The EUR/USD Bulls vs. the Bears: How Analysts are Split on Calling Direction in the Euro-Dollar in 2018

Consensus amongst the analyst community is the EUR/USD exchange rate will rise in 2018, but there are still a number of well respected analysts who see the pair falling in 2018.

The Euro-to-Dollar exchange rate has been the subject of much research at the start of the year because of expectations of above-average volatility in 2018.

This is in part due to the widely-held view that the Dollar will continue the trend that saw it weaken in 2017 into 2018 whilst at the same time the Euro will maintain its winning ways, which overall poses upside potential for for EUR/USD.

The most commonly held and compelling view is that the Dollar will fall as money flows out of the U.S. to the rest of the world.

The catalyst for this low will be accelerating global growth which will start to offer more exciting returns to investors in the rest of the world compared to the U.S.

Yet some are still holding out that this expectation will be proven wrong as Donald Trump's tax reforms will light a fire underneath U.S. growth while increasing repatriation flows of foreign corporate cash piles.

For the Euro, the majority see the currency as likely to strengthen in 2018 as the Eurozone recovery story continues and the European Central Bank (ECB) switches off its money printing presses.

Yet a number of analysts warn the Euro is already bloated and overbought and therefore due a sell-off.

They think the market is overoptimistic about Eurozone growth and the chances of the ECB winding down stimulus in 2018 are therefore low; they are more bearish the Euro, and see EUR/USD falling.

Going With the Flow

One of the most compelling arguments for the Dollar weakening in 2018 is that relating to investment flows out of the U.S. to the rest of the world.

The view is shared by some big-hitters, including Deutsche Bank, ING, and Morgan Stanley.

In summary, the view - with some slight modifications between analysts - goes as follows: investors are now more or less fully bought into US financial assets which have risen spectacularly - especially stocks - but as valuations become increasingly overpriced the number of buyers prepared to pay the high asking prices will diminish.

"Combined US equity and fixed income valuations are at 20th-century highs and it will be extremely difficult to find the marginal buyer of US assets in 2018," says Deutsche Bank Strategist George Saravelos.

The idea that foreign investors' desire to purchase US assets is waning is backed up by data which shows the US financial account turning negative as demand from outside significantly declines and is eclipsed by rising demand for non-U.S. assets by U.S. investors.

According to ING, rising global growth will sharpen investors appetite for emerging market assets and this will attract capital out of the U.S. into the rest of the world, weakening the Dollar in the process.

Recent manufacturing PMI figures released at the start of the year support this view after showing above-expectation results in most emerging market economies, but most significantly China.

Commodities are also on the rise, supported by oil which has risen above 68 Dollars a barrel, and metals have in many cases hit new yearly highs.

Rising commodity prices are on balance positive for BRICS and emerging market economies, as they are normally net exporters of commodities.

Another fairly reliable barometer of world growth is the Baltic Dry Index which measures the cost of shipping dry goods, and this has risen for four consecutive years, reaching a new high in autumn 2017.

Carry Flows

Morgan Stanley says the 'flow' situation for the Dollar is exacerbated by the carry trade advantage of buying emerging market currencies using Dollars.

The carry trade involves borrowing a heap of currency in a jurisdiction where interest rates are extremely low, such as Europe where the official rate is 0.00%, and investing that money into a higher yielding currency such as the New Zealand Dollar, where official interest rates are 1.75%.

Such a carry trade as outlined above would, technically, result in a profit of 1.75% after a year, due to the money earning New Zealand interest of 1.75% for European borrowing costs of 0.00%.

Sometimes a helpful byproduct of the trade is that the Euro will weaken as it is being sold to fund the trade and therefore sold in greater volumes.

Morgan Stanley argues that the US Dollar will become the favoured funding currency for the carry trade in 2018 as the outlook for emerging markets improves and interest rates and currencies rise there.

This holds out the promise of investors not only profiting from the difference in interest rates but also from the currency appreciation, effectively compounding their return.

"The USD should act as the main funding currency along with the CHF; we argue the EUR and JPY no longer qualify as funding currencies," says Hans Redeker, an analyst with Morgan Stanley.

But interest rates in the US are already at 1.5% and likely to rise even higher in 2018 - so why should the Dollar be the premier funding currency for the carry trade when official Eurozone rates are still at 0.00% - why not the Euro?

The explanation given by Morgan Stanley is that the USD is the world's reserve currency and so benefits from extra liquidity.

