Pound Sterling, Sovereign State Gangsterism and Something Else Important

- Written by: James Skinner

- GBP among the underperformers in G10 FX basket

- GBP reserve status, UK sanctions both key factors

- Broad reserve selling possible in bouts of volatility

- Suppressive effect larger for GBP than safe-havens

- But no cause for concern; BoE FX resources ample

Above: Ukrainian's in the U.S. protest at Russia's invasion of the Ukraine. Image: Public Domain. Source: Flickr, Andriy Yatsykiv.

The Pound entered the final session of the week having outdone the Euro to become the worst performer in the G10 contingent of major currencies and one of the more underappreciated influences at play here was potentially Sterling’s role as a reserve currency.

Pound Sterling was carrying a minor loss against the Euro for the week on Friday as it traded a touch below €1.20, leaving it the underperformer for a period in which financial markets experienced significant volatility as a result of Russia’s ongoing attempt at a military takeover of Ukraine.

It’s widely expected among economists and analysts that this and the sanctions used in the international response are likely to have adverse impacts on the European and UK economies, while it’s also true that UK sanctions may necessitate the departure of certain kinds of financial capital from the country.

"Speculation of excluding Russia from SWIFT is also growing. Russian companies would have to increase trade in alternative currencies including the Chinese yuan as a result,” says Philip Wee, a senior FX strategist at DBS Group Research.

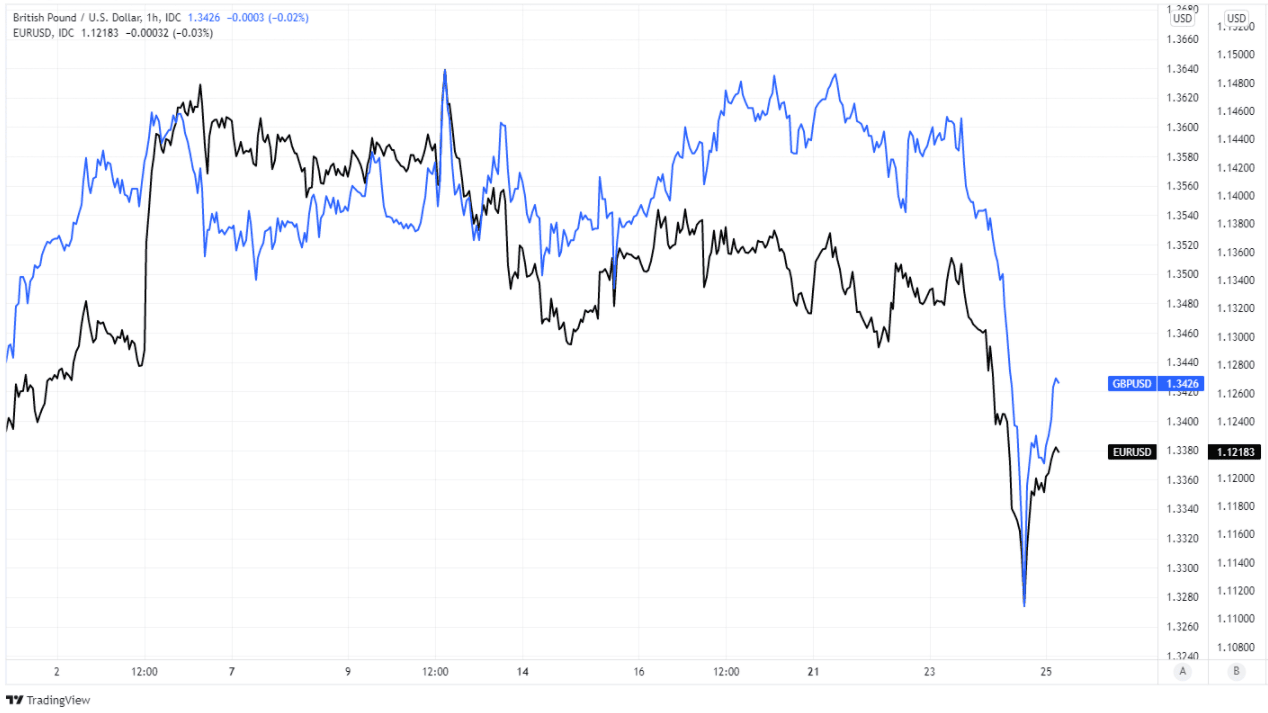

Above: Pound to Dollar rate shown at hourly intervals alongside Euro to Dollar rate.

The above are all reasons for why European currencies might always have been likely to be found at the bottom of the pile this week, although it’s also relevant that Rouble losses did already prompt the Central Bank of Russia to sell some of its reserves.

In addition it’s possible, if not likely, that volatility triggered elsewhere in the global exchange rate complex may have prompted the sale of foreign reserves by other central banks too, and any such sales would have had scope to impact Sterling.

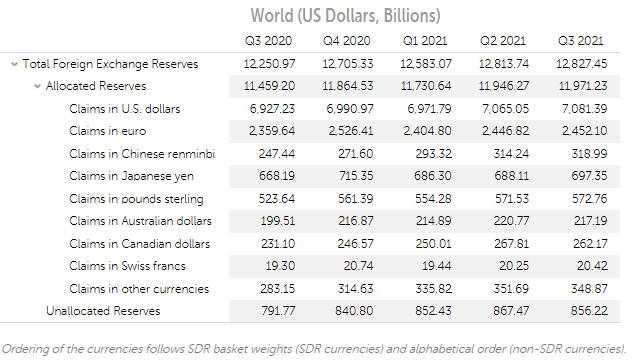

Sterling is - alongside the U.S. Dollar, Euro, Japanese Yen and Chinese Renminbi - one of five pillars underpinning the international financial system through its inclusion in the International Monetary Fund’s (IMF) Special Drawing Right (SDR) basket, and also had a 4.7% share of all reserves known to have been allocated to one currency or another at the last count.

Source: IMF.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

“The SDR basket is reviewed every five years, or earlier if warranted, to ensure that the basket reflects the relative importance of currencies in the world’s trading and financial systems,” the IMF says of the SDR currency unit.

This means Sterling and the Euro are among a handful of currencies that were most likely to have been sold by other central banks seeking to stabilise their own exchange rates amid the signifcant volatility witnessed on Thursday.

However, unlike with other reserve currencies; neither Sterling or the Euro is used as a ‘safe haven’ during times of turbulence and this together with the above may also help to explain why both underperformed so broadly on Thursday.

Source: IMF.

“The safe haven USD, JPY and CHF are at the top of the G10 FX leader board. The sensitivity of Europe to Russian energy supplies clearly taints the outlook for the single currency and we see the potential for further downside movement in the EUR vs. the safe havens,” says Jane Foley, head of FX strategy at Rabobank.

Sanctions-related outflows from the UK and other central banks’ periodic drawdowns on reserve holdings are not cause for concern, however, as if ever it becomes relevant the Bank of England (BoE) itself also has its own reserves and other resources too.

The BoE’s reserves include its own as well as those looked after on behalf of HM Treasury, and are to some extent supplemented many times over by what is something like an unlimited overdraft at the Federal Reserve.

Alongside the the Bank of Canada (BOC), the European Central Bank (ECB), the Swiss National Bank (SNB), and the Bank of Japan (BOJ), the BoE is one of five to be entrusted and endowed with a standing U.S. Dollar liquidity swap facility at the Fed, which are each of an unlimited size.