EUR/USD: Increased Chance of Gap Being Filled?

At the start of the new trading week, we focus in on the ambiguous technical picture displayed by the Euro to US Dollar pair in an attempt to make some sense of it and forecast future direction.

Technical studies are mixed, with some bullish features and some bearish, however, the currency pair’s heightened sensitivity to data in both directions as evinced by its choppy reactions to Mario Draghi’s commentary at the last ECB meeting indicates above all else a feather-light reactivity.

“The Euro had a relatively flat week but it wasn’t without volatility, as the ECB’s decision to keep rates on hold, and the requisite speech from Draghi, saw the pair swing in both directions,” commented Blackwell Global’s Senior Analyst, Stephen Knight.

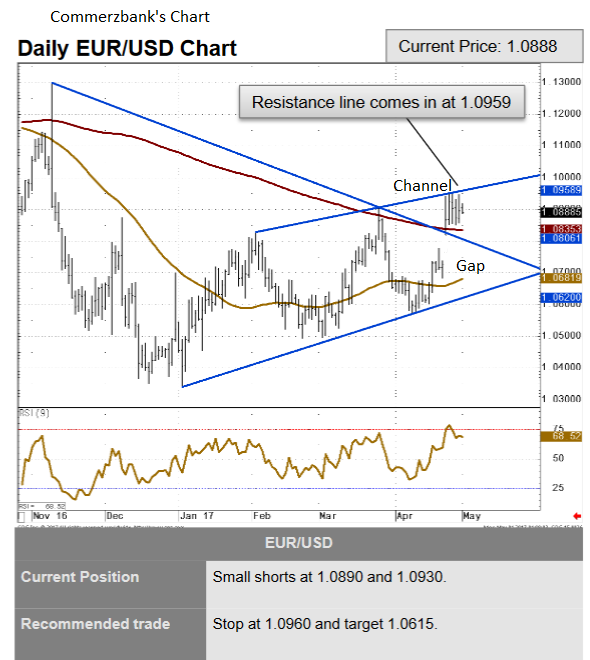

Given the pair’s current structure, and the fact it is pressing up against resistance from the top edge of a rising channel, and due to the fact it has met and been restrained by the 50-week moving average (MA) there is a possibility the resistance will hold and the pair will dip lower – even if only temporarily.

But the biggest indication that the pair may fall is the still-open gap from the start of the previous week.

Market gaps rarely stay open for long unless they are breakaway gaps which this one is not.

The Japanese call them ‘windows’ signifying how they are apt to close again.

We see a heightened possibility of the gap being closed in the week ahead due to its potential for volatility in either direction.

The FOMC (Federal Open Market Committee Meeting) on Wednesday and Non-Farm Payrolls on Friday are two of the most volatile events for the Dollar.

The euro may be affected by the build up to the second and final round of the French presidential election.

“Ultimately, the coming week is likely to be relatively critical for the Euro Dollar given that the consolidative phase is likely to breakdown in the near term. In particular, the EU GDP and U.S. FOMC results are likely to fundamentally set the tone for the coming days and the reality is that the Euro is likely to see plenty of volatility in light of these events,” said Steven Knight.

A crossing below the gap highs at 1.0819 would provide confirmation the gap was closing with a target down at 1.0779.

Our cautiously bearish view is supported by Commerzbank’s Senior Analyst Axel Rudolph who sees resistance from the upper border line of the channel containing upside.

They retain “small short positions” at 1.0890 and 1.0930 with a target at 1.0615.

The Bullish Viewpoint

The bullish perspective is also worth mentioning as there are some fairly strong signs to consider.

The pair has formed two higher highs and higher lows since the January lows which is evidence the trend may be changing from down to up.

The 200-day moving average is supporting last week’s price action which followed the gap and will be a tough layer to break below.

The possibility of a breakout higher for the pair is not ignored by Commerzbank’s Rudolph either, who notes that a, “close above the three-month resistance line at 1.0959 would put the January low at 1.1098 on the agenda.”

We see the potential for a breakout on the news of the French presidential election, next Sunday, with a break above the 1.1050 level harnessing bulls to push the rate up to 1.1200 initially.

Before that occurs, however, there is a chance data during the week could lead to a gap fill.