Battered Markets, Pound Sterling and Euro Catch a Breath, Investors Eye Russian Sanctions

- Written by: Gary Howes

- GBP recovers against USD, EUR

- As global markets stabilise

- But GBP at risk of 'hot money' outflows

- As UK announces significant sanctions

Above: Prime Minister Boris Johnson holds G7 call on Ukraine to discuss the response to the Russian invasion of Ukraine from 10 Downing Street. Picture by Simon Dawson / No 10 Downing Street.

European markets were steady ahead of the weekend, allowing the British Pound and Euro to recover some lost ground against the Dollar.

The Dollar surged against both the Euro and Pound Sterling on the first day of Russia's invasion of Ukraine, which enters a second day Friday, amidst a classic demand for more liquid, low-yielding and safe haven currencies.

Investors ran for safety amidst the geopolitical fallout, demanding Dollars, Yen, Francs and gold. The Euro and other European currencies were under pressure as Russia invaded Ukraine and Western countries imposed another round of sanctions on Russian companies and individuals.

"Broad based global market risk aversion weighed heavily on the pound and global equities. Sterling is at heightened risk of falling to fresh 2022 lows against the dollar if the picture in Eastern Europe continues to deteriorate," says analyst Joe Manimbo at Western Union.

Predicting currency movements in the febrile atmosphere will remain difficult with dip-buying and discount hunting amongst investors offering support for the Pound and Euro, all the while the ongoing conflict and Western retaliation pushes in the opposite direction.

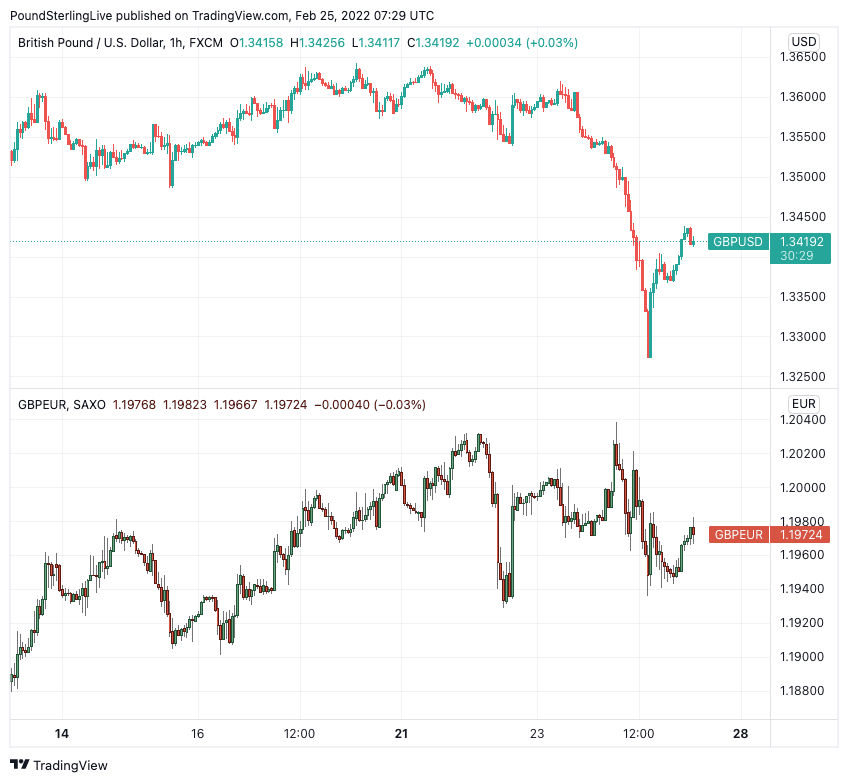

At one point the Pound to Euro exchange rate fell to 1.1928, but it has since recovered to 1.1976 on Friday. The Pound to Dollar exchange rate fell to 1.32724 but has since recovered to 1.3416.

Expect more headline-driven and volatile market conditions over coming hours.

Above: GBP/USD (top) and GBP/EUR (bottom) since mid-month, showing heightened volatility on February 24.

- Reference rates at publication:

GBP to EUR: 1.1968 \ GBP to USD: 1.3418 - High street bank rates (indicative): 1.1730 \ 1.3142

- Payment specialist rates (indicative): 1.1905 \ 1.3350

- Find out more about specialist rates and service, here

- Set up an exchange rate alert, here

"The USD still wins during elevated geopolitical uncertainty," says Adarsh Sinha at Bank of America. Analysts at the bank add that U.S. central bank policy divergence (higher interest rates, faster) has not run its course yet even if the ECB and BoJ "take baby-steps" toward policy normalisation this year.

"This is why we remain bullish USD," says Sinha.

The UK announced its most severe set of sanctions on Russia late Thursday, effectively denying the country access to the City of London and leaving analysts wary the Pound might be exposed to the exit of funds.

All major Russian banks will have their assets frozen and be excluded from the UK financial system, preventing access to Sterling and payment clearing facilities.

"The GBP may weaken as a result of rapid liquidation and repatriation by potentially sanctionable individuals," says Richard Kelly, an analyst at TD Securities.

100 individuals will face personal sanction.

"Russians hold significant UK assets and with layer upon layer of sanctions coming, there is more likely to be pressure on GBP," says Brent Donnelly at Spectra Markets.

Prime Minister Johnson said there was potential to cut Russia out from the Swift international payment system and "nothing is off the table in this regard".

"As Sterling remains risk correlated and the UK is at risk of an exit of 'hot money' flows this underlines that GBP/USD and GBP/JPY are set to remain pressured. Look for the 2022 low at 1.3358 in the former and 152.90/5300 in the latter once we extend clear the 200day MAV at 153.45," says Jeremy Stretch at CIBC Capital Markets.

Further sanctions were announced by the EU and U.S.

"The US and the UK were able to present new powerful sanctions last night and the EU also announced that it had agreed on a new sanctions package at an extra EU summit ending late yesterday. The new sanctions mean that 70% of Russia's financial sector and state-owned companies are now covered by the sanctions and export controls have been introduced," says Lara Mohtadi, an analyst with SEB Bank.

We reported Thursday that headlines pertaining to the ejection of Russia from SWIFT would amount to the most severe possible financial sanction on Russia as it would make the country uninvestible for most nations, apart from China.

We noted heavy selling of the Pound amidst the release of these headlines.

But resistance to excluding Russia from SWIFT came from Germany, Italy and a handful of other European nations which rely heavily on Russia for gas.

Avoiding a worst-case scenario in terms of sanctions will contribute to the more optimistic investor tone ahead of the weekend.

"The sanctions do not include banning Russian banks from the international payment system SWIFT, a measure previously flagged by the US and seen as particularly serious," says Mohtadi. "Equity markets also turned around after SWIFT and the oil sector were not included in the list of sanctions that Biden presented."