Euro Forecast to Test 1.30 vs. US Dollar in 2018: Deutsche Bank

Analysts at Deutsche Bank say they see the Euro-Dollar exchange rate rising towards 1.30 over coming months.

Changes in the flow of capital across borders are likely to be more significant for the EUR/USD pair in 2018 than changes in interest rates argues Deutsche Bank FX Strategist George Saravelos - and the result will benefit the Euro more than the Dollar.

Saravelos and his team make the argument in a fresh assessment on the Euro at the start of the new year, and adds to the growing consensus amongst analysts the Euro should be a star performer in 2018.

Much of EUR/USD's ascent will however be linkted to Dollar weakness; normally rising interest rates are a big driver for a currency, drawing greater volumes of international capital with the promise of higher returns, but this won't be the case for the Dollar in 2018, according to Saravelos.

In fact, it wasn't the case in 2017, as the Dollar weakened overall despite the Fed increasing interest rates three times - and more times than any other central bank in the G10.

Various theories have been put forward to account for this aberration but for Saravelos the explanation is down to the habit of financial markets to discount before the fact, or in other words, most of the upside expected from the Fed raising interest rates, in this cycle anyway, has already been priced into the Dollar.

"The dollar is no longer responding to Fed hikes because it already priced most of the exit around QE. The trade-weighted USD strengthened by a cumulative 25% around FOMC meeting days as the tightening cycle took off in 2013," says Saravelos.

The argument is similar to the views of BMO Capital Market's FX Strategist Stephen Gallo, who recently argued that history shows that after the first three rate hikes in a cycle, successive hikes have rapidly diminishing impact on the currency.

Instead, flows are expected to dominate as they did in 2004-06 when despite being the "highest yielding currency in the world" the Dollar weakened as a result of a growing current account deficit and an imbalance of outflows (other currencies being bought by selling Dollars) eclipsing inflows (other currencies being sold to buy Dollars).

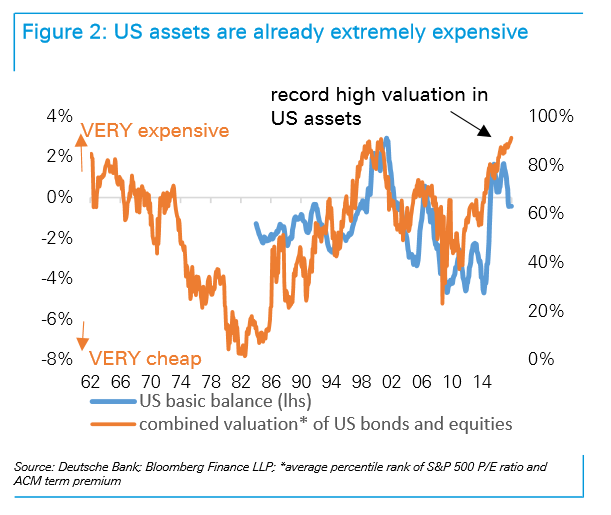

One cause of this change is an expected reversal in financial asset flows as the boat has 'now filled', with foreign investors already invested up to the hilt in the US stock market following the bullish trend of recent years.

"Combined US equity and fixed income valuations are at 20th-century highs and it will be extremely difficult to find the marginal buyer of US assets in 2018," says Saravelos.

The headache for the Dollar will come if foreign investors start selling their US financial assets en masse and pulling their money out, and whilst there are no signs yet this might happen, commodities are starting to move substantially higher, which is an asset cycle warning sign for stocks.

Another flow issue will arise from the new tax reforms, which Saravelos says will weaken not strengthen the Dollar, by requiring the government to borrow more which will widen the budget deficit.

Research shows that when there is a 'twin deficit', which means a deficit in both the budget and the country's current account (essentially its account of inflows and outflows from trade), the currency suffers, and this may become the case for the Dollar.

"Tax reform voted last year will mechanically push America's twin deficit wider by at least 2% in coming years and just like the basic balance turns here have historically coincided with turns in the dollar too," says Saravelos.

One offsetting factor for the Dollar, noted by analysts, is the effect of repatriation flows, resulting from the new tax breaks for company's repatriating overseas earnings.

Company's own an estimated 3.5 trillion in offshore earnings which could be brought back into the US and exchanged from local currencies back into Dollars.

Yet Saravelos argues that this is unlikely to be as strong a factor as previously thought since only about 10% of overseas earnings are non-Dollar denominated and only a small fraction of these are likely to be repatriated anyway, since the tax holiday is open-ended so there is no incentive to bring the money home before a deadline (as there was during a similar repatriation holiday in 2005).

He, therefore, sees this source of flow as unlikely to generate the critical mass to move the Dollar substantially higher.

Whilst estimates of the size and denomination of earnings overseas vary greatly from one analyst to another, this, nevertheless remains Deutsche's position.

Outlook for the Euro

In stark contrast, Deutsche's outlook for the Euro both from a flow and monetary perspective is much stronger.

The Eurozone has a current account surplus which means inflows outweigh outflows and this is a positive for the single currency right off.

Demand for European equities has been strong and is expected to continue rising on the back of the strong economic recovery in the region which is a further plus.

"In contrast to the US, the European flow story is far more positive. European equity inflows picked up last year as the political and growth outlook improved." Says Saravelos adding that, "Fixed income flows may be next."

Europe has a large unhedged Dollar-denominated financial asset position which is vulnerable to liquidation should a rout start in financial markets or the Dollar continue weakening.

"ETF (exchange-traded funds) data from the top-4 European providers show that Europeans have amassed as many dollar assets as their holdings of domestic government bonds. Importantly these holdings are currency unhedged. Combined with a large current account surplus, it will be hard to fight positive European flows in 2018," says the Deutsche strategist.

For the Euro Rates Matter

Although the Dollar is not expected to be affected by rising interest rates the Euro may continue to be sensitive in a more traditional way to changes in interest rates - or at least expectations of changes.

With the official Euro-area interest rate still at 0.00%, a deposit rate at -0.7% and a QE programme still in play, the ECB has some serious catching up to do to get anywhere near the US or even most of the rest of the world, in terms of its monetary policy tightening.

Deutsche speculates that the Euro may be at the same stage as the Dollar was in 2013 when it enjoyed grand 25% gains as the Fed wound down its QE programme and first started to hint it would be raising interest rates.

What economists call the 'neutral rate' (R*) is also much further away for the Euro than the Dollar, meaning the potential for interest rates to rise is greater for the Euro.

The neutral rate, or R* is the ideal level at which interest rates create equilibrium in the economy so as not to cause expansion or contraction.

Saravelos argues it is further away from the Euro-area's current interest rate than it is in the US, where rates have already risen to 1.25% - a level some argue is already at or close to R*.

This suggests greater potential for the Euro to discount the cycle change in monetary policy and further accounts for Deutsche's bullish forecast.

To conclude, then, due to the factors outlined above, Deutsche Bank now estimates that the Euro-to-US Dollar rate will rise to a 1.30 by the end of 2018.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.