Beware a Euro Rebound Next Week as ECB Remains on Taper 'Auto-Pilot'

Image © European Central Bank, reproduced under CC licensing

- Negative data unlikely to derail ECB from plan on cutting quantitative easing

- Thursday ECB meet could lead to rise in Euro on guidance issued

- Some analysts more cautious about rate hikes next September, however, as risks increase

Euro exchange rates could receive a leg-up next Thursday when the European Central Bank (ECB) meets for its September monetary policy meeting.

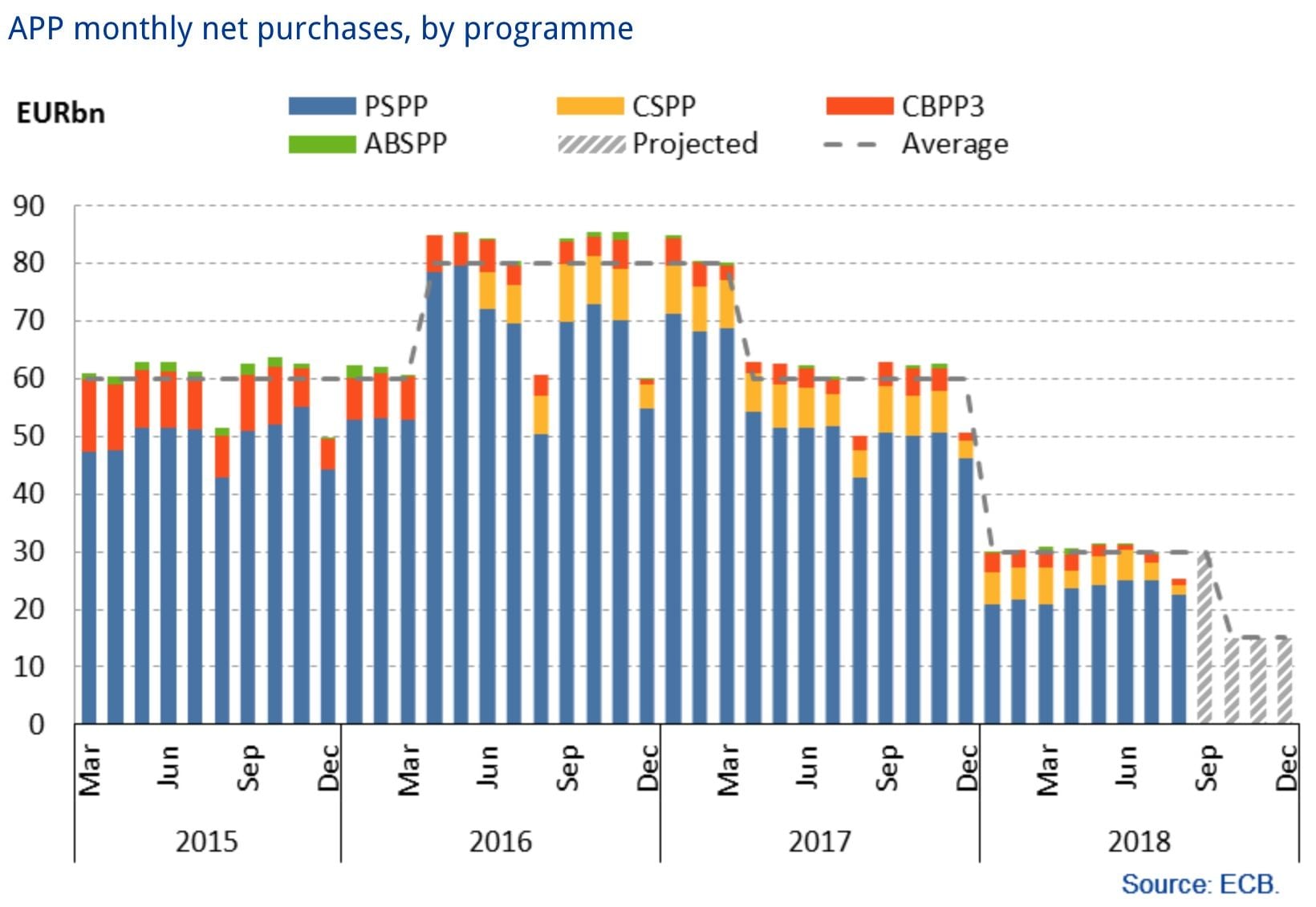

The Bank is widely expected to reduce the volume of its quantitative easing programme (Asset Purchase Programmes) from 30bn asset purchases per month to 15bn, and this should lend support to the currency.

