Euro Probably Peaking Against the Dollar, Could Fall to 1.14 say S.E.B.

The EUR/USD has probably peaked at 1.20 according to Scandinavian lender S.E.B, who struggle to see on what basis the pair could go higher, in the short-term at least.

"Although uncertainty in the short term is substantial we maintain the view communicated earlier that EUR/USD should be close to a peak," says S.E.B's FX Strategist Richard Falkenhall.

Indeed, it is more likely EUR/USD will correct back to 1.1400 in its next move because of a "renewed focus" on comparative central bank policy agendas between the two currency jurisdictions.

Falkenhall thinks the market has got it wrong when it comes to their assumptions on the U.S. Federal Reserve and the European Central Bank - they are too negative about the likelihood of the Fed raising interest rates again and too optimistic about the ECB unwinding its stimulus program.

When its error becomes clear EUR/USD will adjust down.

"The probability of further rate hikes by the Fed is very low today according to market pricing (65% probability for one hike by the end of next year), while the ECB so far has expressed surprisingly little concern over a stronger Euro. However, this relative policy story fits badly with what we have seen in the 2-year yield differential since the beginning of this year," he says.

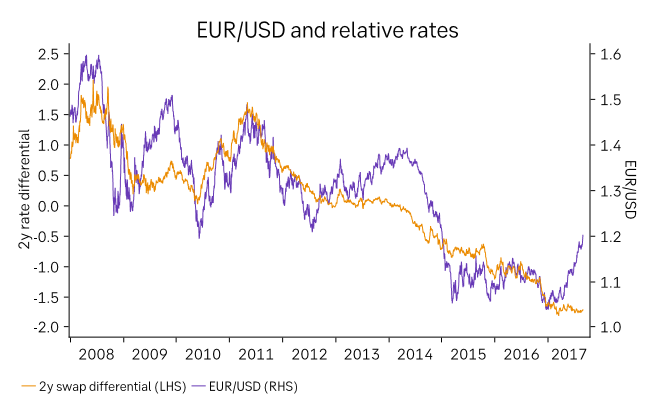

The difference between 2-year yields usually provides a concrete representation of central bank policy differences and currently, it is showing that the Fed is still well ahead of the ECB in its policy normalising curve.

The 2-year yield differential also moves in a tight correlation with the exchange rate usually, and the fact EUR/USD has decoupled and moved substantially higher on its own, as illustrated in then chart below, suggests either yields are not adequately representing central bank policy differences.

Or more likely, according to S.E.B, the EUR/USD is not reflecting them adequately.

"If you ask me, already 1.20 is well above the level where the currency pair should trade given our view on relative central bank actions going forward," says Falkenhall.

"Although the ECB probably will taper purchases further by the end of the year, we still talk about easier monetary policy in the euro area, while we believe current market prising on the Fed is way too cautious. Repricing of Fed expectations should involve at least a temporary recovery of the dollar, as long as the ECB doesn’t surprise on the hawkish side," continued the SEB strategist.

The Recovery

Although EUR/USD is forecast to fall to 1.14 in the short-term once the markets misapprehension over policy differentials is resolved, the longer-term outlook for the pair remains bullish argue S.E.B.

FX 'reserve flows' will become a more dominant driver in the New Year, potentially pushing the exchange rate higher again.

These are flows from purchases made by central banks rebalancing their Euro holdings.

These holdings have fallen to historically very low levels, but will probably rebound from these low levels in the future.

"Over the medium to long term, rebalancing flows may once again dominate the outlook for the currency pair. While the dollar proportion of allocated reserves according to IMF has increased the euro proportion has declined significantly and is back at the 2002 level. This suggests there may be further structural demand for euros and other currencies triggering additional dollar selling over the longer term," says Falkenhall.

Chinese Selling

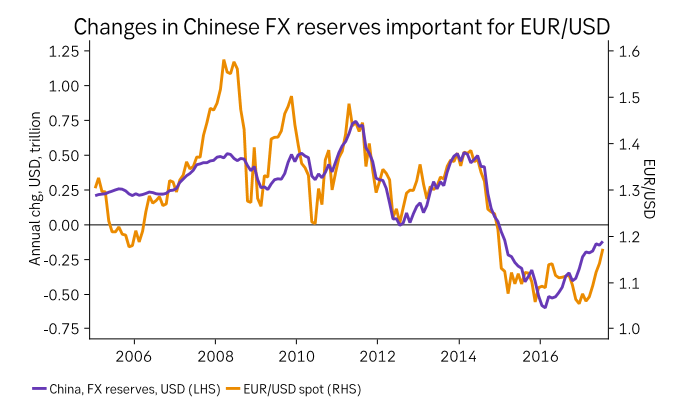

Heavy selling of the Dollar by the Peoples Bank of China (Pboc) has also been a factor in recent Dollar weakness.

There is a close correlation between Pboc FX reserves and the EUR/USD which explains the relationship, and provides a possible factor for ongoing Dollar weakness:

"There is a quite neat long-term correlation between changes in Chinese FX reserves and the value of the Dollar. Although the 12m change in Chinese FX reserves captured in the graph below is still negative, China’s FX reserves have increased by almost USD 100bn as of July this year. Although rising Chinese reserves have generated net inflows to dollar denominated securities, it has probably involved rebalancing out of the Dollar as well."

Overall S.E.B. are negative about the prospects for the Dollar as a result of global flows.

They think that stronger global growth suggests that capital inflows to emerging markets and China will probably continue, boosting rebalancing flows out of the Dollar.

For the same reason, they think that capital flows into the Eurozone are unlikely to end as the "potential return on investments remains quite attractive despite a stronger Euro. This flow scenario suggests that the Dollar will continue to suffer from sustained rebalancing flows," said Falkenhall.

Overall their view is that the pair will fall to 1.14 in the short-term and then rebound to 1.20 by the end of next year.

"We maintain the view communicated earlier that EUR/USD should be close to a peak. The currency pair has moved beyond what seems reasonable, and a renewed focus on central bank policy should support the dollar towards our year-end EUR/USD forecast of 1.14.

"However, there are reasons to suspect it may only be a brief recovery for the Dollar and already next year EUR/USD looks set to move higher as FX reserve flows return as the dominant driver in the currency pair. Our forecast for EUR/USD is 1.20 by the end of next year with upside risks," said Falkenhall.