A further reason is that long-term interest rate expectations are currently lower in the US than in the Eurozone, and this suggests the longer-term carry advantage lies with funding using the US Dollar, not the Euro.

Tax Cuts and the Dollar Bulls

The recent legislation 'reforming' the US tax system has been seen as a major positive driver of the Dollar, and the minority of analysts who are Dollar bulls going into 2018, such as Bank of America Merril Lynch (BofA) and ABN Amro, see this as the main reason for remaining optimistic about the currency.

"Last, but most importantly, we are optimistic about the impact of the US tax reform on the USD, both because of fiscal stimulus and because of repatriation flows," says BofA FX strategist, Athanasios Vamvakidis.

BofA and those like them, see tax cuts stimulating economic growth, which will increase inward investment and support the Dollar.

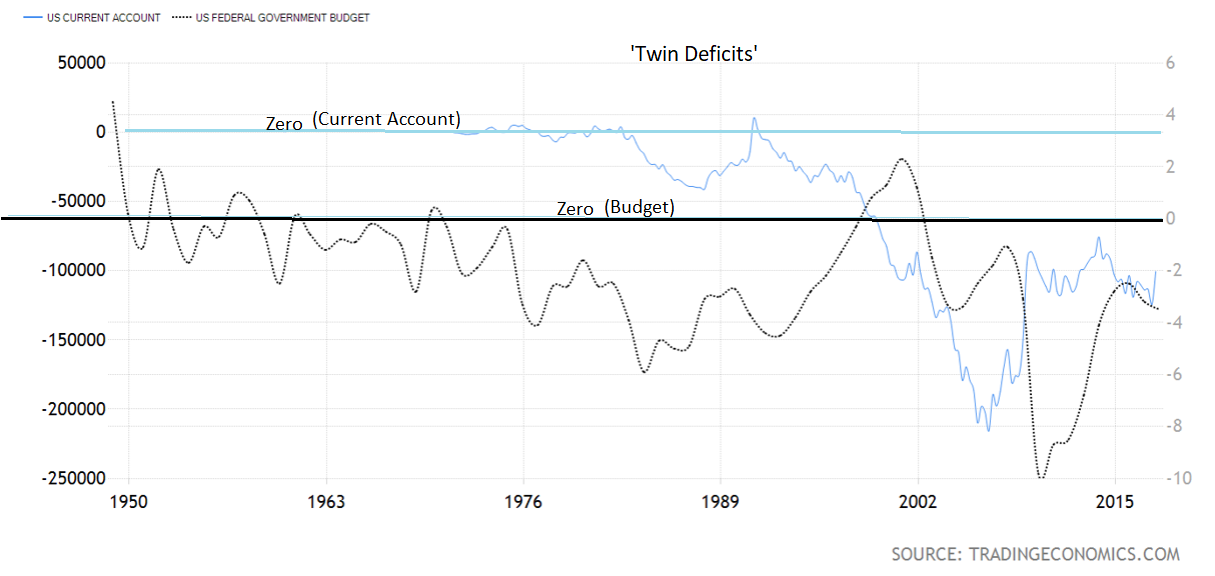

However, the opposing view is that the tax cuts will reduce the U.S. treasury's revenue, causing a budget shortfall - or deficit - which will mean America has both a budget deficit and a current account deficit, and when a country has both these, or a "twin deficit", research shows its currency almost always weakens.

The problem with this argument is that the US already has a "twin deficit" - it has had one ever since 2002, yet in that time the Dollar has both risen and fallen (although it has fallen overall).

(Courtesy of tradingeconbomics.com)

