4 Reasons Why Euro / Dollar is Heading to 1.21 Next

The Euro-to-Dollar exchange rate is forecast to maintain its strong upward momentum as the ECB is seen tolerant of the gains provided the Eurozone economy maintains its current growth rates.

The Euro has taken out fresh 2017 highs against the US Dollar having reached a best of 1.2092 on Friday, September 8. At the time of writing the exchange rate is at 1.2076.

The rally comes after the European Central Bank (ECB) delivered their September rate meeting where they said major policy decisions regarding the ending of the quantitative easing programme would be made at the October meeting.

Fears the ECB would take exeption to the single currency's ongoing appreciation - the rise could hamper further economic growth and undermine inflation - proved largely groundless.

Despite the Euro having risen 15% against the Dollar, the ECB largely dismissed the gains citing a strong economy that is expected to maintain growth.

The GDP forecast for 2017 was actually raised to 2.2% from 1.9% and kept unchanged at 1.8% and 1.7% in 2018/19.

"This is the fastest growth rate in the Eurozone since 2007," notes Westpac's Tim Riddell.

The Euro stopped rising after Draghi clarified that the exchange rate used for the above forecasts was, "EUR/USD at 1.18: the average rate during their formation rather than any projections," added Westpac's Riddell, as this was thought rather low given the current EUR/USD market level of 1.20.

Fears that the strong Euro would weigh on inflation by making imports cheaper were also allayed after the ECB only revised down inflation forecasts by a single basis point in 2018 and 2019, to 1.2% and 1.5% respectively, and kept the inflation forecast unchanged for 2017 at 1.5%.

Expectations had been for much deeper revisions as a result of the strong Euro.

The ECB was widely expected to discuss when it might be winding down (tapering) its stimulus programme but in the end nothing concrete was mentioned expect that the governing council would be discussing the issue more fully before the October meeting and would have a clearer idea of the speed and pace of tapering by December at the latest.

"Draghi stated that discussions at the September meeting on tapering were very much preliminary but that the bulk of decisions around tapering are likely to have been made by the October ECB meeting," said Riddell.

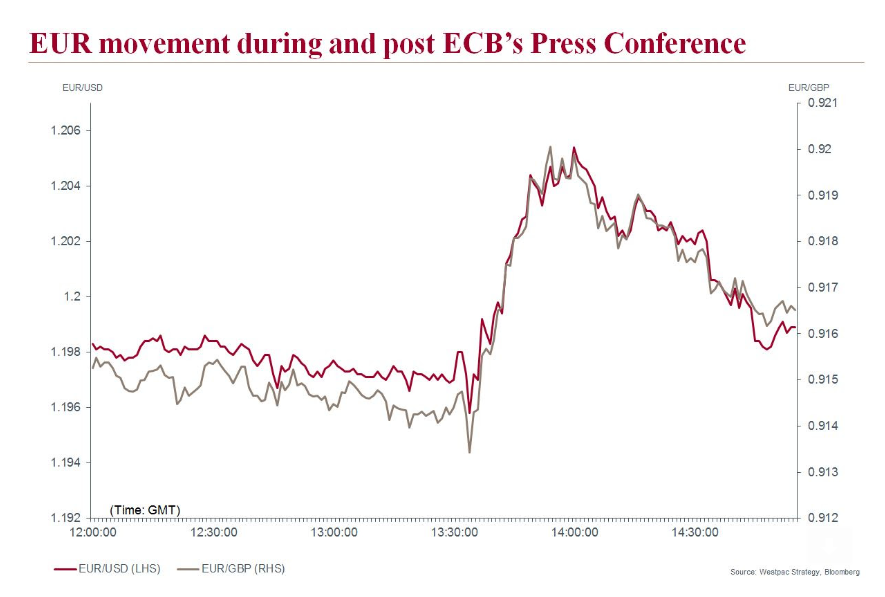

The Euro rose during ECB president Draghi's press conference, but then appeared to peak and roll-over during the discussion about the use of 1.18 as an assumed exchange rate in the calculation of future growth forecasts.

But, the pullback appears to be nothing but minor profit-taking within a clearly well-established trend that should extend further.

Taking stock of today's comments, analyst Kathy Lien at BK Asset Management says we can attribute the Euro's rise against the Dollar to 4 reasons:

1) ECB signaled that a QE decision is coming in October

2) they upgraded their GDP forecasts to the fastest in 10 years

3) Draghi expressed little concern about the EURO and

4) U.S. yields tanked.

Looking ahead, BK Asset Management expect EUR/USD to continue to appreciate into the October meeting taking out not only last month's high of 1.2070 but also make a run for 1.2135, an area where EUR/USD found support in 2010 and 2012.