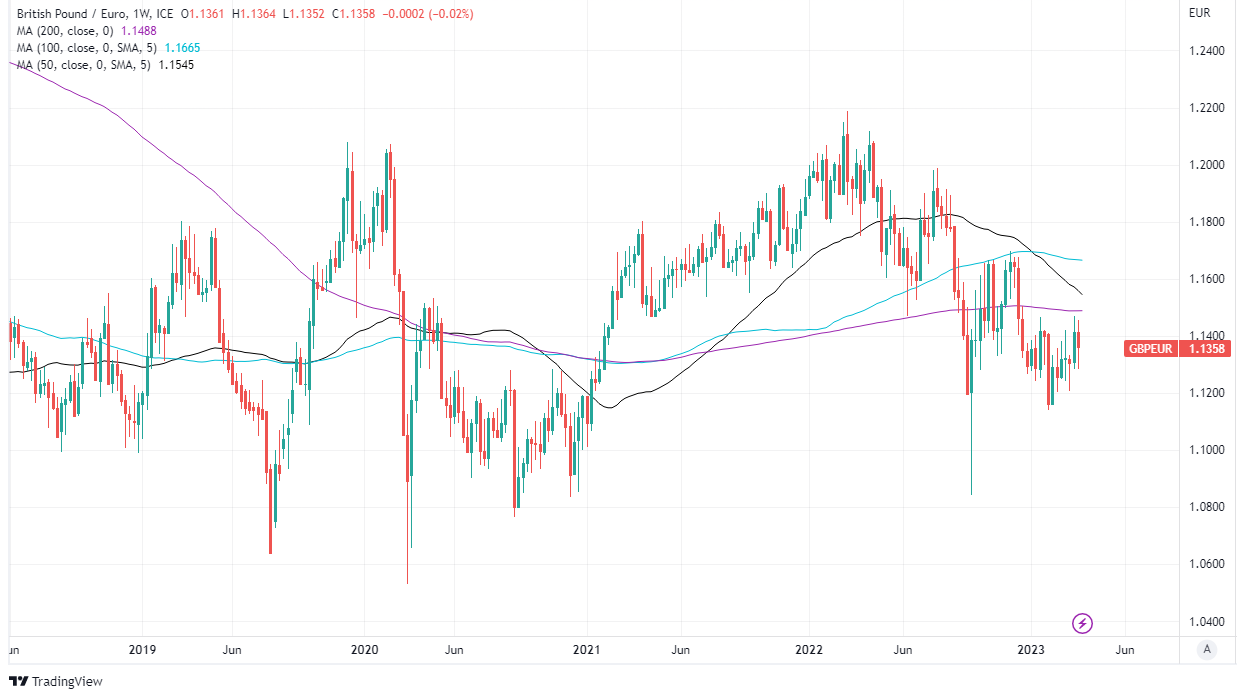

GBP/EUR to Struggle to Hold 1.1389

- GBP/EUR attempting recovery of key average at 1.1389

- Could struggle to advance much beyond 1.14 short-term

- If concerns over EU banks fade & EUR recovers footing

- BoE speeches in focus for GBP as EUR CPI data looms

Image © Adobe Images

The Pound to Euro exchange rate was hobbled near year-to-date highs last week and the risk is that it now struggles to regain a foothold above the nearby 100-day moving average at 1.1389 as market attention returns to Euro Area inflation and the European Central Bank (ECB) interest rate outlook.

Sterling pared earlier losses against the Euro ahead of the weekend as financial markets asked questions about the stability of a large German bank to the detriment of risk assets as well as the single currency, enabling GBP/EUR to recover further from last week's low.

This was after the Bank of England (BoE) raised Bank Rate to 4.25% and noted the better-than-expected economic performance of recent months.

"The BoE meaningfully upgraded Q2 growth from -0.4% (non-annualized) to “slightly” positive and even conservative assumptions on the path from there suggest large upgrades to 2023 Q4/Q4 growth in the May MPR [Monetary Policy Report]," says Michael Cahill, a G10 FX strategist at Goldman Sachs.

Above: Pound to Euro rate shown at daily intervals with selected moving averages. Click image for closer inspection.

"We no longer look for idiosyncratic GBP weakness, as investor sentiment on the fiscal side has improved meaningfully, and are updating both our 6- and 12-month EUR/GBP forecasts," Cahill writes in Friday market commentary.

Cahill and colleagues raised their six and 12-month Pound to Euro forecast to 1.1368 on Friday, from 1.1235 and 1.1111 respectively, in anticipation of a less 'dovish' message coming from the BoE in the months ahead.

This is after BoE indicated that its forecasts for the economy are likely to be raised notably in May, although it also no longer characterised inflation risks as being tilted to the upside and gave no clear signal about the prospect of any further increase in interest rates.

"Throughout last year, the BoE justified underdelivery by leaning on a weak consumer outlook, which was never really challenged because weak growth was expected in the future. With these sizeable growth upgrades, it will be challenging for the BoE to maintain this messaging," Cahill and colleagues say.

