GBP/AUD Week Ahead Forecast: Risking a Deeper Setback

- GBP/AUD stalled & turned away from one-year-highs

- Risks short-term dip below 1.80 if correction deepens

- Any employment recovery in AU could weigh heavier

- UK employment data & annual budget also pose risk

Image © Adobe Images

The Pound to Australian Dollar exchange rate stalled at one-year-highs before reversing to the downside early in the new week but would risk a deeper corrective setback if clarity emerges around the Australian employment situation or if UK economic developments hamstring Sterling in the days ahead.

Australia's Dollar rallied strongly on Monday as U.S. exchange rates fell widely in tandem with market-based measures of expectations for the Federal Reserve (Fed) interest rate in the months ahead as investors and traders mulled the implications of ongoing developments in the U.S. banking sector.

"A weaker USD and revised US rate expectations have led a rally in AUD/USD," says Patrick Bennett, head of Asia FX strategy at CIBC Capital Markets.

Above: Pound to Australian Dollar rate shown at 2-hour intervals alongside AUD/USD. Click image for closer inspection.

Above: Pound to Australian Dollar rate shown at 2-hour intervals alongside AUD/USD. Click image for closer inspection.

This is after the U.S. Treasury, Federal Reserve and Federal Deposit Insurance Corporation (FDIC) jointly and pre-emptively guaranteed something close to a full bailout of depositors in the U.S. banking system.

Bank deposits have been guaranteed while some hope has also been offered for account balances in excess of the FDIC-insured amount to help circumvent concerns about banking deposits at other institutions following the weekend failure of Silicon Valley Bank.

"As a result of the banking system stresses, our economists no longer expect a hike in March but uncertainty is especially elevated – 10 days is a long time in the context of a modern bank run and the macro data set continue to be very strong," says Sid Bhushan, an economist at Goldman Sachs.

Above: Fed Funds rate implied by September 2023 futures contract shown at daily intervals alongside U.S. Dollar Index and USD/AUD. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Above: Fed Funds rate implied by September 2023 futures contract shown at daily intervals alongside U.S. Dollar Index and USD/AUD. To optimise the timing of international payments you could consider setting a free FX rate alert here.

There has been no bailout of stock or bondholders while all measures are so far temporary and aimed only at averting so-called 'bank runs' by circumventing concerns about the safety of deposits across the system.

No 'stimulus' has been provided either and if the measures announced Sunday are comparable with anything it would be the Bank of England's (BoE) emergency intervention and buying in the UK government bond market between late September and late October last year.

"The parallels with the BoE actions following the mini-budget last Autumn are relevant, where the BoE managed to ease liquidity policies while tightening monetary policy around the same time; but an important difference is that pension funds are less vulnerable to runs relative to Banks," Bhushan says.

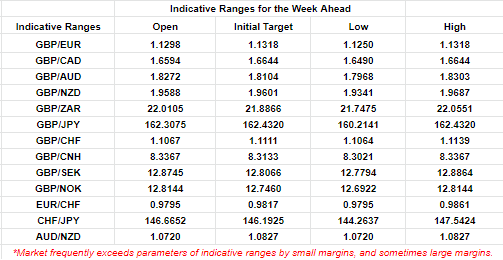

Above: Financial model-derived estimates of probable trading ranges for selected currency pairs this week. Source Pound Sterling Live. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

"Our economists expect a strong employment report in Australia as payback for the two previous weak readings, but they expect a meaningful miss relative to RBNZ forecasts for Q4 New Zealand GDP. Put together, domestic factors could support AUD/NZD moving higher this week," Bhushan and colleagues say.

Monday's supervisory intervention comes at the opening of a busy week for economic data and the central bank policy outlook in Australia, the UK and the U.S. with the highlight of the period ahead down under being the release of Australia's job figures for February on Thursday.

"Given the recent guidance from the Governor of the Reserve Bank of Australia, a downward surprise to employment would pull AUD down more than an equal-sized upward surprise. Stronger than expected Chinese data may also offer some intraday support to AUD/USD," says Joseph Capurso, head of international economics at Commonwealth Bank of Australia.

Above: Pound to Australian Dollar rate shown at daily intervals with selected moving averages and AUD/USD. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Above: Pound to Australian Dollar rate shown at daily intervals with selected moving averages and AUD/USD. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

"AUD/GBP can head higher towards 0.5629 (100 day moving average) [GBP/AUD lower toward 1.7765] if the UK employment and wages data soften," Capurso and colleagues write in a Monday research briefing.

The consensus suggests Australia's labour market drew a line under two months of weakness last month, although any third successive softening would likely prompt a reconsideration of the outlook for the Reserve Bank of Australia (RBA) cash rate with potentially bullish implications for GBP/AUD.

But with Australian data aside, much about GBP/AUD price is likely to be determined this week by any international impact of the latest volley of economic numbers from China on Tuesday and any impact on Sterling stemming from Tuesday's UK employment data and Wednesday's annual budget.