More Euro Upgrades in the Pipeline at JP Morgan After Stellar Start to 2018

The Euro has risen strongly and most analysts think this is just the beginning, but could its own increasing value become the very thing that limits its growth?

After reaching a peak of 1.2292 yesterday (Monday, Jan 15) EUR/USD has now as good as touched investment bank JP Morgan's official forecast target of 1.2300 for year-end 2018, only 15 days into the year.

The spectacular rise has come about as a result of stronger-than-expected Eurozone economic growth, an easing political landscape and a surprisingly optimistic European Central Bank (ECB).

Whilst JP Morgan has adjusted its portfolio weightings to reflect a more optimistic outlook for the single currency, they have not yet revised up their official forecasts - but they are seriously considering it - and bar a substantial shift in financial market dynamics it looks like they will.

The recent minutes of the ECB December meeting contributed to the Euro's rally after they showed committee members arguing for an early exit from QE - the ECB's complex stimulus programme of money printing and bond buying which was implemented to combat the crisis.

"The positive risk bias to the EUR forecast has become more tangible," says Paul Meggyesi at JP Morgan.

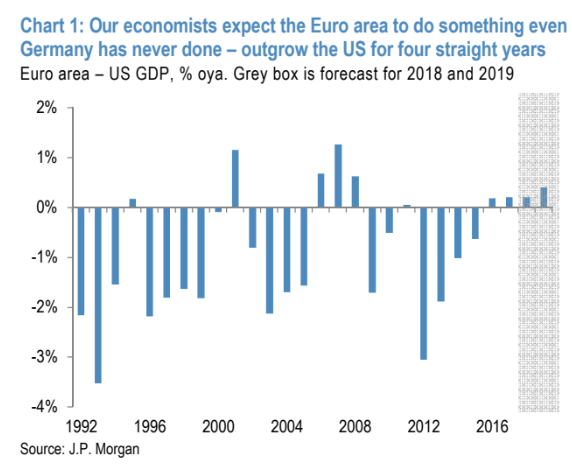

For one, final growth is likely to be much higher than previously forecast for 2018.

"Momentum in Euro area data has improved from already heady levels, resulting in a pretty dramatic upgrade to our 2018 GDP forecast from 2.1% to 2.6%," says meggyesi.

In addition, the ECB has shifted markedly from its previously interminable waiting, to a more proactive stance, which also interestingly contrasts to a more tempered approach by the US's Federal Reserve.

"The improvement in the macro landscape is also now resonating with the ECB which surprisingly indicated in the minutes to its December meeting that it could revise its forward guidance early this year to avoid more abrupt changes at a later stage. By contrast, the Fed failed to upgrade its dots in December, and the result has been a pronounced tightening in back-end bond spreads in EUR's favour," says the JP Morgan analyst.

Euroarea growth is beating even that of the US.

What Could Stop the Euro's Strong Run?

It would now require nothing less than a retrenchment to the old stance by President Draghi, for example, to make J P Morgan think again about revising up their forecasts.

Another outside risk to the Euro is the possibility that the anti-Euro Five Star party (MS5) reaches power in Italy in the spring elections, and begins an Italexit, however, given the bank only places a 5.0% chance of that happening it is hardly a pressing mainstream concern.

Finally, in relation to the EUR/USD pair, in particular, Meggyesi sees a risk of the US Dollar gaining a boost from repatriation flows from the new tax reforms which exempt companies repatriating profits made abroad from having to pay tax in the US.

Meggyesi clarifies these risks below:

"A change to both the profile and the peak level for EUR/USD will be necessary unless: 1) Draghi pushes back in the January meeting against the impression that ECB is travelling more quickly towards a policy exit, 2) there is anecdotal evidence in coming weeks of US corporates bring dollars home, and/or 3) there is a late swing in the Italian opinion polls in favour of MS5."

Furthermore, the investment bank's market technicians - analysts who approach the market in a different manner - are not as bullish about EUR/USD seeing the hurdle of a resistance zone between 1.2177 and 1.2329 as placing a chart 'road block' in the way of the thus-far unfettered rally.

Technical barrier between 1.21-23.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

Euro Overvalued Already?

Whilst it is easy to get carried away with all the upbeat Euro-rhetoric its worth pointing out that the pair is not undervalued anymore - in fact, according to some valuation models it is now somewhat 'overvalued'.

"Our forecasts were set at relatively conservative levels – a peak of 1.23 on EUR/USD - to take account of the fact that the euro is no longer undervalued from a structural perspective (the REER is within a percent of its 20Y average) and indeed is materially overvalued compared to any cyclical interest rate model," says JP Morgan.

