Pound Sterling's Recovery against Dollar, Euro Hit by Sharp Correction in Stock Markets

- Pressure on GBP lifted on talk of further trade negotiations

- Speculators to unwind bets against GBP

- Potential 20% decline in USD ahead says Goldman Sachs

- Ongoing rally in investor sentiment to protect GBP from downside

Image © Adobe Images

Achieve up to 3-5% more currency for your money transfers. Beat your bank's rate by using a specialist FX provider: find out how.

The British Pound peaked above 1.27 against the Dollar and 1.1280 against the Euro on Tuesday, but it appears the stock market's impressive rally of recent days and weeks has decided to take the day off.

There is significant potential for profit-taking in stocks and commodities, given the scale and strength of the recent moves. This makes the prospect of a decent comeback by the U.S. Dollar quite likely as the currency is inversely correlated to stock markets.

The moves remind us that the Pound is not immune to the bigger picture - it tends to fall against the likes of the U.S. Dollar, Yen, Franc and Euro when markets are falling, and has shown a tendency to rise when the opposite is true.

But the flip-side of this is that Sterling tends to appreciate against the New Zealand and Australian Dollars as well as the Norwegian Krone when markets are selling off, therefore those with GBP/AUD, GBP/NZD and GBP/NOK could find themselves presented with a rare opportunity to take advantage of the bounce.

"After the week-long bounce in equities we have seen some notable weakness in early trading this morning, as investors cut back positions on a thin morning for corporate and economic news. The rally looks a little tired, as might be expected after the first week of June saw such a strong move higher. The positive impact from the ECB meeting and Friday’s US jobs report has waned, with no fresh bullish news to take their place," says Chris Beauchamp, Chief Market Analyst at IG.

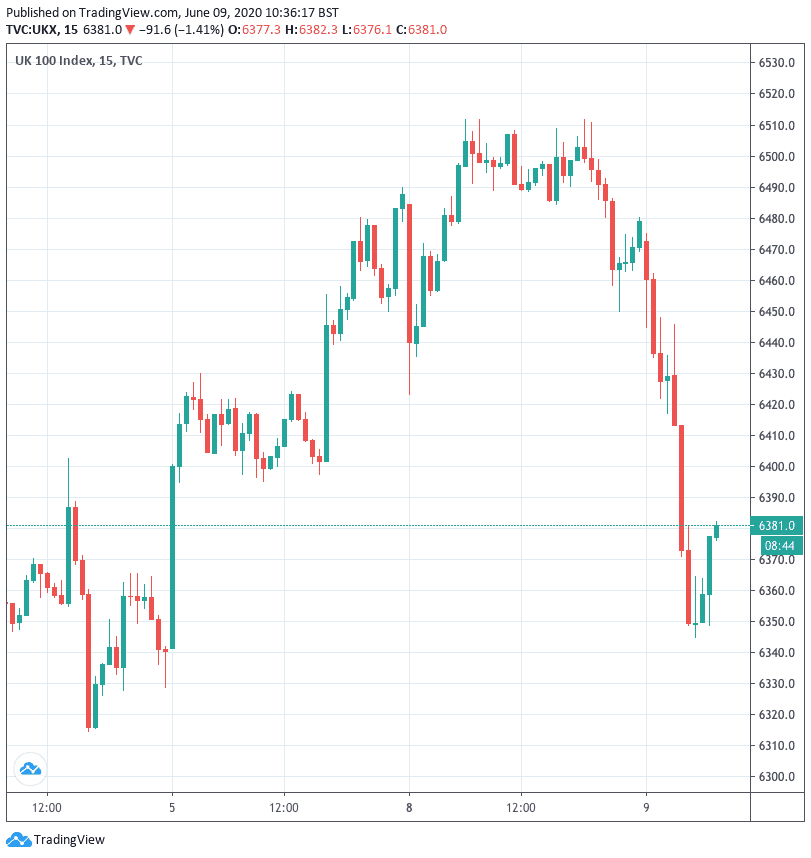

Above: The recent pullback in FTSE 100

For now however, we expect weakness in Sterling to remain limited, particularly as the idiosynchratic risk related to Brexit trade negotiations has faded somewhat.

At the time of writing the Pound-to-Euro exchange rate is quoted at 1.1222, down 0.40% and the Pound-to-Dollar exchange rate is meanwhile down a more substantial 0.75% at 1.2642.

