UK PMIs: "Input Cost Inflation Falls to a Two-year Low"

Image © Adobe Images

The Bank of England's most recent interest rate hike could be the last as new survey data shows a sharp drop in inflation experienced at UK private sector businesses.

The S&P Global PMI for March on Friday revealed that "input cost inflation falls to a two-year low."

The decline reflected a "considerable softening of cost pressures in the manufacturing sector," said S&P Global.

The developments bolster the Bank of England's forecasts that show UK inflation will fall quickly from the second quarter onwards, potentially allowing the Bank to forgo another rate hike at its May policy meeting.

"Many firms noted that lower commodity prices and falling freight rates had been passed on by suppliers. Manufacturers continued to report improving supply conditions, with delivery times shortening to the greatest extent since April 2009," said S&P Global.

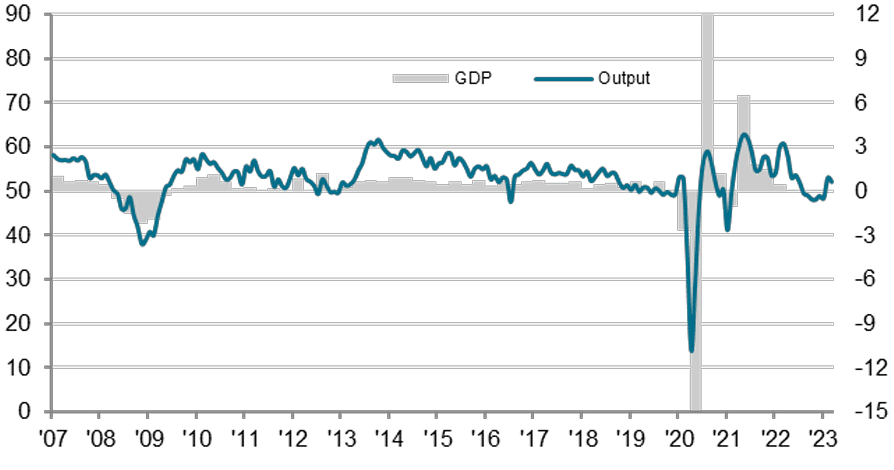

The services PMI for March read 52.8 amidst ongoing expansion in the sector, however, this was down on February's 53.5 and the market was expecting a reading of 53.0

The manufacturing PMI read at 48, consistent with contraction, defying expectations for a flat 50.

Above: PMI at the left column, GDP on the right. Sources: S&P Global, CIPS, ONS.

The composite PMI - which rebalances the data to give a more accurate snapshot of the broader economy - came in at 52.2, which was below the expectation for 52.7 and the previous month's 53.1.

The takeaway is that manufacturing continues to struggle but because the UK economy is overwhelmingly dominated by the services sector growth will likely be recorded in the first quarter of 2023.

From a monetary policy perspective, the easing price pressures suggest February's unexpected inflation spike could be a one-off and that the Bank can leave interest rates at 4.25%.

Indeed, S&P Global said prices charged inflation continued to drift downwards in March as softer cost pressures were gradually passed on to customers.

The findings come on the same day that Bank of England Governor Andrew Bailey told the BBC, "I do not have evidence that companies are putting prices up more than necessary."

He added, "companies should bear in mind that BoE forecasts inflation will fall."

He was also more optimistic about the economic outlook than has been the case for some time, saying the risk of recession this year has gone down quite a lot. "Pretty strong likelihood we will avoid recession this year," he said.