The REER stands for 'Real Effective Exchange Rate' and is essentially a very long-term average of the exchange rate which when compared to the current rate gives analysts an idea of whether the rate is over or undervalued compared to the historic norm.

Cyclical interest rate models are based on interest rate differentials between currency jurisdictions.

A major mover of currencies is the flow of foreign capital in the global financial system, and all else being the same, it tends to flow from lower interest rate countries to higher, increasing demand for the latter's currencies in the process.

Given interest rates in the Eurozone are still at 0.00% and have risen to 1.50% in the US the expectation would be for the Dollar to rise from flow but in fact, the opposite has happened.

Will the ECB Take Fright of the Euro's Rise?

The possibility that an overly strong Euro could become 'self-defeating', is a thesis entertained by Scandinavian bank Nordea, whose analyst Andreas Steno Larsen, has written a note about.

Nordea notes that a stronger Euro will be a drag on inflation by making foreign imports cheaper.

"EUR/USD is currently about 5% higher than the 1.17 level used in the ECB’s staff forecasts. If this level is maintained, the ECB’s own sensitivity analysis suggests that core inflation would be around 0.2% point below the baseline," says Larsen, adding:

"A further 5% rise in EUR/USD would lead to 0.5% point lower inflation in 2019 versus the baseline."

Given inflation is already below the ECB's slightly-lower -than-2.0% target further downside pressure would not be welcomed and might lead the ECB to intervene in markets, probably by verbally talking down the exchange rate.

"The latest FX moves may thus already be enough for the ECB to address the recent FX developments at its next meeting on 25 January," says Larsen, which if true would actually come as an extremely negative surprise for the Euro.

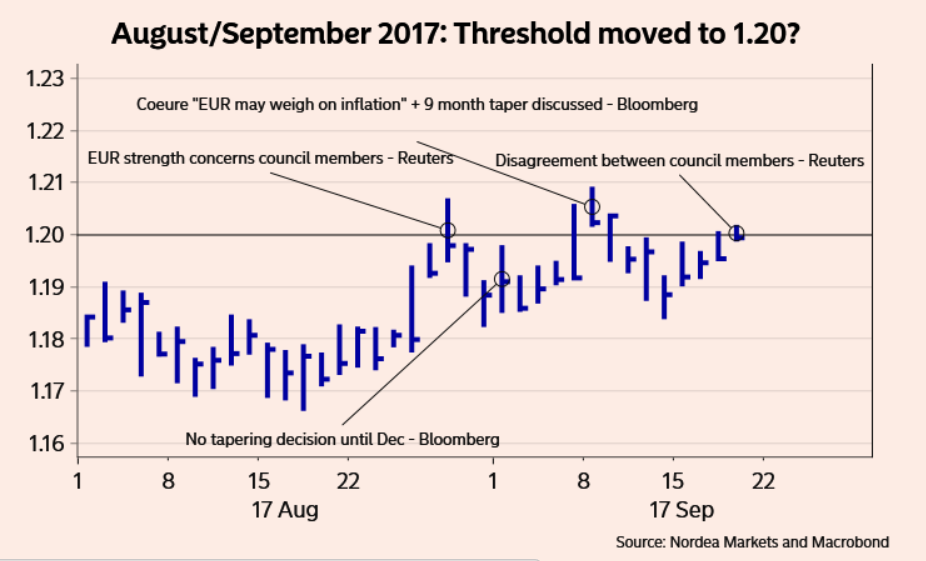

In previous times the ECB has verbally intervened to prevent the Euro from appreciating, first in 2015 when it kept intervening whenever the exchange rate rose above 1.14-1.15, and then in August/September 2017 when it verbally talked the currency down after it touched 1.20.

In 2017 ECB verbally intervened at 1.20 to keep the exchange rate down

This time, the ECB has probably raised the bar for verbal intervention to 1.25, according to Nordea.

"In any case we expect the ECB to step up the verbal intervention against the EUR momentum if EUR/USD hits 1.25."

In relation to the January meeting, Nordea is contrarily sanguine, suggesting FX moves have recently been a little too volatile for the ECB 's liking, and they may be tempted to put the brakes on.

"Adverse FX moves from the ECB’s perspective may mean that it decides to play it safe and not change its forward guidance at the January meeting as the market currently seems too eager to interpret any whatsoever signal from the ECB hawkishly."

Larsen thinks this could see EUR/USD correcting back after the meeting:

"Eventually such a revision of its forward guidance could lead to a downward correction of the recently hawkish pricing of the EONIA forward curve (if the guidance manages to push hike expectations out in time) – leading EUR/USD back towards 1.20 – and potentially below."

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.