GBP/NZD Week Ahead Forecast: Supported by Key Averages

- GBP/NZD stalled & turned away from five month high

- Further losses are possible but key averages support

- U.S. inflation & Kiwi's Q4 GDP could boost GBP/NZD

- UK's employment data & annual budget also in focus

Image © Adobe Images

The Pound to New Zealand Dollar exchange rate reached five-month highs early in the new week before being beaten into retreat by a rallying Kiwi that has left Sterling at risk of a deeper correction with scope for GBP/NZD to fall as far as key moving averages just below 1.93 in the days ahead.

New Zealand's Dollar rallied more than two percent against a falling U.S. Dollar while outperforming all G20 counterparts including the Pound on Monday as market-based measures of expectations for the Federal Reserve (Fed) interest rate fell heavily from the outset.

Falling rate expectations offered relief to other currencies after the U.S. Treasury, Federal Reserve and Federal Deposit Insurance Corporation (FDIC) pre-emptively guaranteed something like a bailout of all bank depositors.

"The degree of USD weakness is modest when set against the more sizeable move in US yields, and also in US yield differentials. This suggests that the USD is receiving some partially offsetting support from a safe-haven bid," says Daragh Maher, Americas head of FX strategy at HSBC.

Above: Pound to New Zealand Dollar rate shown at 2-hour intervals alongside NZD/USD. Click image for closer inspection.

Above: Pound to New Zealand Dollar rate shown at 2-hour intervals alongside NZD/USD. Click image for closer inspection.

"The more the market frets about systemic risks, the greater the likelihood that the safe-haven bid for the USD will begin to dominate more. However, if contagion fears diminish but Fed rate expectations remain capped, the USD weakness seen overnight could extend," Maher adds in Monday commentary.

While Monday's price action saw GBP/NZD turned away from the five-month highs seen going into European trade, the negatively-correlated NZD/USD pair and U.S. Dollar more broadly are both also likely to be highly sensitive to details and implications of Tuesday's inflation data for February.

"US CPI and the stability of the global banking system after recent events will likely be key for how far (and how fast) USD moves from here," writes Zoe Strauss, an FX strategist at Morgan Stanley, in a Monday market commentary.

"A swath of pivotal data released this week will also help to shape RBNZ policy expectations for the April meeting, and can provide further downward momentum to AUD/NZD," Strauss and colleagues say add.

Source: Morgan Stanley. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Monday's moves in the currency and bond markets saw investors fully price out any and all possibility of the Federal Reserve raising its interest rate further at all in the months ahead, although Tuesday's U.S. inflation data for February will be an influential arbiter of whether this is really the case.

"I do think the move in the US yield curve is well overdone, but it does seem to be the case that a 50bps at the next meeting is all but impossible," says Brad Bechtel, global head of FX at Jefferies.

"If they really do feel they have 'solved' this bank run issue and that the dust settles on this then it will actually potentially embolden Powell to keep going on rate hikes," Bechtel writes in Monday market commentary.

The consensus among economists looks for U.S. inflation to fall from 6.4% to 6% for the month of February and for the more important core rate to decline from 5.6% to 5.5% but other price figures emerging from the U.S. in recent weeks have suggested that risk may be on the upside this Tuesday.

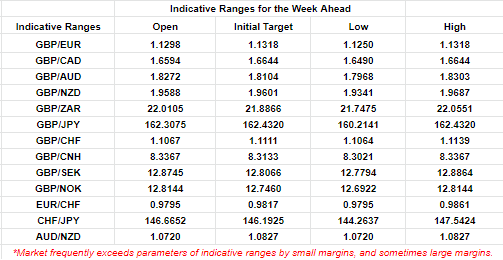

Above: Financial model-derived estimates of probable trading ranges for selected currency pairs this week. Source Pound Sterling Live. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

To the extent that Tuesday's data keeps the prospect of further increases in U.S. interest rates alive, it could come as a setback to the Kiwi and offer support to GBP/NZD ahead of New Zealand's final quarter GDP figures.

"We’ve pencilled in a 0.3% q/q contraction for Q4 GDP, due next Thursday. That’s weaker than our previously published forecast of +0.3% q/q and the RBNZ’s February MPS forecast," says Miles Workman, an economist at ANZ.

"At the risk of sounding like a broken record, given ongoing noise in the data, we’re not convinced a weak read in Q4 can be considered much more than payback from the whopper pace of growth in Q3 (+2.0% q/q)," Workman adds.

The economist consensus already suggests that New Zealand GDP likely shrank by -0.1% last quarter, leaving it running behind the Reserve Bank of New Zealand (RBNZ) forecast, although any steeper fall than this would potentially act as an added headwind for Kiwi exchange rates.

Above: NZD/USD shown at daily intervals with selected moving averages. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Above: NZD/USD shown at daily intervals with selected moving averages. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

"We were already bracing for much more subdued growth in the December quarter. But the final batch of indicators released last week actually suggests a slight contraction. We now estimate that GDP fell by 0.2% in the December quarter," says Michael Gordon, acting chief economist at Westpac New Zealand.

"With the likelihood of a much weaker than expected GDP result – and effectively no other major data releases between now and April – we now expect the RBNZ to lean towards a smaller 25 basis point increase [in April]," Gordon writes in a Monday research briefing.

With U.S. and Kiwi economic data aside, GBP/NZD is also likely to be sensitive this week to outputs from a busy UK economic calendar including the implications that Tuesday's employment figures and Wednesday's budget could have for the Bank of England (BoE) Bank Rate outlook.

Any further moderation of UK wage growth, or decision by the Chancellor to push on with earlier planned tax increases and reductions of energy price subsidies, could have the effect of dampening expectations for the economy and the BoE Bank Rate or vice versa this week.

Above: Pound to New Zealand Dollar rate shown at daily intervals with selected moving averages. Click image for closer inspection. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Above: Pound to New Zealand Dollar rate shown at daily intervals with selected moving averages. Click image for closer inspection. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)