British Pound Gains as the Market's Peak Ukraine Fears Pass

- Written by: Gary Howes

Photo: London protests against war in Ukraine. Credit: Garry Knight. Sourced: Flickr. License: Public Domain.

The Pound to Euro exchange rate was threatening to go below the 1.19 marker ahead of the weekend as investor sentiment turned a corner for the better and aided the Euro but cost the Dollar recently gained value.

The knee-jerk sell-off that greeted news of the Russian invasion of Ukraine on February 24 pulled the Euro and satellite European currencies lower, but a recovery in sentiment has subsequently ensued.

"Markets are taking stock in Russia’s continued invasion of Ukraine that led the West to deliver a second tranche of sanctions aimed at undermining Russian finances over the long run," says Joe Manimbo, Senior Market Analyst at Western Union.

The conflict is by no means over, however forward-looking markets appear to be looking to the future and the positive sentiment suggests the conflict might be fully discounted.

"Markets were preparing for some kind of post-Ukraine normalcy," says Mathias Van der Jeugt, an analyst with KBC Markets.

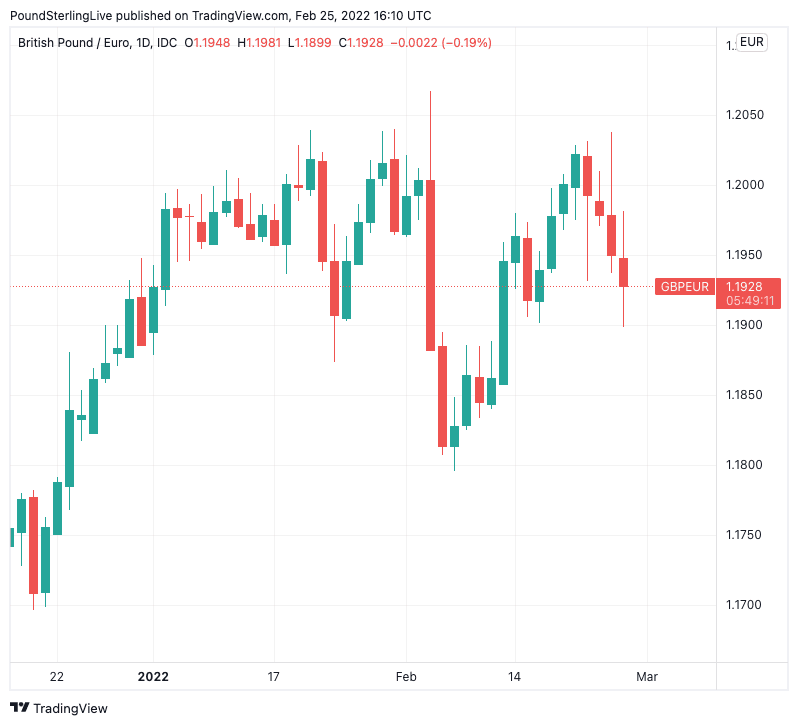

Above: GBP/EUR is threatening a break below 1.19.

The analyst also observes reports Russian President Vladimir Putin might be prepared to hold talks with Kyiv on a neutral status of the country maybe supported sentiment further

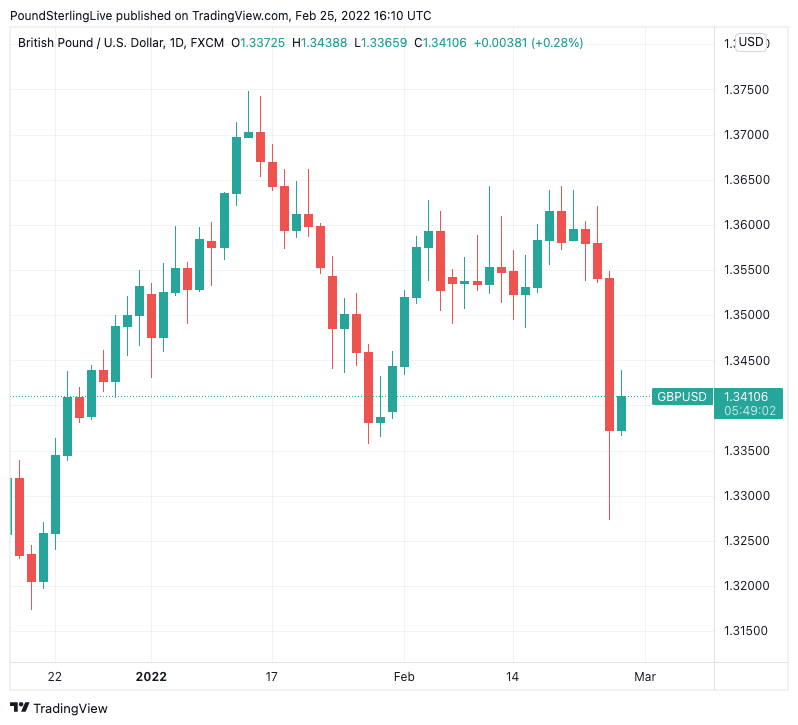

The Pound to Euro exchange rate pulled back from near 1.20 and was at 1.1910 at the time of writing. The Pound to Dollar exchange rate however recovered back to 1.34 amidst a broad easing in the USD as sentiment improved.

