EUR/USD Set to Gain as Economic Performance Gap Between Eurozone and US Closes

The Eurozone economy is playing catch up with the US economy, with important implications for EUR/USD, argues Richard Franulovich, an analyst with Westpac in Sydney.

The dynamic is most clearly seen in the comparative rates of inflation in the two regions, whilst inflation is much higher in the US (1.7%) than in the Eurozone (0.9%), Westpac expect inflation in the Eurozone to rise more quickly than in the US.

As inflation rates coalesce, European interest rates as measured by German Bund yields will catch up with US Treasury yields, closing the currently wide, negative -200 basis point gap between the two.

The yield differential has a big impact on EUR/USD and a closing of the yield gap is very likely to lead to a rise in the currency pair.

What Makes Them So Sure Eurozone Inflation Will Catch Up?

Yet nowhere has inflation remained so stubbornly low as in the Eurozone as Mario Draghi’s every press conference since he took office attests, so why should things be any different now?

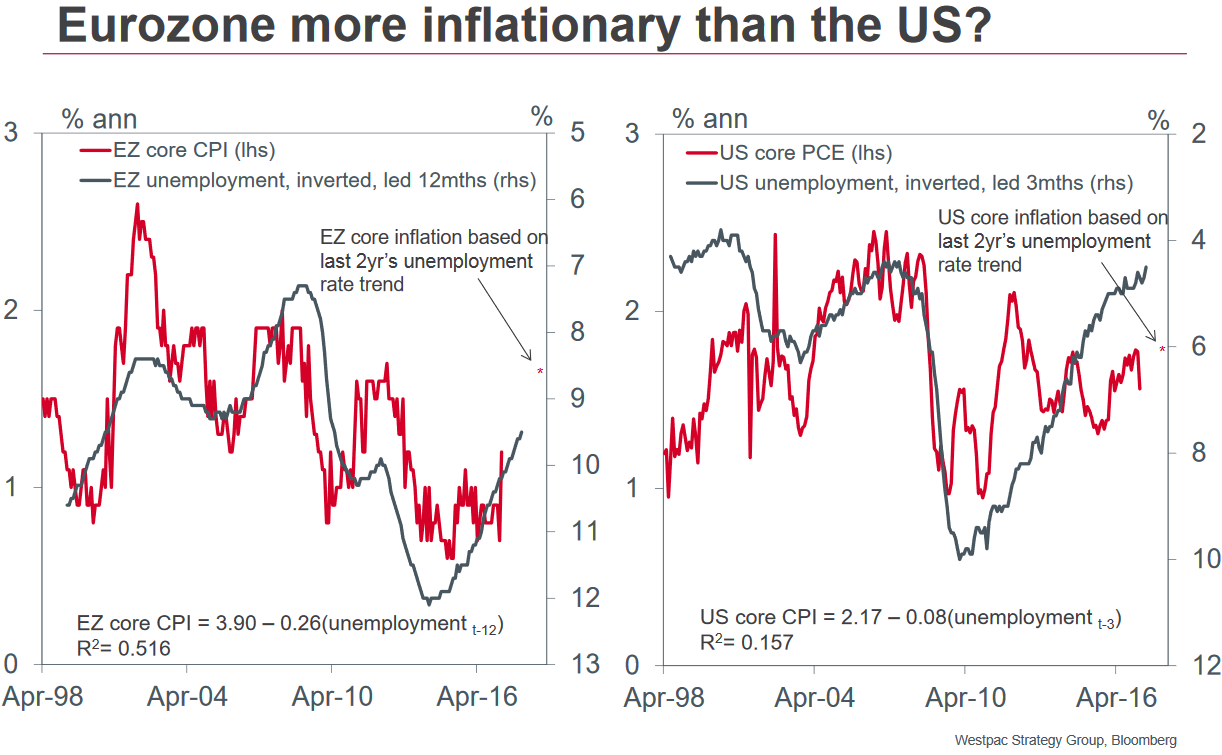

Westpac’s Franulovich says the answer lies in the relationship between unemployment and inflation in the two jurisdictions.

In the Eurozone inflation is much more sensitive to rises in employment than in the states.

The link between the two is represented in the oft-mentioned ‘Phillips Curve’ which shows a rising curve correlation between falling unemployment and rising inflation.

In the Euro-area, however, the curve is much steeper with falling unemployment having a much steeper impact on inflation than in the US.

The effect is based on the principle that as the number of unemployed falls workers become emboldened to ask for higher wages, or employers have to offer higher wages to find the requisite staff, which causes higher inflation.

“In the last 2yrs EZ unemployment has fallen at a -0.07ppt average monthly pace. Extrapolating that would put EZ unemployment at 8.7% in a year’s time (from 9.5% currently*). Our simple regressions suggest an 8.7% unemployment rate would put EZ core inflation at 1.65% in a year’s time, up from a 0.9% average annual rate the last 3mths,” said Franulovich.

Now compare that to his analysis of the outlook for US unemployment and inflation:

“US unemployment has fallen a slower -0.04ppts p/month over the last 2yrs. At that pace US unemployment hits 4.1% in a year’s time. Applying the US regression equation to 4.1% unemployment puts the core PCE at 1.85% in a year’s time, up from an average 1.7% pace in the last 3mths.”

The data suggests that Eurozone inflation will be 1.65% in a year’s time compared to 1.85% in the US.

Such a narrowing of the gap would have major implications for yield differentials and be very bullish for EUR/USD.

*Unemployment remained unchanged in March thus slowing the pace of decline from that in the Westpac report.