Australian Dollar in 1.0% Decline against the Pound as Market Rally Fades

- AUD down after 'Risk rally' takes a breather

- But GBP/AUD has much further to climb before trend turns positive

- Tensions between China and Aus back in the headlines

Image © Adobe Images

Achieve up to 3-5% more currency for your money transfers. Beat your bank's rate by using a specialist FX provider: find out how.

The Australian Dollar has endured a 1.0%+ decline against the British Pound, Euro and U.S. Dollar on Tuesday as the recent recovery in stock markets and commodity prices suffers a rare setback that has combined with a formidable technical resistance point in the market.

The Aussie Dollar remains highly leveraged to the global recovery story, being one of the most responsive financial asset classes to shifts in sentiment and signs of fatigue in the recovery have understandably been felt by the currency.

"Equities have stormed higher in this risk recovery, with the promise of ever more supportive major central banks and the hugely better than expected U.S. jobs report to fuel the optimism. However, with so much good news now priced in, there are signs of a pause in the risk rally," says Richard Perry, analyst at Hantec Markets. "Whisper it quietly, but could a pause even turn corrective."

Any correction, as hinted at by Perry, could result in the Australian Dollar reversing sharply which could allow losses to extend over coming days.

Amidst these latest developments, the Euro-to-Aussie Dollar has lifted back up to 1.6242, having been as low as 1.6065 earlier, while the Pound-to-Australian Dollar exchange rate has rallied up to 1.83, recovering by over a percent from this week's floor at 1.8094.

Despite the rare bounce for GBP/AUD, the exchange rate will have to rally and break above 1.8838, as we noted in yesterday's forecast report, before we would turn bullish on Sterling's prospects. This suggests for now any rallies in Sterling will be identified as potential invitations to sell by speculators and there is a long way to travel before a turnaround transpires.

Technical considerations are also worth noting today as a setback for the AUD/USD rally could well be impacting on the broader Aussie Dollar complex, explaining why the current reversal looks so sharp.

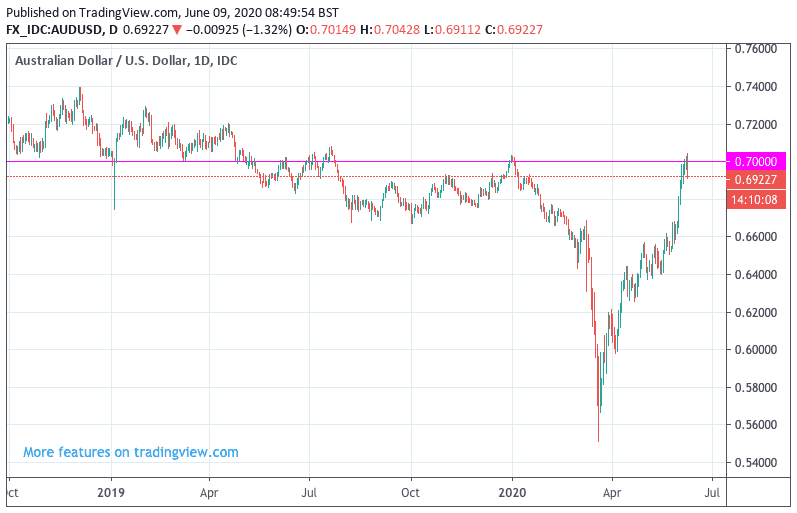

The Australian-to-U.S. Dollar exchange rate rallied to 0.70 before fading back to 0.6932, and if we look at a chart of this market we note that the pair has run into a notable historical resistance point that many traders will be selling into:

"AUD/USD has found last December's peak above 0.70 something of a barrier and after briefly breaking it this morning it has promptly fallen sharply," says Kit Juckes, Global Head of FX Strategy at Société Générale.

Looking ahead, how the Aussie Dollar performs from here will largely rest with how market sentiment progresses.

It appears investors are now turning attention to the mid-week meeting of the U.S. Federal Reserve, where investors will seek confirmation that the world's de facto central bank stands ready to continue underwriting the recovery in sentiment.

Any disappointments on this front could deepen the current sell-off in 'risk on' assets - such as the Australian Dollar - and lead to a deeper correction.

"These moves need to have the context that the are turning back from multi month highs (on AUD, NZD and EUR) versus the Dollar. However, as the FOMC begins its two day meeting, the dollar sell-off has at least for now been curbed. The question is whether this stalling of risk appetite on forex markets begins to lead to profit-taking on the equities bull run?" asks Perry.

On the domestic front, developments concerning Australia's increasingly fraught relationship with China are back in the spotlight following signs that China could be shifting its low-key tit-for-tat battle to tourism and students.

China on Tuesday warned students to reconsider studying in Australia due to the risks from coronavirus and an alleged increase in racial attacks since the outbreak, an accusation steadfastly denied by the Australian government.

The travel warning follows similar advice for Chinese tourists issued last week and is a potential blow for the Australian university sector which was already expected to lose $12BN in revenue from Chinese students this year.

The move follows a spate of low-key moves by China against Australian economic interests ever since Australia made a prominent call for an independent into China over its role in the early stages of the covid-19 pandemic.

Tariffs have already been placed on Australian barley, while extra layers of red tape have been, or are to soon be, wrapped around key exports such as beef, coal and iron ore.

Australia's tourism and education services exports to China were worth a combined A$23BN last year, about ten times the value of the affected barley and beef.

"One would think that all of China’s provocative actions towards Australia lately (barley, beef, tourism, and now education) would have hit the Australian Dollar more than it has by now, but the headlines have barely had any impact on the markets," says Erik Bregar, Head of FX Strategy at Exchange Bank of Canada.

While the market is yet to place any major concern over developments concerning Australia's rising tensions with China, we would be wary that it could become increasingly prominent in the future and expect further measures to be announced which could cap the Aussie Dollar's upside potential, particularly if guns are turned towards iron ore and coal in a more determined manner.