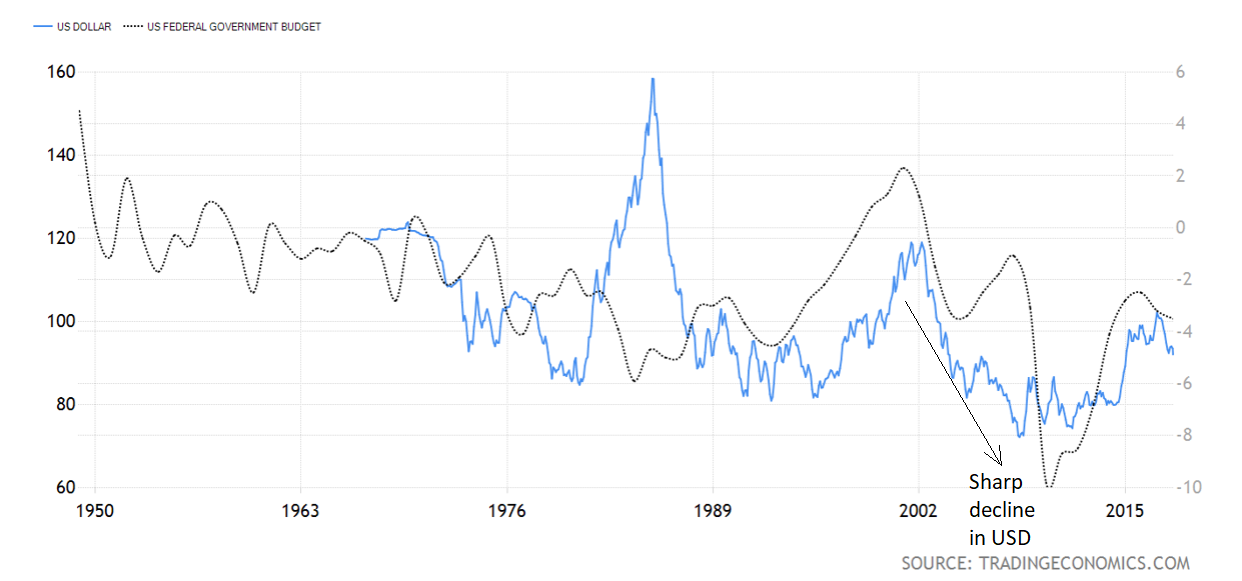

In defense of the twin deficit argument, the Dollar index did see its sharpest sell-off just after 2002 when the budget went from surplus to deficit for the first time and both the budget and the current account deficits were widening at their fastest pace.

(Courtesy of tradingeconomics.com)

As an interesting aside, survey evidence and the view of cynics expect much of the extra money generated from lower corporation tax to be used in 'share buybacks' which will propel the price of shares higher and not in higher worker wages or expansion activities which actually create economic growth.

Yet, from the Dollar's perspective, it could be argued that it will probably be helped in either scenario since buybacks will lead to higher share prices which will slow financial asset outflows whilst investment in expansion and higher wages will support via higher inflation and interest rates.

Repatriation Flows

The few analysts who are bullish the Dollar in 2018 also see appreciation from another source linked to the new tax reforms, and this is repatriation flows of U.S. company earnings, estimated at 3.5 trillion, kept abroad.

Dollar-bullish BofA for example, see this as a major source of strength in 2018 and beyond as the new tax legislation means companies will not have to pay tax twice on their earnings - once in the country of origin and then again on repatriation - only once in the country of origin, and this should be a massive incentive to repatriate.

Although there are a wide variety of estimates as to what percentage of the current cash holdings are already in Dollars and therefore will not need to be exchanged - with BofA saying 40% but Dollar-bears Deutsche Bank saying 90% - in the long-term there probably will be some pressure from repatriation back into Dollars since profits made in foreign territories will initially be denominated in the local currency.

Most of the evidence is survey-based too and there is more of an incentive for companies to play down the extent of their holdings in non-Dollars so as not to give the market a heads up which would see the Dollar appreciate before they had managed to exchange any of their overseas profits and result in a loss from stronger-Dollar exchange rate erosion.

Eurozone Growth and the ECB: Central for the Euro

The majority of analysts are upbeat about the Euro as a result of expectations of continued sharp Eurozone economic growth.

Recent data has been strong and done nothing to change the perception that the region is going from strength to strength.

This will encourage the ECB to switch off its money printing presses and begin to think about increasing interest rates in preparation for rising inflationary conditions.

Higher interest rates will boost the Euro, especially in the beginning, as was the case with the Dollar, which saw much greater appreciation at the start of the Fed's tightening phase then it did at the last meeting in December, when although the Fed raised interest rates from 1.25% to 1.50% the Dollar actually fell because of concerns about long-term inflation remaining moribund.

Those who are most optimistic see the ECB ending stimulus in 2018 and raising interest rates at the start of 2019, however, those such as ABN Amro who are Euro-bears see this view as over-optimistic and think the ECB will extend stimulus into 2019 and not raise rates until late 2019.

Their forecast incorporates this delay and sees EUR/USD falling to 1.1500 in 2018 before rising in 2019.

One major difference between the majority who are bullish the Euro and the minority who aren't is the issue of the availability of credit.

The bulls claim credit is already becoming more available in the Euro-area and this will help stimulate the recovery.

The steepening yield curve has aided Eurozone banks as they can charge higher interest on longer-term loans and make more profit, making them more likely to lend.

