EUR/USD Fades from Recent Highs, But Still has a Shot at Entering Bull Territory

The EUR/USD has faded back from recent highs but we believe the single currency should retain the advantage near-term.

The exchange rate is quoted at 1.0681 at the time of writing, down from recent highs of 1.0719.

For sure, focus in global foreign exchange now shifts back to the US Dollar; so we will be watching events across the Atlantic for further guidance.

Technically, we reckon the Euro-Dollar has more to offer.

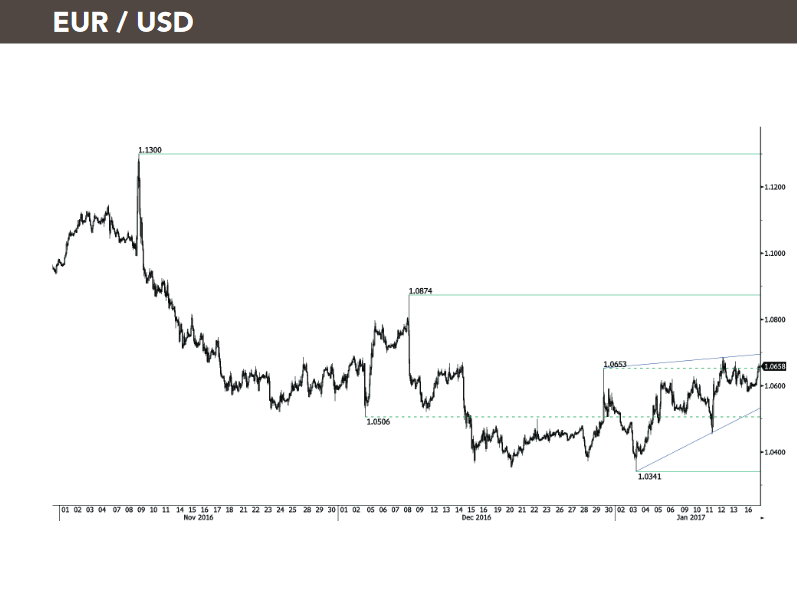

“Should the market go above 1.0700, we remain unable to rule out a move to 1.0820 – the 50% retracement,” saiys Commerzbank’s technical analyst Karen Jones.

The call comes as the EUR/USD registers a 1.77% recovery against the US Dollar thus far in 2017.

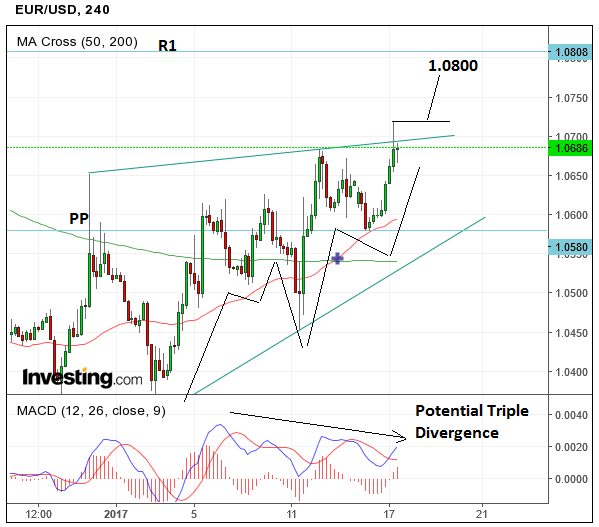

The short-term trend is already arguably up as it is showing a sequence of rising highs and lows on the 4-hour chart, which is normally the first sign of a new uptrend.

A break above the day’s highs at 0.0719 would probably confirm an extension higher to a target at 1.0800.

An obstacle to further upside is provided by the R1 monthly pivot at 1.0808 and the exchange rate is likely to pause if not pull-back at that level if it reaches it.

One proviso to the bullish forecast is the moribund momentum which is making lower lows as the exchange rate makes higher highs.

The non-confirmation is a sign of underlying weakness and could indicate the pair is about to move lower.

This combined with resistance from the trendline linking the late December and mid-January highs is a warning that there is the potential for a reversal.

Insufficient hard evidence of more downside, however, means we retain a bullish view, and assuming the day’s highs are broken and extension to the aforesaid target.

Swissquote Bank’s analyst, Yann Quelenn, is also bullish in the short-term.

“EUR/USD's momentum is still positive despite some consolidations. Strong resistance is given at 1.0874 (08/12/2016 high,” said the analyst.

Janet Yellen, US Inflation in Focus

The Dollar could be in the driving seat mid-week with the first of two speeches by Federal Reserve Chair Yellen being delivered.

"The Fed narrative on portfolio reinvestment has lately shifted toward a slightly more hawkish tone, so watch for any new insights from Yellen," says Elsa Lignos at RBC Capital Markets.

Inflation data dominates the economic docket.

Headline CPI should get another boost from firming gas prices (consensus forecasts headline & core 2.1%).

It will be the first time that headline CPI is north of 2% since mid-2014 and we expect it to hit 2.5% in both Jan and Feb given easing year-ago comps in energy.

"It is dangerous to draw too many conclusions from a single inflation number, but given the stall in the ‘Trumpflation’ trade and the technical pressure on USD, it needs a strong number to avoid a further washout of USD longs," says Lignos.