EUR/USD Rallies After ECB's Nowotny Says Stimulus Not Necessary After 2018

- Euro has strong start to the new week following comments from leading figures in European finance

- Central bankers Draghi, Constancio and Nowotny all repeat mantra of strong growth

- Nowotny says region will no longer need extraordinary stimulus measures after 2018

© European Central Bank, reproduced under CC licensing

The Euro rose strongly on Tuesday after a leading European central banker said he doesn't think the economy would need stimulating after 2018.

The European Central Bank (ECB) would be in a situation to take the 'patient off the drip' by the end of this year, said Austrian central bank head and ECB member Ewald Nowotny.

Up until now the ECB has steered clear of setting a concrete date for removal of its extraordinary stimulus measures and has already extended the deadline once.

The admission from Nowotny, therefore, of specific time boundary was seen as an optimisitc development as it suggests he sees the economy as healthy enough to survive on its own.

The comments led to an immediate market reaction, with the Euro spiking to 1.2378 versus the US Dollar after the news.

Nowotny's was the latest in a series of comments from members of the European Central Bank (ECB).

The general tenor of the remarks were positive and appeared to stave off growth fears, and they were probably behind the Euro's strong performance on Monday.

EUR/USD has risen from a weekly opening rate of 1.2279 to currently trade at 1.2357, largely from, on balance, positively skewed commentary from ECB officials.

The commentary appears to continue to highlight strong growth in the region, largely ignoring fears caused by the underperformance of recent survey data which showed Eurozone PMIs - business surveys measuring activity in key sectors - in March, and even Q1, backtracking steeply.

In his speech on Tuesday Nowotny said, "We have very strong economic expansion, but an unequal one."

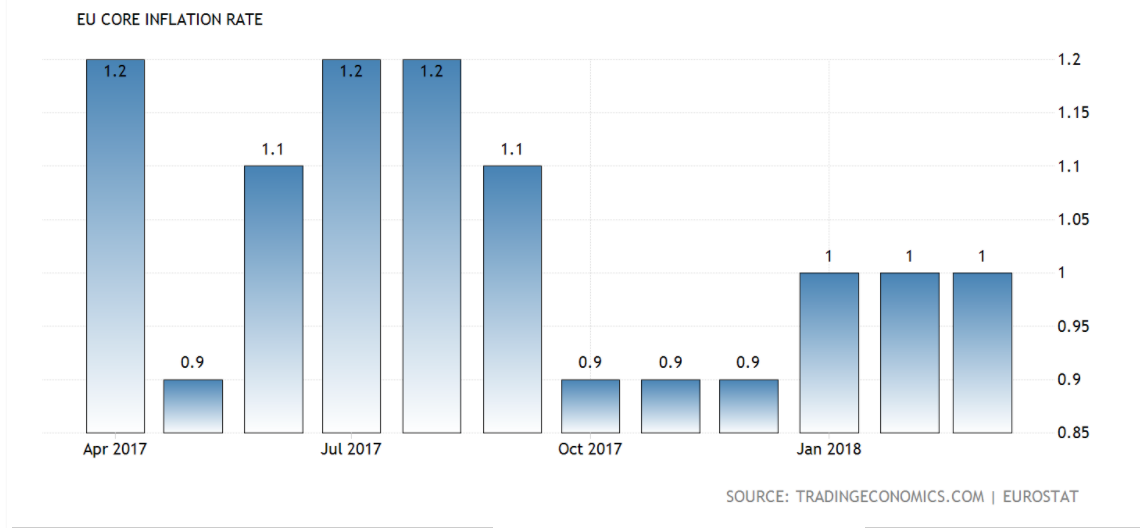

He also reminded market watchers that Eurozone inflation was still lagging below the ECB's target of just under 2.0% (core is stuck at 1.0%) and that this remained an issue.

Image courtesy of tradingeconomics.com

Without higher inflation, the ECB cannot end its quantitative easing programme and begin raising interest rates. Higher interest rates would be positive for the Euro.

"Inflation is at the core of normalising policy," said Nowotney, adding that "Tightening of monetary policy is even more complex due to the huge scale of recent stimulus."

Overall his views comprised something of a middle way, saying that there was a risk "of stifling the recovery if the ECB tightens too soon," and, equally, "a risk of a boom in assets if ECB tightens too late."

