ECB to Clip the Euro's Wings

The Euro to Dollar exchange rate (EUR/USD) is likely to continuing rising but it may struggle above 1.20 due to the probable intervention of the European Central Bank (ECB) says a new research briefing regarding the outlook facing the world's largest currency pairing.

"We envisage only limited upward potential in EUR-USD because at levels above 1.20 the ECB would likely try to halt the momentum with the help of verbal intervention," says chief economist, Dr Jorg Kramer at Commerzbank.

Nevertheless, the position constitutes a substantial upwards revision from Commerzbank's previously more bearish forecast for the pair.

The more bullish outlook is mainly due to deciding the Dollar is unlikely to recover in the second half of 2017 due to sluggish growth (which has had to be downgraded from 2.3% to 2.0%).

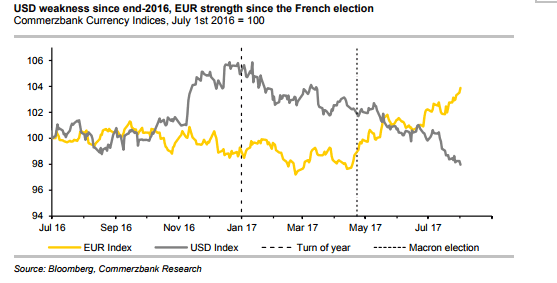

The Euro has been rising ever since French President Emmanuel Macron took office, as shown on the chart below which shows the Euro Index - which is the Euro versus a basket of currencies - and the Dollar Index which is similarly calculated.

But it is not just a unwinding of political risk which has propelled the single currency higher, the Euro has also gained support from the ECB saying it will start to wind-down its stimulus programme and eventually start raising rates.

The ECB will not want the Euro to get too strong, however, as this will start to put downward pressure on inflation since it will cheapen foreign imports.

Given inflation is already struggling and the ECB has been doing everything in its power to help it, they will not welcome having their hard-work undone, and will therefore probably intervene.

"The ECB can be expected to sell the view that its expectation of gradual monetary normalisation depends on the assumption that the euro does not appreciate further. That is likely to be interpreted as a verbal intervention which should limit EUR-USD’s appreciation potential," said Kramer.

US Reality Check

The Dollar side of the pair, meanwhile, rallied strongly at the end of 2016 on the back of promises of more fiscal stimulus from Donald Trump.

It was thought that via tax breaks and infrastructure spending he would oil the engines of economic growth, speeding up the US's recovery, and leading to more rapid policy normalisation from the Federal Reserve.

"The Trumpflation fantasy", however, has "now evaporated", says Kramer, and the market has radically downgraded expectations of where US interest rates will be by the end of 2018 - to 1.5%, which is a much shallower trajectory than that expected by the Fed of 2.25%.

"Not even three rate hikes since last December, executed in perfect regularity, were able to convince the market that we are seeing the start of a rate hike cycle worthy of the name," says Kramer.

The analyst says the market 'mistrusts' the Fed and will not be appeased until inflation recovers, and the Dollar has depreciated substantially, as a result.

Trump's inability to get any of his key pledges ratified by Congress and the Senate has been a problem but now also has the impact of the Russia scandals, which threaten to completely unseat the administration.

"The US government, busier with Russian scandals than with its own political agenda, is no longer considered capable of introducing policies which will support the dollar," comment Commerzbank.

The sanctions the US is imposing on Russia also threaten its ties with Europe which have tolerated unilateral US sanctions so far as they 'only' affected Russian banks however now they are widening it may put pressure on allegiances, with the risk being that the Dollar could be undermined as the world reserve currency.

Finally, another 'outside of left-field' threat to the Dollar is President Trump's avowed desire to find a dovish replacement for Janet Yellen so as to keep the Dollar from appreciating.

However, he is unlikely to succeed in finding a successor who is dovish since the Republican controlled congress, which predominantly opposes loose monetary policy, will probably move to block such a move.