Why Pound Sterling is Falling against the Euro and Dollar in Early August (the S&P 500 is the Clue)

- GBP giving back late July gains

- Reason lies with investor flows

- "GBP tends to rally the last week of the month on real money hedging"

Image © Adobe Images

- GBP/EUR spot: 1.1082 | GBP/USD spot: 1.3088

- GBP/EUR bank rates: 1.0870 | GBP/USD bank rates: 1.2822

- GBP/EUR specialist rates: 1.0980 | GBP/USD specialist rates: 1.2970

Find out more about specialist rates here

The British Pound stormed higher at the end of July but has fizzled out in early August and is at risk of relinquishing the advance, for no obvious reason.

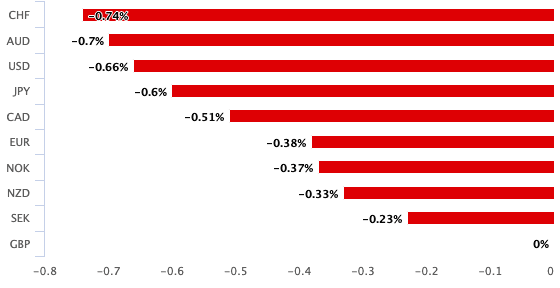

The Pound shot higher against the Dollar, Euro, Australian Dollar and the majority of the G10 fX suited, apart from the Swedish Krona. However, August has seen this outperformance give way to underperformance:

Chart 1: Sterling underperforms again on August 04.

Anyone scratching around for reasons will be perplexed by the moves as there was no single trigger to prompt the late-July gains and likewise there is no trigger to explain the losses seen in early August. We noted at the time that the gains had left some foreign exchange analysts and commentators perplexed, as typically an economic data release or news event would deliver gains of the magnitude witnessed in Sterling.

However, Brent Donnelly, a trader for HSBC in New York has identified the probable cause to be month-end flows linked to the performance of U.S. stock markets.

Donnelly has presented the below chart which shows GBP/USD performance on the last five business days and the first five business days at the turn of all months where SPX was up 3% or more since 2010:

Chart 2: GBP/USD either side of month-end when the S&P 500 has put in gains in excess of 3.0%.

As can be seen, in such months the Pound-to-Dollar exchange rate tends to embark on a sizeable rally, which will almost certainly have been felt in other Sterling crosses, including the Pound-to-Euro exchange rate and Pound-to-Australian Dollar exchange rate.

The reverse is true once month-end has passed, which will explain the current weakness we are seeing right across the Sterling strip.

"There are not many persistent short-term market inefficiencies (because they get arbed away) but GBP around the turn of the month has worked more often than it has not worked back to the days when I was a Lehman Brothers employee," says Donnely.

The S&P 500 rose 5.51% in July 2020, fulfilling the criteria identified by Donnelly for Sterling to rise in the days before month end and revert back following month-end.

The below chart - the GBP/USD four hour chart - shows the pattern identified in chart 2 to indeed be playing out:

Chart 3 (GBP/USD four hour chart) is repeating the behaviour suggested by Chart 2

But why would the Pound embark on such behaviour?

"GBP tends to rally the last week of the month on real money hedging and then mean revert the first week of the month," says Donnelly.

"This predictable pattern emerges as SPX strength means foreign holders of US equities who hedge need to sell USD at the end of the month to match the increased value of their SPX holdings. This hedging pushes GBP out of equilibrium with the peak of disequilibrium at around 11 a.m. on the last day of the month. Then, as the new month starts and the buying disappears, the pair mean reverts," adds Donnelly.

Further weakness is therefore likely over coming days as Sterling reverts back to previous levels, but we would remind readers that Thursday brings with it the Bank of England's monetary decision where any surprises could spark some volatility in the currency.

The big driver of Sterling in 2020 does however remain Brexit trade negotiations, which are expected to deliver some kind of clear conclusion in October when an EU summit will be convented to try and deliver a final breakthrough. Expect nerves to rise ahead of this date which should keep Sterling under pressure in the near future.

Concerning forecasts for the Pound, we have published some widely divergent views of late: Bank of America analysts say Sterling is to undergo a structural shift lower, as a result they have slashed their forecasts for the currency.

Analysts at Citibank are meanwhile more sanguine on the currency and say further near-term strength is possible, their views can be found here.