Yet he continued to endorse the ECB's executive view that "Inflation pressures will materialise eventually" and, therefore, it needed to act pre-emptively by starting to reduce monetary stimulus now, in expectation of higher inflation once growth picked up and unemployment came down.

The policy has been criticised by some as being guided primarily by 'wishful thinking' rather than economic evidence, and the recent run of poor data in the Euro-area, which now has the worst economic surprise index in the G10, has highlighted this possibility.

"His (Nowotny's) last comments highlight what exactly the ECB is doing right now. They're looking to tighten monetary policy while at the same time hoping for inflation to tick higher. Better cross your fingers instead of leaving them open then," says Justin Low analyst at forexlive.

The comments follow on from a host of ECB talking heads which spoke yesterday, including, most importantly, the President, Mario Draghi and his deputy Vitor Constancio.

Draghi was quite upbeat about growth, saying, "looking ahead, we expect the pace of economic expansion to remain strong in 2018."

"The implicit message was that the recent loss of momentum in the economy is unlikely to derail the ECB’s tightening plans unless of course, the slowdown intensifies much further," said Marios Hadjikyriacos, investment analyst at broker XM.

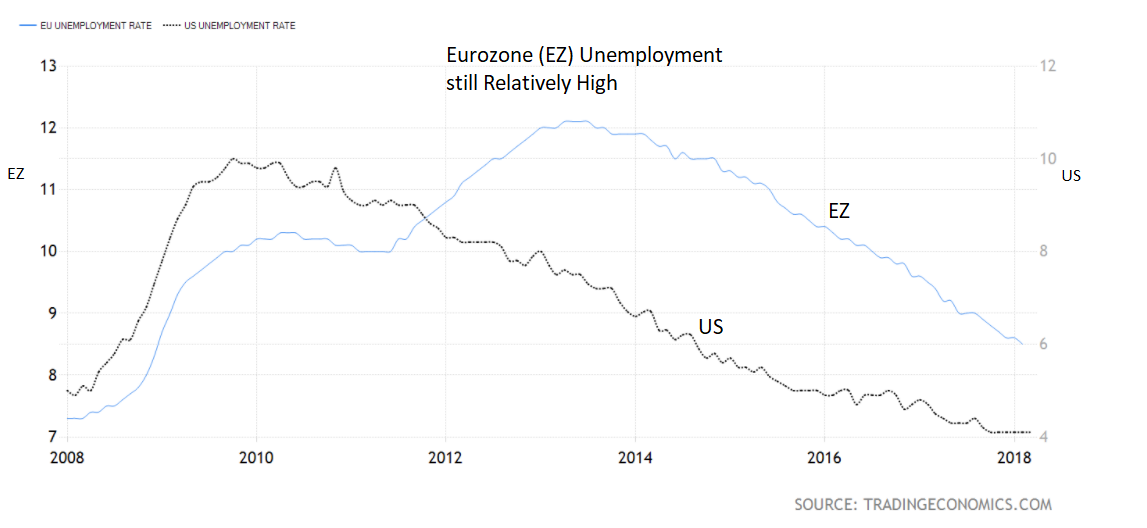

In truth, Draghi also sounded a note of caution around the degree of 'slack' in the economy, which generally means the continued high-level unemployment and 'unused desk space' or 'spare capacity'.

"While we remain confident that inflation will converge towards our aim over the medium term, there are still uncertainties about the degree of slack in the economy."

Persistently high levels of worklessness keep a cap on inflation as has been seen in other countries where unemployment has needed to fall quite low for inflation to pick up - such as the US.

Image courtesy of tradingeconomics.com

As recent data showed, the level of unemployment in the Eurozone remains high by G10 standards even though it has fallen to a new post-crisis low of 8.5%, and this is what is probably behind the stagnant core inflation rate of 1.0%.

Vice-President Vitor Constancio, meanwhile, was more historic in his introductory comments to the European Parliament, but strong growth in 2017 remained the theme.

"Later in the year, the unabated growth momentum offered reassurance that inflation was gradually converging towards our aim. Nevertheless, price developments continued to be subdued and underlying inflation measures had yet to show convincing signs of a sustained upward trend. This was the context for our decisions in October. In particular, we announced that we would scale down the intensity of our net asset purchases to a monthly pace of €30 billion, starting in January this year," said the ECB's vice-president.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.