Euro to Intensify Pressure on the US Dollar, but Beware a May Bump in USD

The Euro is expected to intensify its pressure on the Dollar over coming months, but we note too that the month of May typically favours the Dollar.

The US Dollar continues to struggle as US economic data surprises have turned lower, expectations of large tax reforms and infrastructure spending have been pushed back, and President Trump indicated that he would prefer a weaker Dollar.

Part of the Dollar weakness can be put down to an unwinding of the so-called Trump trade.

The USD rally in November/December 2016 was predicated on very high expectations about the mix of tax reform and fiscal stimulus in the US.

It took us into 2017 with expectations that momentum could extend while the new US President would iron out the details on delivering on the expectations markets had sown into the Dollar.

Yet, when the time came to deliver, the White House proved wanting and the Dollar left high-and-dry.

“We view the White House’s announcement on tax reform (confined into a one-page document) as insufficient to provide the Dollar with any relief,” says a note from UniCredit Bank on the matter.

Analysts note the US administration has failed to provide significant clarity and guidance on its proposals and, importantly, their implementation.

This week’s unveiling of the tax plan did not deviate from the norm of vagueness and lack of detail.

“This is bound to be perceived as a disappointment for USD-bulls and should increase pressure on the Dollar. EUR-USD is likely to trade close to 1.09-1.10 until the second round of the French presidential election has passed,” say UniCredit in a note dated April 27.

Assuming a Macron victory, “we would expect appreciating pressure to intensify,” warn UniCredit.

What Happened

The White House presented a modest set of guidelines for tax reform.

Details were scant, but they mostly aligned with the outline for tax reform that President Trump offered while campaigning.

Key elements of today’s announcement included:

- A reduction of the top corporate tax rate from 35% to 15%;

- A shift to a territorial system for corporate taxes;

- A temporary tax reduction for the repatriation of profits earned abroad;

- A reduction of the number of personal tax brackets and a decline in the top rate to 35%;

- Doubling of the standard deduction for individuals; and

- Significant limitations on deductions.

“Details in today’s announcement were insufficient to accurately assess its budgetary impact,” says Lewis Alexander at Nomura.

As a point of reference the proposal put out by Trump in September was estimated to raise Federal deficits by roughly $6tr over 10 years.

In announcing the plan, Secretary Mnuchin argued that significant restrictions on deductions and higher growth (3%, specifically) would essentially offset the budget impact of the proposed reductions in tax rates.

Eliminating deductions, however, has proven to be extremely challenging argue Nomura who remain skeptical that the administration can implement policies that would lead to sustained growth of 3%.

“It is possible that the USD could remain soft for a while as the unwinding of the Trump trade turns into the remorse trade,” says Daniel Been, Head of FX Strategy at ANZ Research in Sydney.

But the US Dollar Could Rally in May

While the Euro is looking increasingly bullish against the Dollar, coming weeks might disappoint those holding out for a Euro rally.

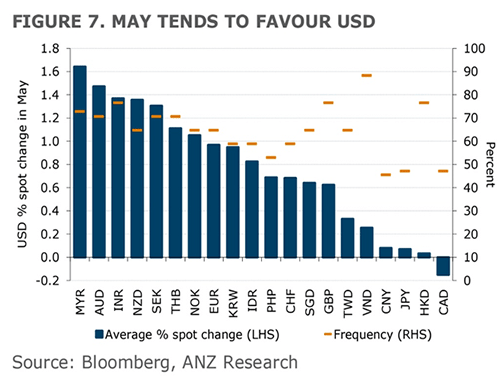

As we have already reflected on, the month of May tends to benefit the Dollar.

“We are coming up to that time in the year which has tended to favour the USD in the past,” says Been.

“For reasons unknown, the USD has historically shown broad-based strength against the G10 and Asian currencies, with the exception of CAD,” notes Been.

The analyst speculates that the Dollar rises in May due to a recovery following a typically poor April performance by the USD.

“If so, and given the weak showing of the USD in April alongside positioning that is looking extended in Asia, there are prospects for a near-term recovery,” warns Been.