Pound Sterling Looks Like it Wants to Go Higher Against the Euro and Dollar

- GBP rally has faded into month-end

- But could restart trend of appreciation

- GBP could play catchup with stock market recovery

- Exit from lockdown could trigger either weakness or strength

Image © Adobe Images

![]() - Spot GBP/EUR rate at time of writing: 1.1484

- Spot GBP/EUR rate at time of writing: 1.1484

- Bank transfer rates (indicative): 1.1182-1.1260

- FX specialist rates (indicative): 1.1252-1.1380 >> More information![]() - Spot GBP/USD rate at time of writing: 1.2480

- Spot GBP/USD rate at time of writing: 1.2480

- Bank transfer rates (indicative): 1.2143-1.2230

- FX specialist rates (indicative): 1.2225-1.2368 >> More information

The British Pound has found its ambitions to go higher against both the Dollar and Euro restrained this week, but a look at the set-up of both GBP/USD and GBP/EUR markets suggest the currency is itching to restart and extend a multi-week rally.

Sterling's gains since mid-March have ultimately stalled over recent days, yet it does continue to occupy the upper spectrum of its range and May could well see the trend of appreciation continue, particularly as global equity markets continue to improve in tone.

The Pound has caught the coattails of the sizeable market recovery that is now in its sixth week, ensuring the Pound-to-Euro exchange rate has rallied back to just below the 1.15 barrier and the Pound-to-Dollar exchange rate rallied back above 1.24.

"Risk On - Risk Off (RORO) has been the dominant driver of FX, its current grip on the market even tighter than seen during the global financial crisis. Currencies are being driven by the vagaries of risk appetite," says David Bloom, Global Head of FX Research at HSBC.

But, the rally in stocks does this week appear to have left the Pound behind; with most Sterling pairs settling into a sideways pattern and we wonder if some catch up is in order and a breakout imminent.

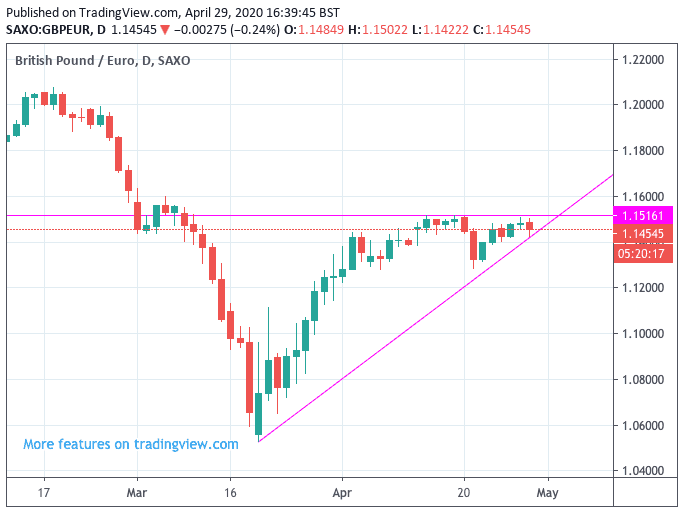

The Pound-to-Euro exchange rate in particular looks like a candidate poised for a move higher given that the uptrend still technically remains intact:

Above: GBP/EUR daily chart showing a trend of appreciation since mid-March

The Pound-Euro rate has steadied on top of its 200-day moving-average at 1.1459 and was testing the 61.8% Fibonacci retracement of the 2020 downtrend at 1.1488 (see below) on Thursday but the exchange rate could finally gather the momentum required to cross over the latter rubicon.

We are however wary that a break higher might require some kind of fundamental trigger, which could come from a combination of disappointing GDP data out of the Eurozone on Thursday. Markets could be radically underestimating the size of the first-quarter economic downturn in the Eurozone, risking fresh losses for the Euro-to-Dollar rate, which would ultimately be reflected in gains for GBP/EUR.

Positive Brexit developments could also shift the dial on Sterling exchange rates but with no negotiations underway this week we see any near-term developments on this front as being unlikely. More probable would be the release of news of measures to ease the UK lockdown.

We have been warning that Sterling could be exposed to potential downside if the markets give a thumbs down to the UK's lockdown exit plans, or lack thereof.

"Britain is mum on when it plans to roll back lockdown measures weighed on the Pound and largely kept it sidelined while the euro and others rose against the greenback. The perception that Britain would ease lockdown measures later rather than sooner led many to kick further down the road U.K. economic recovery prospects," says Joe Manimbo, an analyst at Western Union.

UK Prime Minister Boris Johnson returned to work this week after an illness caused by covid-19, and in an address outside Downing Street said that the time would come when he would unveil measures. Indeed, there has been a steady drip-feed out of the UK media over recent days regarding various plans to ease the lockdown, including plans to reopen schools. Media reports suggest that an announcement on some easing measures could be made on either Thursday or Friday.

Polls nevertheless confirm that the UK public continues to strongly support lockdown measures for as long as they are required and this might yet cause the government to maintain a slow and steady approach.

Delay could in turn contribute to Sterling's moribund state for a while longer.

"Attention has shifted towards easing the restrictions, but a premature move risks a big ‘second wave’ and a resurgence in fatalities. Unwinding the lockdown is therefore likely to be gradual, meaning a full return to normality may be some way off for the UK economy," says Philip Shaw, Chief Economist at Investec Bank plc.

Shaw says the Pound does appear to be responding to issues concerning the country's response to covid-19, citing evidence that the fall in Sterling up until March 23 appears to have been due to concerns about the UK’s initial response to virus.

"Sterling has strengthened following the lockdown on 23 March to a greater extent than its G10 peers," says Shaw.

Image courtesy of Investec

Investec have told clients they have adjusted their forecasts and now look for Pound Sterling to rise to 1.26 against the Dollar and 0.87 against the Euro by end-2020, against previous forecasts for $1.20 and 92p. 0.87 EUR/GBP gives a GBP/EUR exchange rate of 1.15, while 0.92 gives a rate of 1.0870.

Paul Spirgel, an analyst on the Thomson Reuters currency desk tells traders to maintain an eye on how various countries exit lockdown, saying that countries that see a strong bounce-back relative to peers could see their currencies outperform.

"As the global pandemic plays out, most countries will continue offering extraordinary accommodation. The main difference is likely to be timing, which could cause short-term currency shifts. Barring an unexpectedly independent UK economic recovery, or a quick UK-EU trade agreement, this dynamic should cap GBP/USD by its recent trend high in the mid 1.26s," says Spirgel.