Pound Sterling in Best Daily Opening against Euro Since Mid-May, Looks for 7th Successive Daily Gain against U.S. Dollar

- GBP finds relief, goes higher

- EU and UK committed to further trade talks

- Autumn summit likely says Germany's EU ambassador

- Market guilty of being too negative on GBP heading into June

Above: File image of Germany's Merkel and UK's Johnson. Image © Gov.UK

- Achieve 3-5% more currency for your money transfers. Beat your bank's rate by using a specialist FX provider: find out how.

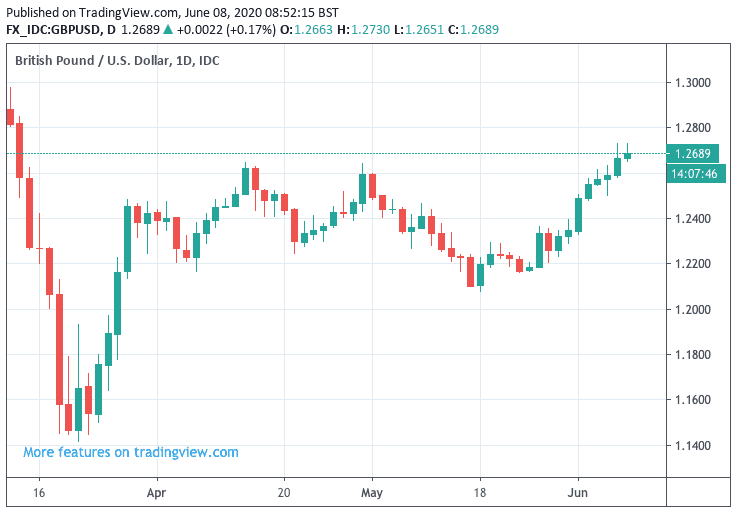

The British Pound started the week on a positive footing against both the Euro and Dollar, with the GBP/USD at its highest daily opening since March 12 and the GBP/EUR exchange rate recording its highest daily opening since May 15.

The gains in Sterling come amidst an ongoing improvement in global market sentiment as well as the evaporation of Brexit trade negotiation anxieties as the EU and UK have all but conceded that there are no looming hard deadlines for negotiations and they will likely run right through until year-end.

The Pound has now rallied for six days in succession against the U.S. Dollar, with the Pound-to-Dollar exchange rate trading at 1.2698 at the time of writing, levels last seen on March 12.

Despite Brexit trade negotiations ending in stalemate last week, the Pound-to-Euro exchange rate has rallied back to 1.1250, having started the new week at 1.1230, its best daily open since May 15.

The Pound lost value through the course of May, falling against most major currencies, as investors grew increasingly wary that talks would fail in June as a key European Council summit falls on June 19, while the UK faces a month-end deadline to request an extension for the negotiation period.

Foreign exchange options markets showed that traders were becoming increasingly worried that June would provide a negative outcome for Sterling as the cost of insuring against a big fall in the value of the currency had risen sharply, particularly towards mid-month.

Above: Cost of insuring against a big fall in GBP during June in the options market had been rising in May. Image courtesy of CME Group.

However, this fear appears to have been the result of a synthetic deadline that never really existed and the market will likely unwind some of its negativity which could prompt further gains.

"The fourth round of negotiations with the EU ended showing no major progress, but sterling seemed unaffected, both because the dominant theme over the past few days has remained the widespread improvement in sentiment tied to the lockdown exit phase, and because, at least formally, the chief negotiators on both sides hinted at the possibility of progress being made in the next few months," says Asmara Jamaleh, Economist at Intesa Sanpaolo.

Following the just-concluded round of talks, UK Chief Negotiator David Frost said in a statement, "progress remains limited but our talks have been positive in tone. Negotiations will continue and we remain committed to a successful outcome."

Frost says the UK is talking to the European Commission about setting up face-to-face talks in order to make a breakthrough. "We are willing to work hard to see whether at least the outline of a balanced agreement, covering all issues, can be reached soon," said Frost.

Meanwhile, UK Prime Minister Boris Johnson is expected to meet the European Commission President Ursula von der Leyen at some point in June to try and inject some political momentum into talks, confirming that that not only is effort being made by both sides to reach a deal, but there is the required flexibility on timelines required to achieve success.

Markets were apparently too pessimistic on Sterling heading into June and a clearer view of the state of play is allowing some of that negativity towards the UK currency to evaporate.

Last week it was said by a German official that EU leaders will intervene in Brexit trade negotiations in autumn, with the aim of sealing a compromise deal at a summit on 15 October.

Michael Clauss, Germany’s ambassador in Brussels, said there had been “no real progress” in the talks so far but predicted they would become the EU’s main political focus in September and October.

Germany will assume the rolling presidency of the EU in the second half of the year and will be key in generating the momentum required on the EU side for negotiations to end in success.

"Is a deal possible? Yes, definitely. But I think it also means that UK needs to have a more realistic approach," Clauss told an audience of the European Policy Centre. "To put in short, I think you cannot have a full sovereignty and, at the same time, full access to the internal market. So this Brexit issue is going to absorb a lot of political or most of the political attention we expect in September and October."

The question of Brexit has taken a backseat position across European capitals which have been almost exclusively focusses on fighting the coronavirus pandemic, which the UK believes is a major reason why the just-ended round of talks have stalled.

The EU and UK disagree on issues concerning fishing rights, so-called level playing field rules and governance.

The EU's Chief Negotiator Michel Barnier had on Friday confirmed what foreign exchange markets were expecting: that the EU and UK still remain too far apart to strike a post-Brexit trade deal.

Barnier delivered a press briefing following the conclusion of the previous week's negotiations - the last before the end-June deadline by which an extension must be agreed - saying there had not been significant progress on fisheries, level playing field provisions, governance, and police & judicial cooperation.

"On all these points, we are asking for nothing more than respect of the Political Declaration," said Barnier. "We must stick to our commitments if we want to move forward! In all areas, the UK continues to backtrack on the commitments it has undertaken in the Political Declaration."

However, the UK says the EU is asking for far more sacrifices on sovereignty than is the case with already-struck free trade deals, for instance with Canada and South Korea.

"As to our demands being unreasonable, these are our demands. No qualification UK can put to them will change our demands. We need to find space for compromise loyal to mandate of EU - that’s the challenge that lies ahead of us," Stefaan de Rynck, advisor to Michel Barnier, told and Institute for Government event in May.

"It’s a democratic decision to sign up to such commitments. We need to move beyond the kind of idea that signing up to international commitments that are legally binding would have some kind of threat to national democracy. We fully respect the UK has left," said De Rynck on the EU's demand that the UK sign up to level playing field rules.

De Rynck concedes the EU is "asking for a lot on state aid [dynamic alignment] because Member States and EU industry are very concerned'. Says: 'We need to find ways forward on the regulatory approach, also on state aid issues, otherwise we will not be able to conclude a deal."

With regards to fishing quotas, De Rynck said there are "timid openings" on fishing and both sides have "maximalist" positions. "It’s time we get more into granular discussions on stocks on quotas, on access to waters and see where the landing zone is on that".

Because pressures relating to Brexit might have lifted following recent developments on the trade negotiation front, we would expect the Pound to potentially rise in value.

However, expect rallies to ultimately be capped as this is an issue that will remain in place for some months, stifling the Pound's full potential.

Expect headwinds to start building again as year-end approaches, when the real hard deadline facing the EU and UK arises.