The high degree of stimulus from the ECB has also helped repair bank balance sheets and these are now in much better health than previously.

Those bearish the Euro, such as BofA, however, are more sceptical and argue there is still insufficient access to credit in Europe, banks are still saddled with high numbers of non-performing loans and are shy to lend out for fear of defaulting debtors.

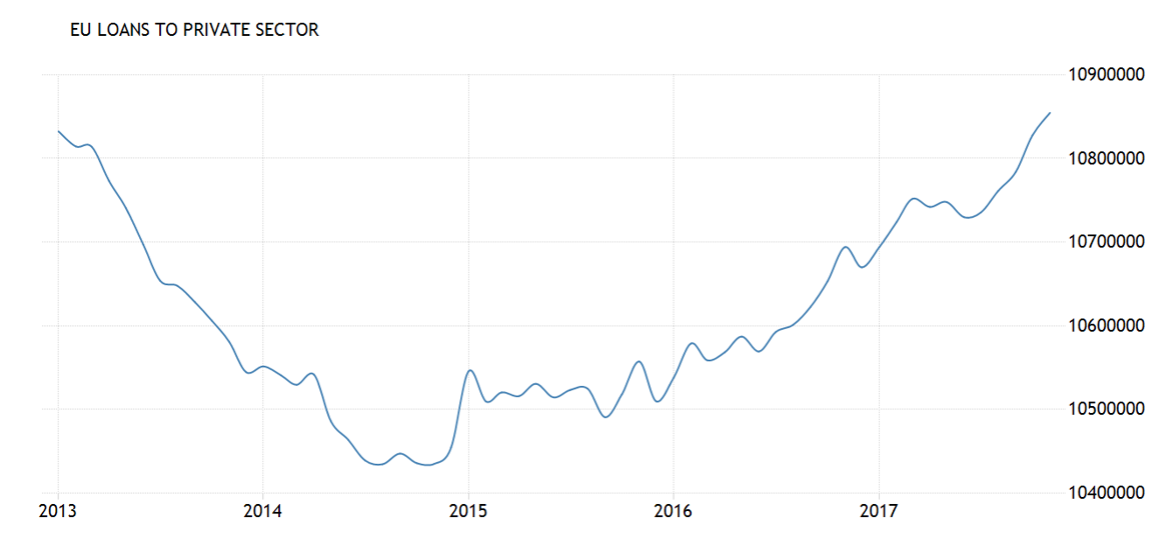

There is a high degree of correlation between the flow of credit and growth in Europe which means growth is likely to be capped going forward due to bunged credit pipelines.

"The Eurozone recovery is creditless. This is a problem, as empirical evidence suggests that creditless recoveries are usually weak and fragile. The correlation of credit with growth is the strongest in the Eurozone among G10 economies. However, the Eurozone has the weakest private sector credit growth in the G10 group," says BofA's Vamvakidis.

The actual data shown in the chart below suggests differently. It shows a healthy growth in loans to the private sector, especially, over the last two years.

(Courtesy of tradingeconbomics.com)

Political Risk

Euro-bulls now see Euro-area political risk as a provincial concern.

The main battle took place in the French presidential elections when Europhile Macron decidedly beat Eurosceptic Le Pen and in the process decided the fate of the whole region.

The only remaining risk is in Italy which has elections in the spring (date yet to be decided) and where the anti-Euro Five Star party is still popular, however, given the new reforms to the electoral system, they are unlikely to win the critical mass of seats required for an Italexit without forming a coalition, which is highly unlikely given their anti-establishment aversion to the other parties and their own avowed contempt for partnerships.

Germany - the only other main source of risk is also unlikely to cause major upset - they contend, due to the overwhelming majority of the electorate voting for parties which were pro-Euro, and although there is a risk of another election occurring, it is unlikely that it will result in a Euro-sceptic party acquiring the power required for an upset.

Euro-bulls, such as ING, in fact, see the Italian election as an opportunity for the Euro to unburden itself of what is left of the risk premium which still weighs it down, and for them it will probably rise after the Italian elections in one of three steps up in 2018, the other two coming after ECB stimulus reduction.

Summary of Forecasts

Deutsche Bank and ING forecast EUR/USD to rise to 1.30 during 2018, and Morgan Stanley sees the exchange rate rising to 1.2400.

BofA has a U-shaped forecast with EUR/USD falling to 1.10 in the first half of the year and then recovering to 1.20 thereafter and ABN Amro forecast a steady decline to 1.15 by the end of the year.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.