The EUR/USD: Forecast for the Coming Week

EUR/USD is biased towards making further gains in the week ahead due to the material risk that the US Dollar will weaken following the testimony from former chief of the FBI James Comey on Thursday.

On the same day, the European Central Bank (ECB) governing council will meet to fix monetary policy for the next interim period and whilst they are expected to want to talk the Euro up the region has shown significant enough recovery for its improved prospects not to be overlooked.

In our previous weekly forecast, we set 1.1480 as an upside target, however, we shall have to revise that down in light of the discovery of new resistance levels in the 1.1390-1.1400 zone.

These resistance levels, which include a key trendline and the R1 monthly pivot are expected to put a cap on EUR/USD’s appreciation.

Our new upside target is, therefore, 1.1390, with confirmation coming from a move above 1.1300.

Data for the Euro

The main event for the Euro is the ECB rate meeting.

The ECB will probably want to keep the Euro down so they are unlikely to gush about the recent recovery, and frustratingly low inflation makes it highly unlikely they will talk about a timeline for dismantling QE.

ECB chair Mario Draghi probably has not altered his stance from two weeks ago when he said that the region still needed stimulus, so if anything the Euro is likely to remain either neutral or to fall.

“While we do look for the ECB to change it's balance of risk around growth from downside to neutral, we think that the forward guidance is likely to remain unchanged based on recent comments from Draghi and other Governing Council members. This should leave a dovish tone, as markets realise that the ECB needs to see a lot more progress on inflation before the easing bias goes,” said Canadian Investment Bank TD Securities in a note to clients.

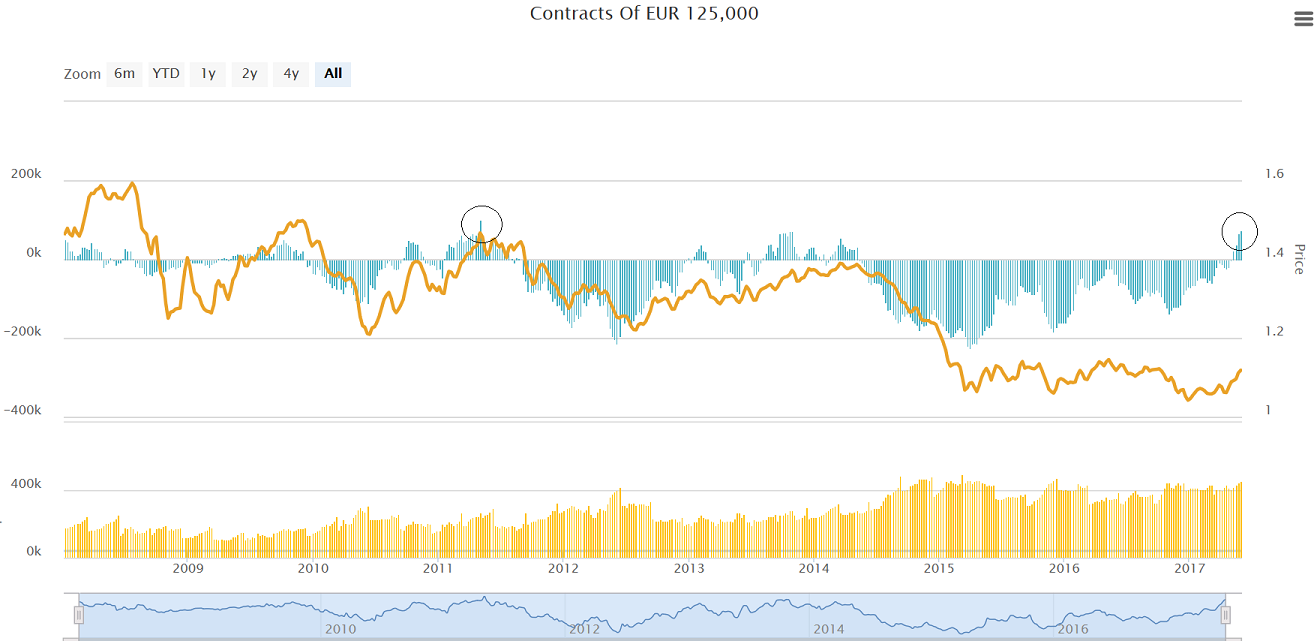

Net Bullish Positions Rising

The Euro has seen a the massive rise in investors giving up their bearish positions in the future’s market.

The divergence between the relatively low Euro and the record high positive positioning in the futures market - which is a reflection of the smart money’s optimism for the currency - suggests the Euro may seek to ‘catch up’ and, therefore, has further to rise.

“The EUR net long has climbed to a fresh multi-year high, exceeding (in contract terms) the 2013 high to reach levels last seen in 2011. Short covering remains the dominant driver (six consecutive weeks) in delivering an improvement in the net, with gross longs hovering just below the record seen in April,” said Scotiabank’s Osborne.

Data for the US Dollar

The Dollar sold off after Friday’s disappointing Non-Farm Payrolls print which came out well below expectations at only 138k.

However, the data was not sufficiently bad to undo expectations that the Federal Reserve will raise interest rates a quarter of a percent in June and as such is unlikely to have a lasting negative impact on the Dollar, according to the consensus view.

“Will the disappointing May employment reports derail the Fed’s plan to raise interest rates in June?" Asked NBF Economics rehetrocially, in a note to clients.

"The Fed will likely look at the bigger picture. Non-farm payrolls, despite May’s soft print, have now increased for an 80th consecutive month, an unprecedented achievement in the U.S,” NBF answered.

Whilst a rate hike in June is still very much on the cards, expectations for rate rises further out in the future have contracted. to below 50% that the Fed will raise rates two more times in 2017.

The chance of two more rises in 2017, for example, has fallen to below 50%.

Over the next two weeks there will be a curfew on Fed officials talking about monetary policy ahead of the June FOMC, and during the period the Dollar is expected to trade with a downside bias.

“The next 2 weeks is the “quiet period” before the FOMC meeting, so there won’t be any comments from U.S. policymakers to bolster those expectations. For this reason, we expect the U.S. dollar to underperform over the next 8 days ahead of the June 14 FOMC meeting,” said BK Asset Management’s Kathy Lien.

More potential weakness for the Dollar is possible on Thursday when the former head of the FBI James Comey gives testimony to the Senate at 17.00 BST.

He will be questioned about whether President Trump asked him to stop the FBI’s Russia investigation. There is a risk of a sizeable sell-off should he continue to fuel allegations the President attempted to cover up his defence advisor Flynn’s connections with the Kremlin.