Reasons for Caution on Pound Sterling Outlook vs. Euro and Dollar say Analysts

- Written by: Gary Howes

- GBP left licking wounds

- Bank of England key to short-term direction

- Validus say they retain caution on GBP outlook

- Rabobank, Validus concerned on EU-UK trade tensions

- Market rates at publication: GBP/EUR: 1.1629 | GBP/USD: 1.3796

- Bank transfer rates: 1.1403 | 1.3510

- Specialist transfer rates: 1.1550 | 1.3699

- Get a bank-beating exchange rate quote, here

- Set an exchange rate alert, here

Foreign exchange analysts at Validus Risk Management say they remain cautious on the outlook for the Pound while investment bank Rabobank says the outlook for the UK currency has turned more cloudy.

The calls come in the wake of a 1.60% decline recorded by the Pound against the Dollar last week, while against the Euro the UK currency recorded 0.15% decline.

The new week starts with further declines with both of the two major Sterling exchange rates in the red.

The UK currency's 2021 uptrend against the Dollar is now being questioned by analysts as a result of the previous week's sharp decline while five consecutive weeks of glacial change in the Pound-to-Euro exchange rate is failing to inspire confidence amongst those looking for stronger purchasing power in the UK unit.

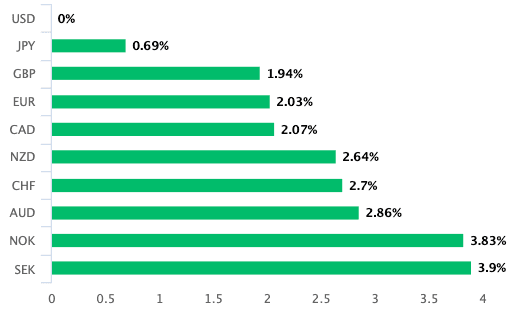

Above: Gains made by the Dollar in the previous week

Concerning the immediate outlook, the Bank of England's Thursday policy meeting forms this week's highlight on the Pound's calendar.

"Sterling may need the Bank of England's Monetary Policy Committee to deliver a more hawkish than expected message on June 24 to recoup some of its recent losses against the U.S. dollar," says Robert Howard, a Reuters market analyst.

Expect the Bank of England to give their latest assessment on the UK economy but to keep interest rates unchanged.

Indeed, fireworks are unlikely and it will only be at August's Monetary Policy Report where any major shift in policy would be announced.

The market is nevertheless likely trade the Pound according to where they think the Bank might be headed come August, buying the Pound if they believe the UK's economic recovery would push the Bank into raising rates in 2022.

Any hints supporting this view could yield some gains towards the latter part of the week.

But, the move lower in Pound exchange rates in reaction to Friday's retail sales data is a reminder that much of the good news on the economic outlook might already be 'in the price' of the Pound and that it is susceptible to downside moves in response to data disappointments.

Marc Cogliatti, Principal at Global Markets for Validus Risk Management, asks whether it is right to maintain a cautious stance on Pound Sterling, "or whether we should be more optimistic given how well the pound is holding up?"

In his view there are three reasons to maintain caution, the first is positioning in the futures market which suggests that traders are "net long GBP which makes the pound vulnerable to a fall if or when these positions are unwound".

Therefore "an element of caution remains justified," says Cogliatti.

Above: GBP/EUR in 2021 (top pane) and GBP/USD (bottom pane).

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Secondly, Validus Risk Management notes momentum behind Sterling's early-2021 rally had stalled.

Although this lost momentum means the currency can no longer necessarily be considered 'overbought' failure by GBP/USD to break the 2018 high at 1.4380 "gives cause for concern," says Cogliatti.

A third sentiment risk for the Pound is the potential for a trade war between Britain and the EU over the application of the Northern Ireland protocol.

Speaking to Sky News at the G7 meeting, Boris Johnson said he’ll do “whatever it takes” to protect the integrity of the UK and that he is prepared to invoke Article 16 if necessary.

"For now, discussions will continue, but at the very least, it’s a far cry from the amicable separation we all hoped for when the trade detail was announced back in December," says Cogliatti.

Validus Risk Management say the maintain a cautious bias towards Sterling, as "there continues to be further challenges ahead".

Jane Foley, Senior FX Strategist at Rabobank also views the potential for EU-UK trade tensions as a headwind to the Pound.

"We see current headwinds for the pound in the shape of the delayed re-opening of England’s economy and potentially as a result of tensions with the EU over the Northern Ireland protocol which have raised the threat of a trade war," says Foley.

{wbamp-hide start}{wbamp-hide end}{wbamp-show start}{wbamp-show end}

The EU on Thursday said it has received a request from the UK government to suspend some elements regarding the Northern Ireland protocol until September in order to allow for more time to arrive at a solution to facilitate the flow of meat products from Great Britain to Northern Ireland.

The EU said they would now consider the request.

We noted on June 09 rising fears of a trade spat between the EU and UK in the near-future as the EU threatened tariffs on UK exports over a failure to fully implement the Northern Ireland protocol.

The UK has accused the EU of being heavy handed in their demands and failing to respect UK sovereignty, arguing the protocol makes clear the EU must not jeopardise the integrity of Northern Ireland's standing in the UK market.

The dispute looks like one that will simmer for some time but headlines on the matter could spark some jitters in Sterling rates.

Despite the EU-UK trade concerns Rabobank say they maintain a forecast that EUR/GBP could still head to 0.84 by year end.

This would give a Pound-to-Euro forecast target of 1.19.