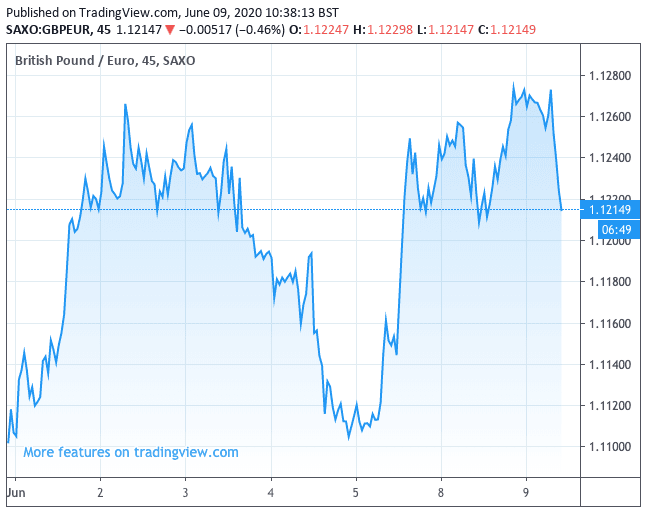

Above: GBP/EUR during June

Sterling has risen over the course of June, with markets overturning some of the deeper losses sustained in May when the UK currency came under pressure owing to rising anxieties over the prospect of a failure in Brexit trade negotiations.

The latest data from the Commodities Futures Trading Commission showed that currency speculators raised their bets against Sterling, with net short positions on the currency rising for a sixth week in a row, to the highest level since November. However, the data was for the the week to June 02, which is the day on which last week's fourth round of EU-UK trade talks got underway and confirms how nervous the currency market was becoming in anticipation of a significant failure in negotiations.

However, both the EU and UK instead indicated a strong desire to push talks forward and we expect further rounds of talks between the two negotiating teams as well as top-level discussions between Prime Minister Boris Johnson and his EU counterparts to take place over coming weeks and months, with a mooted Autumn summit between EU leaders on the matter looking to be the next big hurdle for markets to turn focus on.

"Looking further down the road, we think the trade negotiations will follow the same pattern as the withdrawal, i.e. we need to get much closer to the actual deadline on 31 December 2020 before the two sides will be willing to compromise," says Mikael Olai Milhøj, Senior Analyst at Danske Bank.

With June no longer looking to be a critical month for talks, some of the pressure on Sterling has been released and those bets that had built up in anticipation of Sterling downside will have to be unwound, which should provide an element of technical support to Sterling.

"GBP/USD ran into resistance by 1.2730 for the second straight session ahead of the weekly cloud base near 1.2738," says Paul Spirgel, a Reuters market analyst. "While GBP/USD has cleared multiple DMA resistance level in its recent move higher from mid-May's 1.2075 low, anchoring itself near 200-DMA resistance by 1.2680, its shallow dips hint there may be more room for more gains."

The EU's Chief Negotiator Michel Barnier last Friday said negotiating teams should be able to resume face-to-face talks from the end of this month, saying there will then be "more concentrated, focused work on the more difficult points. I hope this will give a new boost to the 11 negotiating tables".

Johnson and European Commission President Ursula von der Leyen are meanwhile scheduled to meet next week around the 18‑19 June EU summit to try and give the Brexit negotiation more traction.

Also aiding Sterling higher during the course of June is the ongoing recovery in stock markets and commodity prices, a development that is likely to play out further.

"The U.S. Dollar has begun to turn lower, alongside a broader pro-cyclical rotation across markets. In light of its high valuation the currency’s downside could be substantial if the depreciation trend continues - perhaps in excess of 20% on a trade-weighted basis," says Zach Pandl, a Strategist with Goldman Sachs.

Monday saw the S&P 500 return to levels seen in January ensuring the index has now erased its 2020 losses. The Dow Jones and Nasdaq followed up with positive figures, which has contributed to a slump in the value of the Dollar.

"Nothing seems to be able to stand in the way of the risk-on sentiment at the moment," says Terence Wu, FX Strategist at OCBC Bank in Singapore. However, Wu notes that some pullback is likely following the recent strong gains. "Some caution may be had from the Treasuries and commodities spaces, where back-end yields and crude oil slid after strong gains last week. However, positivity can still be had from U.S. equities."

The British Pound is likely to remain supported as long as the current 'risk on' environment remains in place, while any setbacks to sentiment could result in a reversal lower. However, we don't see any significant developments that might challenge the ongoing recovery but are conscious that markets rarely move in a straight line and bumps along the way should be expected.

"There may be further room for extension from current levels if sentiment holds up," says Wu. "Upside momentum remains strong for the GBP/USD."

The outlook for the world's economy took a firm step forward on Friday after U.S. jobs data surprised the market by showing a sizeable increase in the number of employment people in the world's largest economy.

The U.S. surprise was swiftly followed by a similar outcome in Canada, which forced the markets to rethink their view on how long it would take the global economy to recovery.

"Nonfarm payrolls rose an astonishing 2500k, the highest on record. To say that no one saw this coming would be a gross understatement; no one even forecast a rise, let alone a record rise," says Marshall Gittler, Head of Investment Research at BDSwiss Group. "Many people are shouting 'fraud' and 'cooking the books,' which is entirely possible. However, I’d like to point out that Canada’s employment data for May, released at the same time, showed the same pattern. Employment rose by 290k instead of falling by 500k, as expected."

As long as this assumption is maintained, we would assume the background conditions for further New Zealand Dollar gains agains the likes of Sterling, Euro and U.S. Dollar are in place.