EUR/USD Avoids Breakdown After May Inflation Data

The Euro to Dollar exchange rate (EUR/USD) is rising after the release of Eurozone inflation data showed no change from analyst’s expectations.

The pair had been sitting on an important chart level in the 1.1130s from which it rose by 7 basis-points following the release.

If the pair had pierced below the level instead, as some had feared, it would have signalled a bearish change in the broader trend targeting the lower 1.10s.

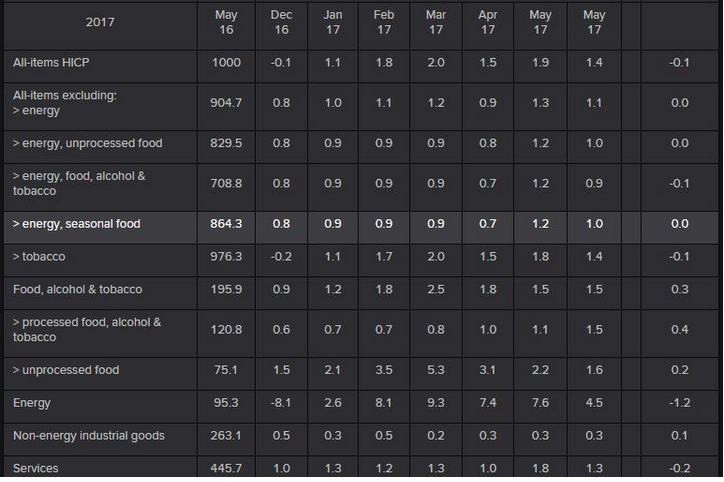

Inflation in May fell -0.1% both for general and core goods.

Although this was lower than the 0.4% and 0.5% respectively witnessed in April, it was what the market had expected, and thus came as no surprise and probably some relief.

On yearly basis inflation rose 1.4% and 0.9% respectively compared to May in 2016, which was also lower than April but – again had been pre-empted by the market.

“Euro continues to feel some love this morning and relieved there's no nasty downside surprise in this data given the ECB's recent lower forecasts,” commented Forexlive’s Mike Paterson.

Commerzbank’s Karen Jones notes how the pair has fallen to the base of the channel which suggests an overall negative tenor to the chart:

“EUR/USD outlook is negative. The Euro has eroded the 2-month uptrend and should come under renewed downside pressure.

Initial support is the 1.1135 channel followed by the 1.1070 23.6% retracement of the move higher this year.”

Reaction and Analysis to Latest Eurozone Inflation Data

Inflation is a central concern of the European Central Bank (ECB) who are responsible for setting interest rates.

Higher inflation pressures them to increase interest rates to encourage saving over spending.

Higher interest rates support the Euro as they attract more inflows of capital.

The ECB is widely expected to start winding down its monetary stimulus measures as a result of the recovery in the Eurozone economy, however, inflation remains lows suggesting growth is not strong enough yet to start the wind-down process.

The market expects the ECB to start to reduce QE at the start of 2018, however, continued low inflation could delay it.

"The largest upward impacts to euro area annual inflation came from fuels for transport (+0.19 percentage points), accommodation services (+0.07 pp) and heating oil (+0.06 pp), while telecommunications (-0.10 pp), garments (-0.06 pp) and social protection (-0.04 pp) had the biggest downward impacts," said Eurostat.

The minor changes in the Euro after today’s data were due to the results mirroring market expectations.

A higher inflation print would have strengthened the Euro and a lower than expected print weakened it.