Pound Bought as Traders Eye Brexit Finish Line

- Written by: Gary Howes

- Optimism grows for deal breakthrough

- But GBP stays coy, hard to shift

- Progress made on level playing field

- Final battle appears to be over fish

Image © Bank of England

- Market rates: GBP/EUR: 1.1071 | GBP/USD: 1.3471

- Bank transfer rates: 1.0860 | 1.3190

- Specialist transfer rates: 1.0990 | 1.3377

- More about bank-beating exchange rates, here

The British Pound has extended Tuesday's +1.0% advance against the Euro, Dollar and other major currencies into Wednesday, amidst media reports that a post-Brexit trade deal was nearing completion.

The contents of a briefing delivered by EU Commission President Ursula von der Leyen to the EU Parliament saw Sterling advance, but reports that negotiations remain stuck on fisheries means a deal could yet still be unachievable.

von der Leyen told the EU Parliament that "the good news is that we have found a way forward on most issues."

The comments added impetus to an advance in Sterling that was sparked on Tuesday evening when a senior BBC journalist said talk of an imminent deal was doing the rounds in parliamentary circles.

"Big buzz in the last hour among Tory MPs that the UK is heading towards a Brexit deal with the EU. Eurosceptics being reassured they will be happy," said Nicholas Watt, Political Editor BBC Newsnight.

The tweet was picked up by market newswires, with traders and foreign exchange commentators we follow citing it is being behind a rally in Sterling.

It was also widely reported that Parliament was being prepared to sit through the Christmas recess period. Under plans being inspected by leader of the House of Commons, Jacob Rees-Mogg, MPs and Peers will be asked to sit on Monday, Tuesday and Wednesday next week if a deal is reached by the weekend, The Telegraph reports.

"Sterling’s rally looks to have received a further boost from headlines suggesting that the Parliamentary session is set to be extended into next week in order to debate and potentially ratify a trade deal with the EU," says Simon Harvey, FX Market Analyst at Monex Europe.

The Pound-to-Euro exchange rate rose by 0.80% in the wake of the news, while Wednesday's advance takes the pair up to 1.1110 , the Pound-to-Dollar exchange rate rose by 1.0% on Tuesday and a further 0.75% on Wednesday to quote at 1.3541.

Harvey cautions on the market's reaction, adding:

"We remain sceptical over the timing of a deal and the risk of markets buying the rumour - a dynamic that wrong footed traders just a fortnight ago - but our base case remains that a narrow trade deal will be reached before December 31st. The reluctance of leaders to announce a no-deal exit after Sunday’s deadline reinforced this view as the political will to reach a deal remains."

Watt cautioned that nothing is confirmed yet and MPs are saying "many a slip between cup and lip".

"But MPs being told the signal will come if and when Jacob Rees-Mogg announces that the commons will sit on Monday and Tuesday next week. That would come before any UK / EU announcement," says Watt.

That Rees-Mogg would announce Parliament would sit on the 21st and 22nd of December was actually doing the rumour mill on Tuesday morning, but it appears a number of market participants wanted this rumour to backed up.

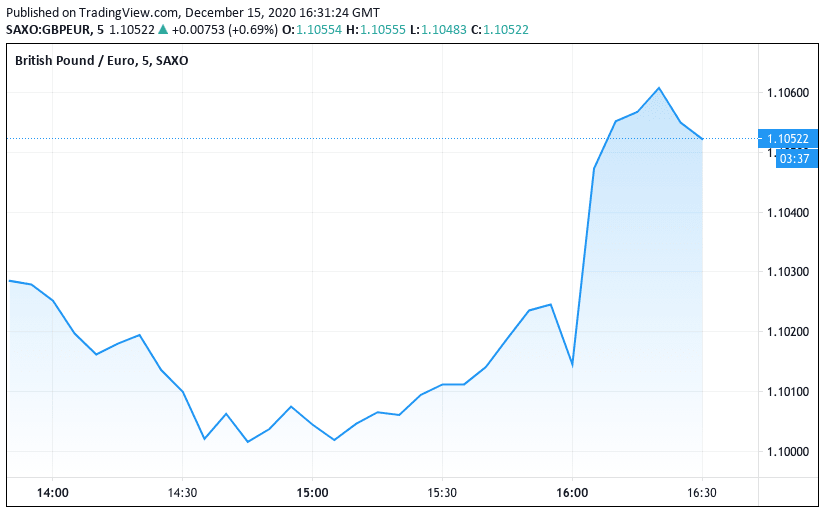

Above: GBP/EUR jumps on chatter of an imminent deal.

"Interesting to see an informal cabinet push to reassure veteran Brexiteers. They are being told their concerns have been addressed. Key issue is over the level playing field - a mechanism in which EU and UK would observe common rules but in a way that would respect sovereignty," says Watt, adding:

"Brexiteers being reassured that the UK has seen off unilateral punishment by the EU if the UK diverges from EU standards in future - the “lightening tariffs”. They are being told UK has negotiated a joint dispute mechanism. That could lead to punishment if one side loses".

While there does appear to be something afoot, other well connected journalists are urging caution.

"Nothing is imminent on Brexit tonight, according to sources, both sides are pretty certain nothing will happen immediately, a deal is very much still not there although the next few days have potential," says Bruno Waterfield at The Times.

Adam Parsons at Sky News said, "I know Westminster is apparently talking about an imminent Brexit deal but... I haven't heard anyone say that among Brussels diplomats".

Richard Colebourn, Europe Bureaux Editor at BBC News said "both British and European officials in Brussels are firmly briefing tonight that they don’t expect an imminent breakthrough on a Brexit deal."

