Week-Ahead EUR/USD Exchange Rate Predictions: Downside Bias Within a Range

The Euro to Dollar exchange rate's headlong run towards 1.0 have faded of late thanks largely to an ongoing short-covering rally that may fuel further short-term upside.

Longer-term, the prospect of the Euro equaling the US Dollar remain elevated, but bears must be patient as no market ever runs in a smooth line.

Short-covering is what happens when traders betting on the exchange range going lower find themselves on the wrong side of the market as it begins to rise.

There is then a panic as they close out their losing bets at a loss, fuelling more demand and pushing the pair more rapidly higher in the process.

The unique feedback loop drives the market up rapidly.

Nevertheless, data from US futures exchanges is showing that the number of bearish traders are declining and therefore any short-covering is likely to result in a moderate rather than explosive appreciation.

From a technical perspective, the range is inconclusive but the overarching trend is still down, indicating that probabilities favour a continuation lower.

A break below the range lows at 1.0339 would indicate more downside, however, any moves lower are likely to be stymied by a support barrier at 1.0300 provided by the S1 monthly pivot.

Upside has a clearer path higher if the range highs can be pierced, with a move above 1.0675 leading to an extension up to 1.0800.

As a rule breakouts from ranges extend the same distance as roughly the width of the range, and our targets are conservative minimums.

This week’s main events for the Euro

For the Euro to rebound substantially central bankers in Frankfurt need to provide a clearer time line for an end to their money printing programme.

This is why the December ECB meeting minutes are likely to attract a lot of attention, as they will indicate whether any of the governing council, who set interest rates, are seriously considering winding up, or ‘tapering’ money printing.

If the minutes, scheduled to be released at 12.30 (GMT) on Wednesday 11, show there were any officials making a strong case to switch the printing presses off, then the Euro could recover.

Other Eurozone Data

The Eurozone is undergoing a steady economic recovery spearheaded most recently by above trend growth in the largest economy – Germany – and the fourth largest, Spain.

Set against this, however, are fears about elections this year and the possibility that they may lead to the election of an anti-EU government in Holland, France or possibly Italy.

This might result in a further fracturing of the union following the UK’s departure in 2016.

Although the probabilities are low that this will happen, some are arguing they were also low for a Brexit at the start of the referendum campaign and for

Trump winning at the start of the US presidential campaign.

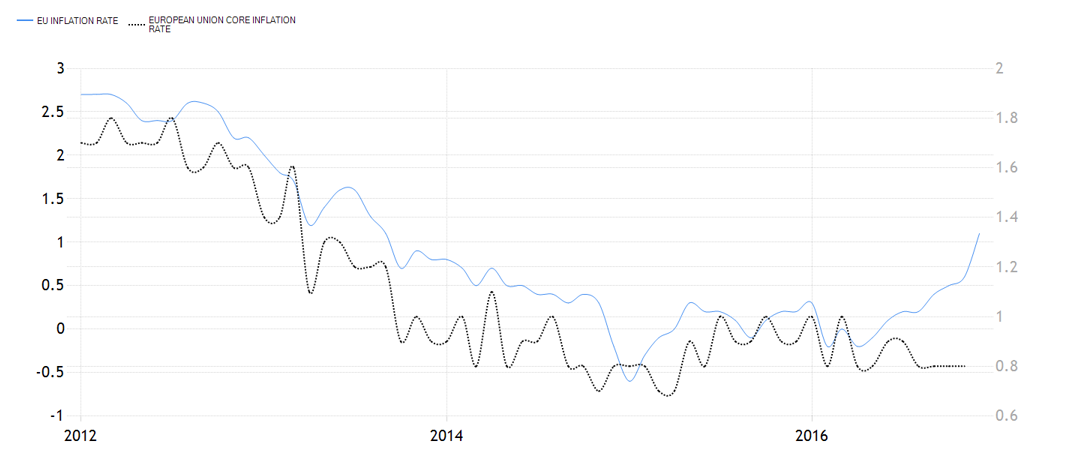

Eurozone Inflation has been rising rapidly – up 1.1% in December, but Core inflation is not rising as quickly causing many to be cautious about whether the price bump will last.

Eurozone Unemployment data will be a key release at 10.00 on Monday 9, but analysts see it flatlining at 9.8%.

A surprise fall of more than one basis point – so to 9.6% or lower – would probably cause a rally in the Euro, as unemployment has been seen as one area where the region has been making progress, albeit at a painstakingly slow and insufficient rate.

The key release will be Industrial Production on Wednesday 11, which is forecast to rise by 0.5% from -0.1% previously.

Data to Watch for the Dollar in the Week Ahead

The message from Federal Reserve speakers is likely to dominate headlines and supply further upside to the Dollar in the coming week.

“We wouldn't be surprised to see some hawkish Fed talk this week, with the intention of preparing markets for the prospects of a 1Q17 rate hike.

Strong US inflation and growth data over the next month will likely see the reflationary uptick in US yields continue and this means a USD buy-on-dips strategy remains attractive,” said ING’s Turner.

Apart from that, the main data release is on Friday when Retail Sales for December is released at 13.30 GMT.

It is expected to show a strong 0.7% month-on-month (mom) rise whilst Core Retail Sales is forecasts to have grown by 0.5% mom.

Michigan Consumer Sentiment is another big release on Friday, and is estimated to come out at 98.5 from 98.2 previously, at 15.00.