The Pound Finds Some Positive Takeaways in UK Labour Market Stats, Holds Key Levels vs. Euro and Dollar

- GBP takes in first of week's major economic reports

- UK economy adds 180K jobs in December

- But disappointment as wage growth slips

Image © Adobe Images

- Spot rates at time of writing: GBP/EUR: 1.0808, -1.75% | GBP/USD: 1.1852, -2.15%

- Bank transfer rates (indicative): GBP/EUR: 1.0520-1.0596 | GBP/USD: 1.1537-1.1620

- Specialist money transfer rates (indicative): GBP/EUR 1.0650-1.0701 | GBP/USD: 1.1650-1.1745 >> More details

Pound Sterling was left churning at around 1.20 against the Euro and 1.30 against the Dollar following the release of UK labour market statistics that showed the UK economy continues to add jobs to its workforce, but the pace in wage increases has started to fade.

There was good and bad news from a foreign exchange market perspective, firstly the positives:

According to the ONS, the UK added 180K to its labour force in the three months to December 2019, which is more than the increase of 145K the market was looking for. This is however still below November's 208K but it must be remembered that hiring does tend to slowdown into the Christmas period. The claimant count meanwhile grew by 5.5K, well below the 22.5K the market was looking for.

The strong outcome was due largely to a 203K increase in full-time work, which was partially offset by a 23K fall in part-time workers. The unemployment rate held steady at 3.8%.

76.5% of people aged 16 to 64 were in paid work in October to December 2019 ????

— Office for National Statistics (@ONS) February 18, 2020

This is a record high, 0.4 percentage points higher than the previous quarter and 0.6 percentage points higher than a year earlier ???? https://t.co/PBXNufA2e3 pic.twitter.com/WxZ2Lzl93t

And the negatives: while the headline jobs numbers beat expectations, the wage component of the report disappointed somewhat.

Average earnings, with bonuses included grew by 2.9% in December, which is below the 3.0% markets were looking for and well below November's 3.2% expansion.

Average earnings, without bonuses included, read at 3.2%, which was below expectations for 3.3% and and below November's reading of 3.4%.

The Pound-to-Euro exchange rate trades at 1.20, largely unchanged on the day's open. The Pound-to-Dollar exchange rate meanwhile trades at 1.30 which is slightly softer than where it started the day.

The currency market reaction to the labour market report is understandably sanguine as there are some good and bad elements to digest, but primarily because the data covers the December period and therefore does not fully account for any lift in economic activity following the General Election.

We would expect the March labour report, which covers January, to have more of a bearing on markets.

However, the overall tenor of the report suggests the UK's labour market remained relatively robust at a period of intense political uncertainty, therefore this provides a decent springboard to a more decided upturn in both wages and employment in the first half of 2020.

"The larger-than-expected rise in employment in December suggests that the labour market joined the rest of the economy in turning a corner at the end of last year," says Thomas Pugh, UK Economist at Capital Economics. "the strength in the labour market in Q4 will give some comfort to the MPC that it was right to keep rates on hold at 0.75% at its meeting on 31st January. Of course, this is all old news, but the most recent surveys are suggesting that employment growth will continue to pick-up in Q1, which we think will contribute to the MPC keeping rates on hold at its next meeting on 26th March as well."

The Bank of England's MPC in February opted to keep interest rates unchanged, despite the obvious slowdown in UK economic growth witnessed towards the end of 2019. The MPC wanted time to assess whether the December 12 election had lead to a boost in business confidence, which would in turn presumably lead to increases in wages which would in turn lead to higher rates of inflation. How wage dynamics progress over coming months will ultimately determine whether the Bank opts to cut interest rates, which would be on balance a negative for Sterling's valuation.

"A recovery in household spending growth, trade and a sharp rise in government spending will further raise demand for labour in 2020. Still nervous about the prospect of a disorderly exit from the single market at the end of 2020, firms may remain reluctant to raise capital investment much. Instead, they may continue to rely on the UK’s flexible labour markets to raise productive capacities," says Kallum Pickering, Senior Economist at Berenberg Bank. "By the H2 2020, as the imbalance between strong demand for labour and weak supply of labour starts to show up in faster wage growth, the BoE will likely turn more hawkish."

Berenberg expect the next move at the Bank of England to be an interest rate hike, due in the second half of 2020. When central banks raise interest rates, the general rule of thumb is the currency they issue appreciates in value.

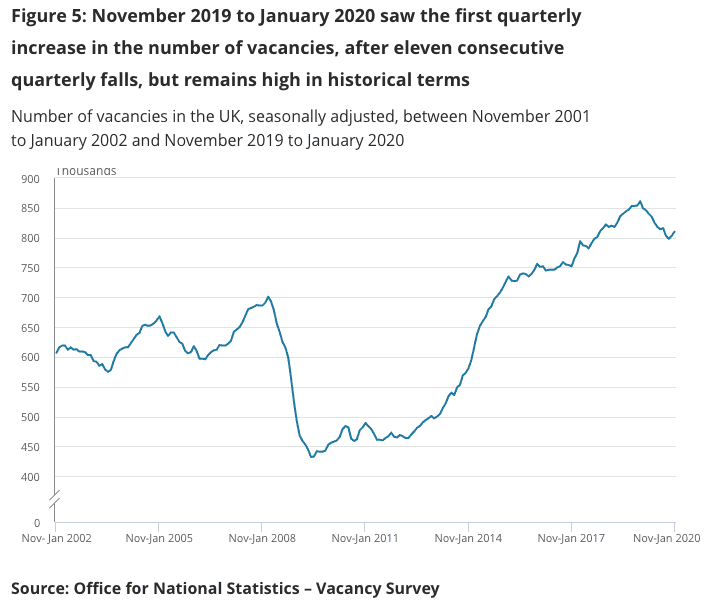

The ONS also showed job vacancies had ticked higher towards the end of the year, suggesting a potential bottom has been forming as the number of vacancies had been in a downward trend in 2019.

For November 2019 to January 2020, there were an estimated 810,000 vacancies in the UK, 7,000 more than for the previous quarter (August to October 2019) but 50,000 fewer than for the previous year.

"For each vacancy, on average there were 1.6 unemployed people for employers to choose from. At the height of the financial crisis, this ratio was closer to 6," says Nikesh Sawjani, UK Economist at Lloyds Bank. "Generally, these dynamics should put upward pressure on wages as firms compete for labour."

"An environment where the amount of output being produced for each hour worked remains low, while firms are having to pay more, means that unit labour costs – the cost of producing a unit of output – are rising. It is this dynamic that leads us to expect that domestically generated inflation pressures will continue to build. Overall, this latest news is a reminder that even current levels of pay growth – in a tight labour market – are inconsistent with market expectations of a lower level of Bank Rate," adds Sawjani.