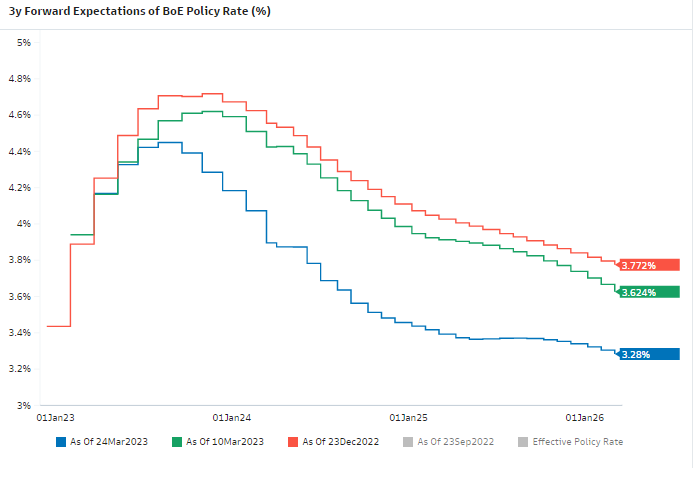

Above: Changes in market implied expectations for BoE Bank Rate between selected dates. Source: Goldman Sachs Marquee. To optimise the timing of international payments you could consider setting a free FX rate alert here.

"We would consider turning even more positive on GBP if we became confident in a revised approach from the BoE," they add.

The absence of commitment to any further increase in interest rates is one possible reason for the Pound's underwhelming performance following last Thursday's decision and is another for why Sterling is likely to listen closely to Governor Andrew Bailey on Monday and Tuesday this week.

Governor Bailey is set to address the London School of Economics at 18:00 on Monday before appearing in front of the House of Commons Treasury Select Committee at 09:45 on Tuesday and days after S&P Global PMI surveys indicated the UK's nascent economic rebound likely lost momentum in March.

"The composite output prices index fell to a 19-month low of 59.5 in March, from 62.2 in February, driven by a drop in the services output prices index," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

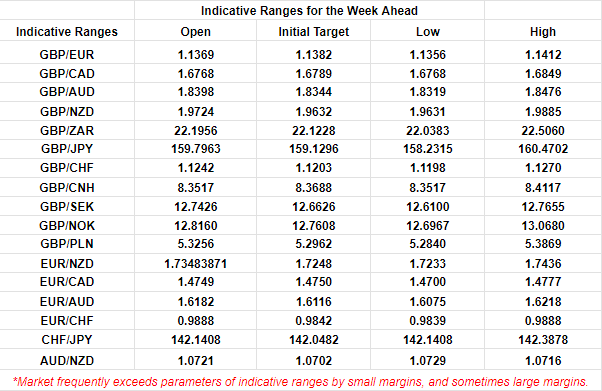

Above: Quantitative model-derived estimates of probable trading ranges for selected currency pairs this week. Source Pound Sterling Live. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

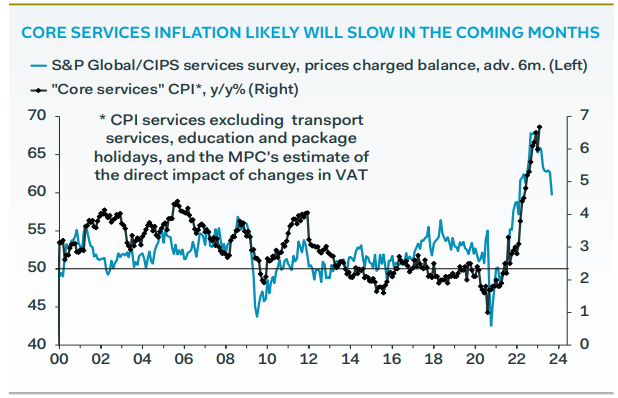

"Our chart below shows that the MPC's measure of “core services” inflation looks set to slow over the coming months. This, on top of the drop in the employment balance, suggests the case for further increases in Bank Rate is not compelling," Tombs adds in a Friday research briefing.

GBP/EUR is also likely to be responsive to financial market sentiment relating to the European banking sector this week after benefiting on Friday after benefiting from speculation about the condition of a large German lender.

That potentially leaves Sterling at risk in any recovery by global markets this week and ahead of Friday's Euro Area inflation figures for March, which will almost certainly have implications for the European Central Bank policy outlook.

"Headline inflation will decline quite rapidly over the next six to seven months as the base effects play in favour of a rapid reduction in inflation. What we want to see is a steady and clear convergence towards the 2 per cent target," ECB Vice President Luis de Guindos told Business Post at the weekend.

Source: Pantheon Macroeconomics.

"In that respect, core inflation is going to be key. It is very difficult to converge towards the 2 per cent target in a sustainable way without a clear decline in core inflation," he also said in an interview with the business newspaper.

The consensus among economists sees Eurozone inflation as likely to fall from 8.5% to 7.5% for the month of March on Friday but also looks for the more important core inflation rate to rise from 5.6% to 5.7%.

The risk around Friday's inflation numbers would be on the upside, however, if last week's data from the UK is anything to go by while any stronger-than-expected figures would be a downside risk for the Pound if they lead to a fresh upward drift in market-implied expectations for the ECB's interest rate.

"We raised rates by 50 basis points in March and we are open-minded with respect to the future. We are data dependent," the ECB's de Guindos said.

Above: Pound to Euro rate shown at weekly intervals with selected moving averages. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.