Investors Pile into the Pound

Image © Adobe Images

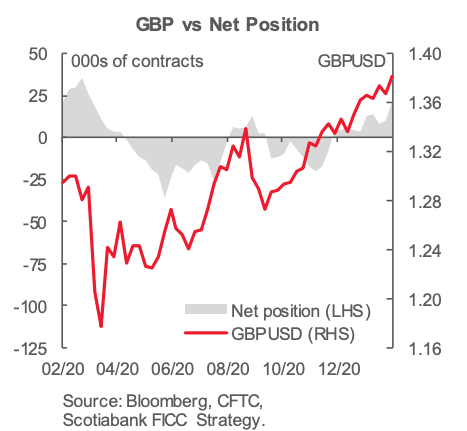

Traders are becoming increasingly bullish on the prospects facing the British Pound according to data that reveals how the foreign exchange market is betting.

Insights into how traders are positioned on foreign currencies from the U.S. Commodities Futures Trading Commission - the most extensive data set available - shows last week saw the biggest increase in bets for further Sterling upside recorded since February 2020.

"The GBP position saw the largest week-on-week bullish bet with an increase of $1BN taking the pound’s net long to its highest mark since Feb 2020," says Shaun Osborne, a foreign exchange strategist with Scotiabank.

The realignment in investor sentiment towards the UK currency comes amidst a period of outperformance by the British Pound, which has risen against all its major peers thus far in 2020.

"Net GBP long positions ramped higher. Investors are hoping that the UK’s relatively rapid vaccine roll-out programme will support the recovery in the economy this year," says Jane Foley, Senior FX Strategist at Rabobank.

The net long on the Pound now stands at $1,824BN.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

"CFTC data ending 9 February show speculators materially increasing their bullish positions on GBP as the UK’s vaccination advantage and fading prospects of negative rates supported the currency," says Francesco Pesole, FX Strategist at ING Bank N.V.

The British Pound recorded a new nine-month high against the Euro and a new 34-month best against the Dollar at the start of the new week, driven by rising global stock markets and expectations that the UK economy was on the cusp of a strong vaccine-lead recovery.

Analysts say the significant shift in sentiment towards the Pound has much to do with the Bank of England, which on February 04 effectively signalled negative interest rates would not be introduced in the UK in 2021, triggering a major reassessment in Sterling and UK assets right across the financial market.

"The fact that GBP net longs jumped specifically in the week ending 9 February after having shown contained volatility since the start of the year tends to indicate that speculators had entered precautionary GBP shorts linked to the risk of negative rates in the UK," says Pesole.

Osborne says markets are favouring the UK currency amid a reduction in BoE negative rate bets and a quick rate of vaccinations in the UK.

"Net longs were also lifted by the more hawkish than expected take-away from the February BoE policy meeting," says Foley.

Despite the Eurozone lagging the UK in the pace of vaccine rollouts, investors actually increased bets for gains in the Euro with the net Euro growing by $616mn.

Investors meanwhile remain overwhelmingly positioned for further downside in the U.S. Dollar, however the scale of this bet has decreased over recent weeks.

The Pound-to-Euro exchange rate rose to a high of 1.1459 on Monday, its highest level since May 11, 2020.

The Pound-to-Dollar exchange rate rose to a high of 1.3903, its strongest level since April 27, 2018.