Pound Sterling Forecasts vs. Euro and Dollar Upgraded at ING

Image © Adobe Images

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Foreign exchange analysts at ING Bank N.V. have upgraded their forecasts for the British Pound, saying that the currency's "persistent undervaluation" should disappear now that a 'no deal' Brexit has been avoided.

Furthermore, the faster pace of UK vaccinations and the prospect of a stronger economic recovery in the second quarter of 2021 are expected to provide added upside momentum.

"Sterling is now free to reap the benefits of a faster vaccination rollout in the UK relative to the eurozone," says Petr Krpata, Chief EMEA FX and IR Strategist at ING. "With GBP having suffered persistent Brexit-related undervaluation since 2016, the currency should now start the process of a gradual convergence towards its medium-term fair value."

The faster vaccine rollout is tipped to allow the UK to ease covid-related restrictions sooner than peers, prompting a strong outturn in the economy starting in the second quarter.

The improved economic performance would in turn mean the Bank of England will no longer feel the need to be quite so 'dovish' i.e. talk up the prospect of further quantitative easing or interest rate cuts.

{wbamp-hide start}{wbamp-hide end}{wbamp-show start}{wbamp-show end}

The call comes ahead of an important February policy meeting at the Bank of England - scheduled for Thursday 04 - that will see policy makers give their verdict on whether interest rate cuts into negative territory are feasible in the UK.

The heightened attention on the meeting means it could prove to be particularly volatile for Sterling, and some analysts say a sharp drop is likely if the Bank unexpectedly cuts interest rates.

However, Pound exchange rates have risen over recent days, suggesting markets are sanguine to the risks of such a move and are instead opting to keep focus on the economic benefits of the country's speedy vaccine rollout.

The Pound-to-Euro exchange rate rose to its highest levels since May 2020 over the course of the past 24 hours, with the pair quoting a new 8-month high at 1.1369 on Tuesday. The Pound-to-Dollar exchange rate is meanwhile only up slightly in 2021 as a broad-based strengthening of the Dollar keeps Sterling bulls at bay.

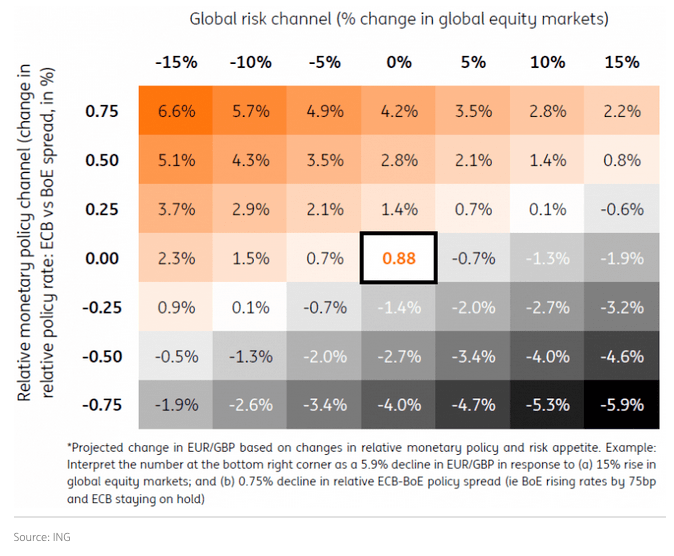

Looking ahead, there are a number of scenarios that the Pound could follow, according to ING.

The 'base case' assumption is that the UK's early advantage in vaccinations allows for an earlier reopening, however this is not expected to deliver a lasting advantage.

Furthermore, it is assumed the UK economy and Sterling can play some 'catch up' from the underperformance suffered under the weight of Brexit uncertainty over past months. But, Brexit and unemployment are nevertheless still expected to weigh on the outlook and cap exuberance.

The EU-UK relationship will likely see further uncertainty in 2021, but it is assumed by ING this will start to die down.

The BoE and ECB are not expected to cut rates, but the ECB will likely keep quantitative easing purchases running into 2022.

A potential negative scenario for Sterling sees the odds of Scottish independence referendum rise, which would in turn likely weigh on sentiment.

Another key risk to be aware of - but this does not form part of the base case' assumption - is that a new variant of covid-19 resets the vaccination programme, leading to a reset in the progress out of the pandemic.

"The prospects for sterling have improved dramatically and the undervalued currency should benefit from the mix of faster vaccination, stronger rebound in 2Q and a less dovish BoE (vs the ECB). While risks remain in place (the negative headline news around the Scottish independence referendum; the ongoing risk of tariffs should UK government choose to deviate from EU labour laws), these should only slow, rather than reverse, sterling's upside," says Krpata.

ING now forecast the Pound-Euro exchange rate at 1.1630 by the end of June 2021 and 1.1764 by the end of the year.

The Pound-to-Dollar exchange rate is forecast at 1.45 by the end of June 2021 and 1.53 by the end of the year.