Euro to US Dollar: Forecasts, Data and Events for This Week

The Euro to US Dollar pair has been rising steadily in an ascending channel as US political risk combined with monetary policy issues have supported the Euro and depressed the Dollar.

The current short-term rally is expected to continue higher as there are few indications, especially from price action of impending weakness.

Within the confines of the channel, the exchange rate has risen to the upper border where it is now exerting pressure.

This is a slightly negative sign as the upper borderline is likely to push the exchange rate back down inside the channel, so there is a heightened risk of a correction.

Nevertheless, despite this, the pair is expected to continue rising despite a loss of momentum, as measured by MACD, during the most recent portion of the rally.

Data for the Euro

The main data release for the Euro in the week ahead is Manufacturing and Services PMI, out on Monday, July 24.

Manufacturing is forecast to fall from 57.4 to 57.2 in June and Services to rise to 55.5 from 55.4 previously.

Apart from PMI data the only other major release is the IFO sentiment gauge for Germany which is based on surveys with business professionals.

The gauge measures their view of the current situation as well as their outlook for the medium-term.

It is expected to result in a slight dip in sentiment in July.

Data for the Dollar

The main event in the week ahead is the meeting of US Federal Reserve on Wednesday, July 23 at 19.00 BST.

They are not currently expected to increase rates at the meeting, however, the they will release a statement outlining their current stance.

Recent US data has been poorer-than-expected, leading to concerns about whether the Fed really will raise interest rates ‘one more time’ this year as they are currently expected to.

“U.S. policymakers are still talking about raising interest rates one more time this year, but nearly every piece of U.S. data released this past week casts doubt on the need for additional tightening,” said Forex guru Kathy Lien of BK Asset Management.

Another key release for the Dollar is the first estimate of Q2 GDP, out at 13.30 on Friday, July 28.

The market is pricing in a 2.5% quarterly year-on-year rate and 2.6% quarter-on-quarter rate.

“A print at least in the mid-2% range would provide some relief that US growth has returned to an above-trend pace after a disappointing Q1. But a pace closer to 2% would likely be taken negatively by markets, as weaker than expected growth amid low inflation can be expected to lower the Fed's conviction in its policy rate path,” said Canadian investment bank TD Securities.

The Employment Cost Index is also out in the coming week and is a key gauge of earnings and therefore potential inflationary pressures, and Fed policy.

The Index is scheduled for release at 13.30 on Friday, July 28.

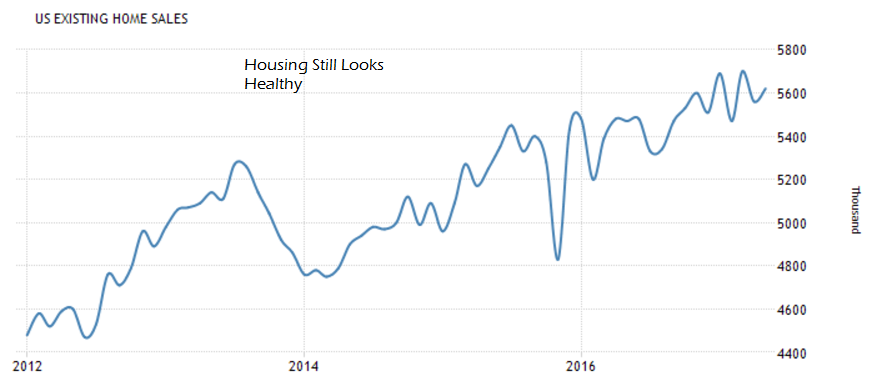

There is a lot of housing data out although there are no signs that its long-term upward trend in growth will slow, as illustrated on the charts below:

Other key data includes PMIs, durable goods orders, the final reading of Michigan consumer sentiment and consumer confidence; advance estimates of goods trade balance and wholesale inventories; Chicago Fed national activity index, Richmond Fed manufacturing index, and Kansas Fed manufacturing index.