'Sell Pound Sterling in May'

- May tends to favour USD

- Equity market losses weigh on GBP at start of new week

- GBP coud gain against Euro in May, but decline against USD

Image © Adobe Images

![]() - Spot GBP/EUR rate at time of writing: 1.1373

- Spot GBP/EUR rate at time of writing: 1.1373

- Bank transfer rates (indicative): 1.1075-1.1155

- FX specialist rates (indicative): 1.1145-1.1270 >> More information![]() - Spot GBP/USD rate at time of writing: 1.2427

- Spot GBP/USD rate at time of writing: 1.2427

- Bank transfer rates (indicative): 1.2092-1.2179

- FX specialist rates (indicative): 1.2180-1.2315 >> More information

The British Pound starts the new week slightly higher against the Euro but softer against a broadly firmer U.S. Dollar, as global stock markets trade in the red amidst ongoing caution as to the economic impact of covid-19 and emerging geopolitical tensions over China's role in propogating the outbreak.

Global market sentiment therefore appears to still be firmly in charge of foreign exchange trading and the soft start to the week should tend to aid the likes of the Yen, U.S. Dollar and Franc and disadvantage the Australian and New Zealand Dollars as well as emerging market currencies. Sterling tends to trade softer against the Dollar but more mixed against the Euro in such market conditions.

"Rising tensions between the U.S. and China over the coronavirus are supportive of both USD and JPY. We expect USD to remain supported this week," says Kim Mundy, a foreign exchange strategist at Commonwealth Bank of Australia.

The Pound suffered a sharp sell-off against the Euro at the start of May, but if seasonal trends dominate foreign exchange markets Sterling could yet end the month higher against the Euro but lower against the U.S. Dollar.

Seasonality can often play a significant role in how a currency performs, as fiscal and tax year-ends fall at different times of the year while broader equity market investments also tend to show seasonal trends that can in turn impact FX, and May is regarded as the most reliable month for delivering predictable returns.

Analysis from Bank of America Merrill Lynch Global Research (BofA) shows April has historically been the most positive for Sterling against the Dollar with an average return of +1.8% since 2010; the positive seasonality in April remained intact in 2020 with a gain of 1.37% being recorded by the Pound-to-Dollar exchange rate.

Against the Euro the advance was even greater with the Pound-to-Euro exchange rate rallying by 2.23%.

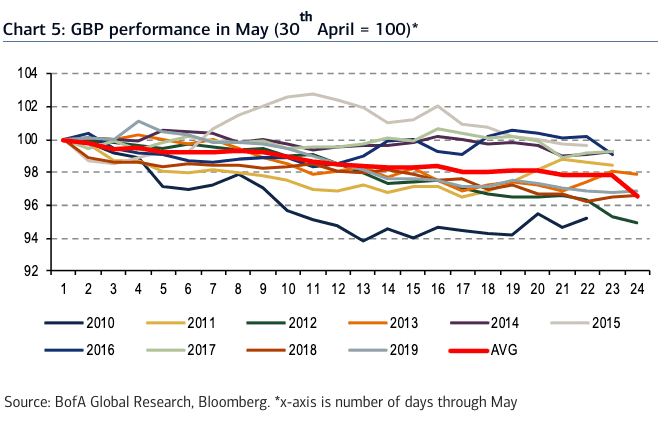

But, May tends to be negative for Sterling against the Dollar.

"As much as April is a positive month for GBP, driven in large part by the new UK tax year and corporate dividend repatriation of overseas income, May is a month where USD strength is the main driver for GBP/USD under-performance," says says Kamal Sharma, Director of G10 FX Strategy at BofA.

"May’s seasonal patterns suggest further USD strength is due, so we think that current levels in the AUD, NZD and Asian currencies likely present a peak," says Daniel Been, Head of FX and G3 Research at ANZ.

Global foreign exchange joins the wide financial market place in being driven by 'risk on' / 'risk off' trends since the covid-19 crisis exploded in late February. Since then all currencies have tended to move according to where they sit on a Ro Ro scale.

The Yen, Franc and Dollar are your typical 'risk off' beneficiaries while the Australian Dollar, New Zealand Dollar and Norwegian Krona are your 'risk on' beneficiaries.

The Pound leans towards 'risk on' in the spectrum. The findings of a seasonal impact on Sterling therefore "strongly suggests that May is a risk-off month," says Sharma.

"FX performance and drivers are likely to vary greatly depending on the post-lockdown path for the global economy," says David Bloom, Global Head of FX Research at HSBC. "Risk On - Risk Off (RORO) has been the dominant driver of FX, its current grip on the market even tighter than seen during the global financial crisis. Currencies are being driven by the vagaries of risk appetite."

With broader market sentiment likely to maintain a tight grip on foreign exchange markets for the foreseeable future, Bank of America's research therefore chimes with that old market adage to 'sell in May' in anticipation of a summer lull in market performance therefore does appear to be valid.

However, while Sterling might be expected to struggle in May against the Dollar, the UK currency might be less exposed to loses against the Euro, as analysis shows the Euro tends to under-perform more than the Pound.

If EUR/USD is falling further than GBP/USD it stands that the EUR/GBP cross in turn falls, which gives GBP/EUR appreciation.