Meanwhile newswires are saying that 'Brexiteers' in the Parliamentary Conservative Party want to see a deal by Thursday if they are to have time required to give a meaningful vote on it next week.

Until a clear outcome to trade talks emerges any major moves either higher or lower are likely to be short-lived.

{wbamp-hide start}{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Various media and political analysts are reporting that while progress has been made on the contentious issue of level playing field provisions, fisheries remains the final hurdle.

The Pound recovered further ground against the Euro, Dollar and other major currencies over the course of the 24 hours leading into the mid-week session, amidst some positive comments on the status of talks from key politicians.

Commentary is sparse, with Germany's EU ambassador said there is chance for UK trade deal by the end of this week.

Irish Foreign Minister Simon Coveney - perhaps the most vocal of EU politicians - has issued his latest commentary on negotiations, saying "I think what we're seeing this week is some progress." His understanding is that progress has been made on level playing field provisions.

He said one indication that talks are serious is that the negotiating teams have "gone really quiet".

Indeed, the sheer number of newswire headlines surrounding talks have certainly declined.

"The market awaits further news regarding Brexit, and GBP will be driven by headline volatility over the coming days. The EU suggested there was a degree of progress regarding discussions surrounding the level playing field. However, the UK has disagreed, stating 'talks remain difficult.' While the UK may be talking up the difficulties of gaining a deal in order to defended political interests, the possibility of a no deal cannot be ruled out," says Jeremy Stretch, a foreign exchange analyst at CIBC Capital Markets.

The Pound-to-Dollar exchange rate retains a broadly positive bias amidst rising expectations for a deal, going from a low of 1.3135 last Friday to 1.3374 at the time of writing.

The Pound-to-Euro exchange rate - perhaps the better barometer for market sentiment towards Brexit - is meanwhile staying faithful to the range it has occupied for the majority of 2020:

Of note is the 1.10 level which has become something of a fulcrum and it is fitting that just days before a final outcome to talks it has latched onto 1.10 once more.

In the absence of the major 'make or break' moment moves in either direction away from 1.10 will likely be faded.

"GBP has now stabilised, pencilling in lower odds of a negative outcome from the UK-EU trade negotiations," says Francesco Pesole, a foreign exchange strategist with ING Bank. "The reduced imminent risk of the worst case scenario is also evident in the modestly changed rhetoric, with UK officials now describing a no deal outcome as 'possible' vs 'very likely' or 'most likely' in prior days."

George Vessey, UK Currency Strategist, Western Union Business Solutions says "there remains a glimmer of hope that a post-Brexit trade deal will be secured before year-end and the British Pound is being supported by this optimism."

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Vessey adds that it comes as no surprise to him that trade talks extended after the soft Sunday deadline, but the lack of clarity on a future deadline suggests "this could go down to the wire".

The latest non-official commentary that we do have on the status of talks appears to be that a route forward has been found on the level playing field - i.e. the degree to which the UK will mirror EU rules in order to maintain tariff-free access to the EU market.

We noted in this article out Tuesday that both sides had made some concessions to allow for a potential accord on this area of difficulty.

Vessey says a deal would see Sterling rise by a potential 2-3% should a deal be reached, but a 'no deal' scenario could see it fall up to 10% in the near future.

With reports of some progress on level playing field provisions, it would appear the issue of fisheries remains a sticking point.

{wbamp-hide start}{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Fishing: The Final Hurdle

"Is the battle over post-Brexit fishing rights the final chapter in the EU-UK trade talks?" asks Joe Barnes, Brussels Correspondent for The Express.

EU Chief Negotiator Michel Barnier has been widely reported as having said that a deal could be reached as early as this week should both sides agree a solution to fisheries access.

"But the wrangling has seemingly taken a turn for the worse," Barnes wrote on Tuesday. "It started with a claim by Barnier that the UK had 'backtracked entirely' from a proposal on how to decide future access to UK waters after a three-year transition for fishing rights. He said the Brits tabled plans last week on Monday but had rowed back on them by Thursday."

Deciding what happens immediately after the three-year transition, which Barnier already considers too short, is where the 'difficulty' lies in finding an agreement over fisheries, according to the EU's negotiator, according to Barnes.

Barnier reportedly briefed EU officials that the UK had offered a three-month consultation period with 'guaranteed access' for EU boats while future fishing quotas are decided if the UK chooses to shut off its waters after the end of that transition.

But the EU is reportedly seeking a much stronger mechanism that prevents either side from abusing the ability to shut out the other side's boats from their waters.

"This includes a plan for there to be 'economic and judicial' consequences if the UK or EU shut their fishing grounds," says Barnes. "Barnier wants a cast-iron way to ensure Britain's access to the single market is forever linked to European boats' ability to fish in UK waters. This is built on the idea of cross suspension, allowing the EU to introduce punitive tariffs in other areas of the agreement."

The two sides are meanwhile reported to also be at odds over a request by the UK to include just demsersal fish, such as turbot, in the deal while stripping out pelagic species, such as mackerel, from the talks.

The EU has apparently also rejected excluding waters 6 to 12 miles from Britain’s coast from the deal.

"The great misconception yesterday was that people thought Barnier believed Britain was finally backing down on fishing rights – the complete opposite is true. EU sees UK position on fish as hard as ever and it doesn't live up to Brussels' vision of maintain stability," says Barnes.

A UK spokesman has meanwhile said they have by no means given ground on fisheries, underlining that this issue could yet run for a few days yet.