G10 central bank tightening in the wake of Russia's invasion of Ukraine, Bank of England tightening expectations were pulled back the most.

He says this might explain some of the Pound's underperformance against the Dollar of late.

But why does Oxford Economics see far few rate hikes than the market brain is currently expecting?

"The additional squeeze on households also increases the risk of a more abrupt slowdown in activity," says Goodwin.

He explains the UK’s energy price cap imposed by the regulator OFGEM means the pain for consumers will be delayed until October when the next pricing regime kicks in.

As a result Oxford Economics are cutting their forecast for UK GDP growth in 2023 by 0.5 percentage points, which is more than the 0.1 point cut for 2022.

“The MPC finds itself in an increasingly difficult situation. On the one hand, the prospect of higher inflation exacerbates their recent concerns that workers will be encouraged to ask for higher pay rises and firms will implement bigger price rises. But on the other, it will intensify the squeeze on household spending power and raises the risks of both an abrupt growth slowdown and very low inflation in two years’ time, the horizon which the MPC typically focuses on for policy," says Goodwin.