The ECB hinted it might taper purchases in September at its June meeting when it said that it anticipated a drop in monthly purchases after September and a complete end to QE by the end of the year.

Nothing is certain, however, and a slew of negative European economic data releases as well as mounting political risk in the region has led some analysts to question whether the ECB will go ahead with its plans to 'remove the punchbowl'.

The tenor of European economic data releases could be an issue for policy makers to consider.

The latest blot on the Eurozone scorecard came from an unexpected drop in German industrial production which showed a -1.1% fall, the data coming on the heels of a surprise drop in German factory orders on Thursday.

Contributing to the drop in manufacturing output from Europe's industrial engine was a reported fall in German exports of -0.9% in July, well undershooting forecasts of a 0.2% rise.

A higher-than-expected rise in imports of 2.8% led to a narrowing of the trade surplus to 15.8bn from 19.3bn previously and 19.0bn expected.

Inflation too has fallen: a slowdown in both broad and core inflation of a basis point, from 2.1 to 2.0 and 1.1 to 1.0 respectively, in August raised concerns last week.

Poor data coupled with increased political risk from Italy are major headwinds which threaten to derail the ECB's plans to curtail QE.

Such expectations could be creeping into current Euro valuations, ensuring the potential for an upside surprise should the ECB confirm it is unconcerned by recent developments.

Strategists at ING Bank are confident that the central bank will go ahead and halve asset purchases at their meeting on September 13.

"Market volatility, Italian fiscal policies and low core inflation will do little to divert the ECB from its taper plans," says Carsten Brzeski, chief German economist at ING Bank N.V. "The auto pilot, turned on in June, should stay on. On Thursday, the ECB will in our view deliver the first step of the pre-announced dovish tapering: a reduction of the monthly QE purchases from €30bn to €15bn."

Bar the onset of a financial crisis the central bank is expected to continue with plans to taper, and, "Italian calls on the ECB to extend QE beyond December this year should meet with deaf ears," says Brzeski.

Such an outcome could well play into the Euro gains.

The next meeting will witness the publication of the ECB's staff economic projections as well, but these are expected to remain unchanged, and could, if anything show a slight rise in growth projections due to the weak Euro, says the ING economist.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

If there is a spoiler it could be core inflation, which, according to Brzeski, has been subject to "extreme optimism" by the ECB, who forecast a rise from 1.0% to 1.9% by 2020 (on average). Their latest projections in this regard, therefore, should require close scrutiny.

Notwithstanding a rise in headwinds the growth trajectory of the region is considered safe.

"The underlying solidity of the Eurozone recovery should comfort the ECB to stay on auto pilot," says the economist.

With the end in sight for asset purchases the next market focus will be on when the ECB raises interest rates, an increasingly contested subject by analysts.

Although ING foresee the first rate hike coming in either September or October 2019, with Draghi wishing to exit his position on a 'high' there are others who are more cautious.

Fears of European political 'fragmentation' had surged in August, according to Blackrock's geopolitical risk dashboard, says Wei Li, head of ishares EMEA investment strategy at Blackrock, in an interview on Bloomberg TV.

European equities were the "least owned exposures" and were "pretty unloved" said Li.

In relation to ECB rate hike expectations Li was cautious about endorsing the consensus view that the ECB would raise rates after summer 2019:

"A lot will be growth dependent and election outcomes. It is way too early to say whether September 2019 is the data to look out for. What we do know is that hikes won't happen until after summer next year at which point we will have to re-evaluate based on growth and inflation indicators whether that is the right path to take."

Eurozone PMIs not bad

Despite German data take a turn for the worse not all data out of the Eurozone has been bad: Eurozone PMIs showed a basis point rise to 54.5 in August from July's 54.3. Importantly this is a final PMI reading and shows a slight upward revision from the initial 54.4 flash estimate.

"Leading data suggests that the Euro area’s economic momentum remained largely unchanged in August," says Angela Bouzanis, chief economist at FocusEconomics.

"August’s increase was driven by a marginal acceleration in output growth, although the pace of expansion was still one of the weakest recorded in the past year-and-a-half. Similarly, new order growth picked up slightly, but remained subdued in the context of recent historical data."

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here