"The slightly improved tone helped the British and Canadian currencies recover from two-month lows," says Manimbo.

(Request a FX quote with Global Reach to access market beating exchange rates and access one-on-one currency payment support).

A key risk element to markets is the scale and scope of sanctions delivered by the West and its allies in response to the Russian invasion: to date they have largely been on the tepid side, particularly from the EU.

It is reported that Eastern EU states are looking for much more severe sanctions than central and Western Europe counterparts, while Italy reportedly managed to carve out an exemption for its luxury goods sector in any sanctions package.

Joe Barnes, Brussels Correspondent at The Telegraph reported, "Italian prime minister Mario Draghi successfully secured a carve out for Italian luxury goods from the EU's package of economic sanctions against Nato".

"Apparently selling Gucci loafers to oligarchs is more of a priority than hitting back at Putin," an EU diplomatic source told Barnes.

Belgium reportedly negotiated concessions for its diamond exports according to Barnes.

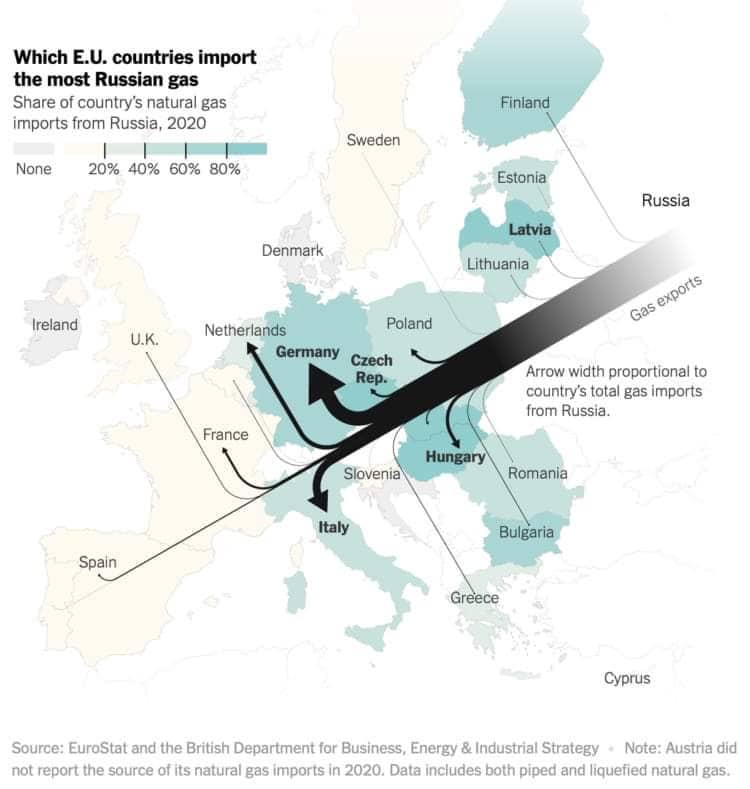

Germany, Italy and Cyprus are meanwhile opposed to ejecting Russia from Swift, with Germany's heavy reliance on Russian gas cited as a reason for the opposition put up by Europe's largest economy.

The faultlines within Europe are likely to ensure Russian sanctions never reach their full potential. From a financial markets perspective this is in fact supportive of risk, even if the morality is questionable.

But foreign exchange analysts caution any reprieve in market volatility may not last long amid reports of Russian forces descending on the Ukrainian capital.

Indeed, fighting is fierce and the EU, U.S. and UK are all indicating further sanctions are to come.

A number of EU figures - including Ireland's Foreign Minister Simon Coveney - confirm that ejecting Russia from the SWIFT payments system remains possible.

Such an outcome could potentially trigger another market sell-off that would hit the Euro and boost the Dollar.

Above: GBP/USD has struggled to reclaim 'peak fear' losses.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Economists say this would severely hurt Russian trade and this would in turn spell a potential ceasing of gas and oil exports to Europe, significantly hitting economic growth prospects in the region.

"Global inflation is set to increase due to supply chain disruptions. In particular, oil prices broke through the USD 100/bbl level on 25 February and we believe that there is scope for these to continue rising towards the USD 150–170/bbl range," says Carlos Casanova, Senior Economist Asia at UBP.

Economists are routinely raising their inflation forecasts in the wake of disruptions to global supply chains and commodity supplies as a result of the war.

"The outlook for the U.K. economy has darkened following the Russian invasion of Ukraine. We have hiked our forecast for the peak rate of CPI inflation in April to 8.0%, from 7.7%," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics.

The Bank of England and all its major peers now face a scenario of surging inflation and slowing growth, a situation that will become all the more acute as oil prices rally.

This prospect in turn thrown into question the speed they raise interest rates over the course of 2022 and 2023: those central banks that slow will likely see their currencies lose value while those that stick to raising rates will likely find their currencies supported.

For now the Bank of England appears set on raising rates in March and May again.