Euro-to-Dollar Rate Still Undervalued Despite Hitting Three-Year Highs

- Written by: James Skinner

EUR/USD is merely returning to "normal levels" but low inflation could become a stumbling block for the Euro later in 2018.

The Euro remains undervalued against the US Dollar even after January’s surge and could continue to march northward, according to one strategist, while another says it is a “clear buy-on-dip currency”.

The Euro-to-Dollar rate hit a three year high this week at 1.2296 as a robust global economic backdrop keeps risk appetite alive and supports an aggressive pursuit of yield and returns among traders, which is a favourable backdrop for the Euro.

However, even after last year’s double-digit gain over the US Dollar, and in the wake of January’s 1.94% rise, the Euro is only just approaching “more normal levels”.

The consensus among strategists, analysts and economists has been for the Euro to end the current year around the 1.22 level, although the number of bullish forecasters who are predicting an overshoot of this level appears to be growing by the day.

“Even after breaking yet another multi-year high, we see EUR/USD as still undervalued - by around 1-2% based on our short-term fair value model. This points to a benign outlook for the cross, with a fairly limited downside risk,” says Petr Krpata, chief EMEA fx strategist at ING Group.

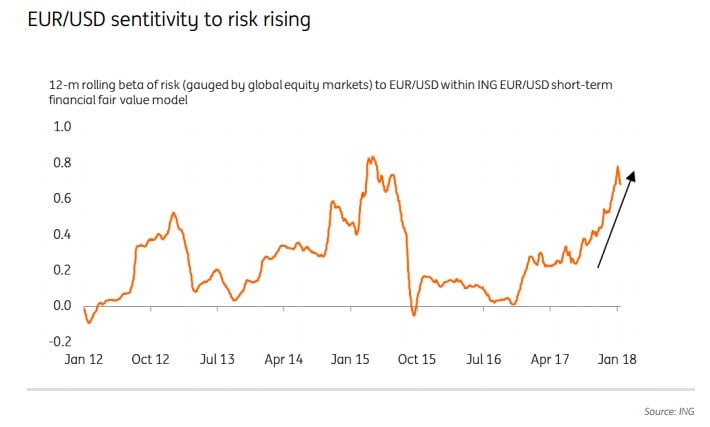

Above: ING Group graph showing correlation between EUR/USD and global risk appetite.

ING’s short term economic model shows the Euro as still being undervalued above the 1.2200 threshold while other studies carried out by the bank show the common currency sharing an increasingly strong relationship with risk appetites globally.

“Clearly, the sensitivity of EUR/USD to the risk environment has been rising meaningfully over the recent months, underlying the shift in investors’ attitude towards the common currency, with EUR turning into an investment currency,” says Krpata.

The Euro’s beta to global stock markets, or its sensitivity to changes in global stock markets, has recently returned to the high levels it was at just before the European Central Bank announced the start of its quantitative easing program back in January 2015.

This means that, so long as the global expansion remains intact and investors are happy to take risk, the Euro could continue to rise throughout 2018.

“The fact that the EUR/USD strength seems fully explained from a short-term fair value model perspective suggests that the fears of an overdone move in EUR/USD may not be justified,” Krpata notes.

Above: EUR/USD rate shown at weekly intervals.

Bullish bets on the common currency have already pushed the Euro-to-Dollar rate back to levels last seen in January 2015, with the currency having overcome a key technical resistance level just before the market closed last Friday night.

“We embrace the strong EUR and expect EUR/USD to break the 1.30 level later this year as the market starts focusing on the second step of the ECB policy normalisation - the eventual deposit rate hikes,” Krpata forecasts.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

A Hole Where the Sun Don’t Shine

Although EUR/USD’s surge may have left some in the analyst community questioning whether the currency had gone a bridge too far, or if it would continue to rise unabated, the vast swathe of commentary coming from trading desks across the City suggests the latter is more likely.

“The dollar seems to have tumbled into a hole where the sun don't shine. Lots of market commentators are no doubt scrambling to adjust their forecasts as EUR/USD slices through 1.22 on the tenth trading day of the year,” writes Alvin Tan, a strategist at Societe Generale.

“Both RSI daily and weekly indicators for EUR/USD are in overbought territory, but we should see new highs in coming months. The euro is a clear “buy-on-dip” currency.”

With risk appetites and global growth aside, further highs in the Euro-to-Dollar rate over coming months will depend on evolving expectations around the European Central Bank’s exit from its quantitative easing program and whether the US Dollar remains “in a hole where the sun don’t shine.”

Inflation and the Euro are Key to ECB Policy

Minutes from the latest ECB meeting showed policy makers preparing to adjust their forward guidance on interest rates later this year, which fuelled the latest burst of strength in the Euro.

The ECB’s comments come despite persistent disappointments over lacklustre inflation.

These disappointments saw core-inflation, which removes some volatile commodity items from the goods basket, remain stubbornly below the 1% threshold throughout the fourth quarter.

“The increasingly robust and broad-based economic recovery in the euro-zone is helping to dampen concerns over the dampening impact on activity and inflation from the stronger euro,” says lee Hardman, a currency analyst at MUFG.

Without a sustained pickup in inflation the European Central Bank will be incentivised to keep going with its bond buying program for longer.

The stronger the Euro gets in the interim, the greater the ECB’s inflation challenge will be as a stronger currency neutralises price pressures by making imported goods cheaper to buy.

“However if the euro continues to strengthen more sharply than expected in the year ahead, it would encourage the ECB to be more cautious than otherwise when continuing to tighten policy,” Hardman adds.

That being said, Hardman says the Euro’s rise in the last year merely serves to return it to “more normal levels” and that the key issue for the ECB will be the pace of the Euro’s gains rather than its overall rise in value.

Analysts at the Japanese bank forecast a steady appreciation for the EUR/USD pair throughout 2018, with the rate likely to finish the year around 1.2700. This is above the consensus forecast for 1.2200 but beneath the 1.30 level predicted by the team at ING Group.

Readers can learn more about what analysts and strategists say is in store for the Euro-to-Dollar rate in 2018 here; Compilation of Major Bank Forecasts, Currency Views for 2018.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.