EUR/USD Exchange Rate Bounces Following Yellen Speech But Strength to be Limited

EUR/USD appears ready to end the week on a positive footing as the US Dollar is sold across the board following Janet Yellen's opening remarks at the Jackson Hole Symposium.

The big event for the US Dollar of the week has just passed.

The USD bounced higher, and then promptly fell, following comments from US Fed Chair Yellen that a 2016 interest rate rise was highly likely.

The chopping trade in the Dollar shouldn't come as a surprise - we feel markets had really made a mountain out of a mole hill with this event.

The opening remarks were always going to be academic in nature, and there was never going to be an official announcement for an interest rate rise at the event.

Yellen noted that based on this economic outlook, the FOMC continues to anticipate that gradual increases in the federal funds rate will be appropriate over time to achieve and sustain employment and inflation near our statutory objectives.

"Indeed, in light of the continued solid performance of the labor market and our outlook for economic activity and inflation, I believe the case for an increase in the federal funds rate has strengthened in recent months," said Yellen.

We get the sense that for the EUR/USD to have fallen traders would have wanted a solid signal for a September interest rate rise.

Rather, it looks as though we have confirmation that December will be the date.

This let the wind of the Dollar's sail and EUR/USD has popped towards 1.13 again.

"It’s a case of nothing new from the Fed chair, sort of hawkish and sort of dovish. August is nearly over, thank goodness," says Neil Wilson at ETX Capital.

Lee Hardman, Currency Analyst at Bank of Tokyo Mitsubishi called it when he told us he believes that Fed Chair Yellen was unlikely to explicitly signal that the Fed plans to resume rate hikes in September although it will be left open as a “live” meeting dependent on the incoming economic data.

“It could prompt some initial relief, weighing on the US dollar,” says Hardman.

Hardman noted that there would be a much larger market adjustment if Fed Chair Yellen encouraged the market to price in a higher likelihood of a September rate hike which would provide more support for the US dollar in the near-term.

Hardman says any USD weakness will remain temporary in nature and EUR/USD is unlikely to break above 1.1450.

Technicals Suggest Growing Downside Pressures

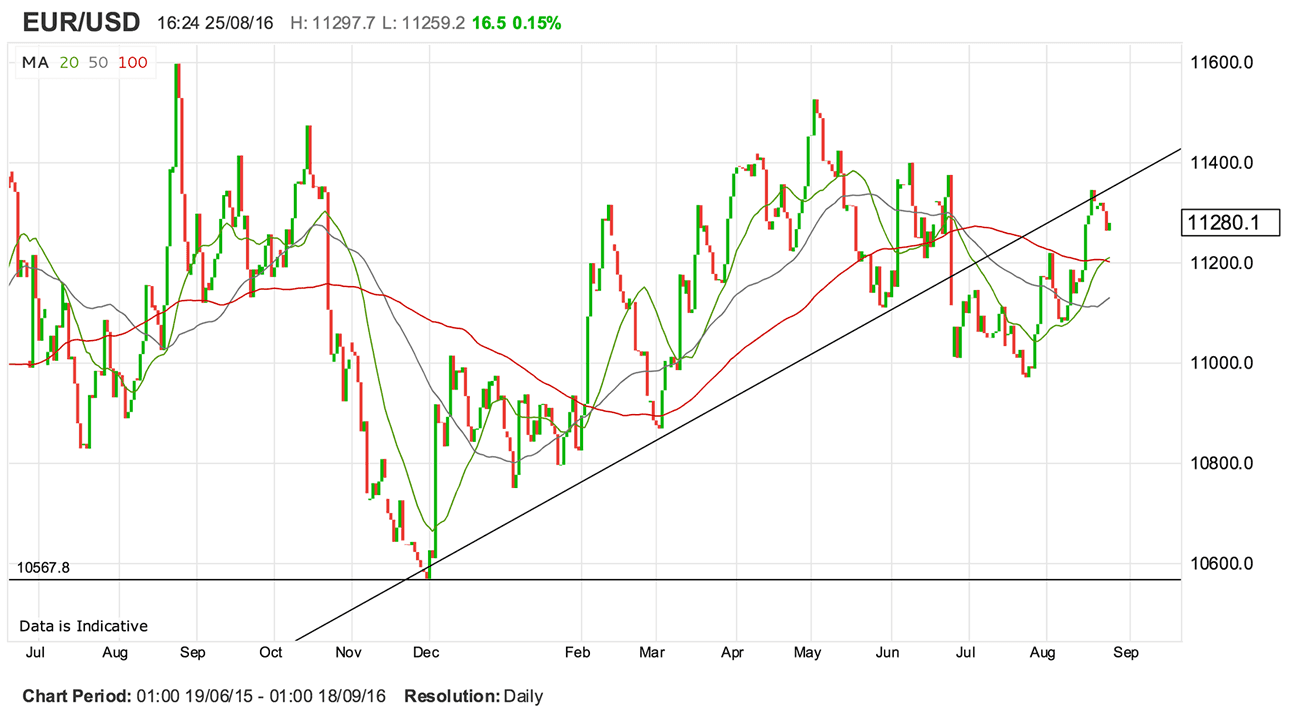

The Euro has actually been in an uptrend against the Dollar since it turned higher off the 1.0560 level in December 2015.

The rally higher has of course evolved in fits and starts, but since the Brexit-inspired decline in June many in the analyst community are losing faith in the currency pair's ability to convince that this trend remains tenable.

Above: The trend higher in EUR/USD, in place since December 2015, is failing to convince. Image: IG.com, PoundSterlingLive.com

We have heard a number of analysts suggest the inability to sustain the trend higher is likely to see EUR/USD remain muted at best.

"After having levelled off around the trendline at 1.1320 for some days now, it fell sharply yesterday. Moreover, the indicators are giving off some weakening signals. If the 1.1223/33 zone is broken to the downside, the to-date positive outlook would deteriorate. Our favoured trading range: 1.1180 – 1.1360,” says Ralf Umlauf at Helabe Bank in Frankfurt.

We also note how the EUR/USD exchange rate has remained below the ‘major’ 2015 trend-line giving the charts a bearish look-and-feel.

The four-hour chart below shows how the pair backed off the from the trend-line and formed an a-b-c correction in the process:

A-b-c’s are corrective patterns and there is still no evidence yet that the exchange rate will necessarily move lower, however, a break below the ‘c’ wave lows at 1.1245 would mark a change in the mini-trend, which combined with the trend-line rejection and the MACD creeping below the key zero line which distinguishes up from down-trend, provides a compellingly bearish short-term outlook for the pair.

Such a move, therefore below 1.1245 would strongly favour a continuation down to 1.1200 first, and then below that, to 1.1145.

Upside is more problematic as there is layer upon layer of resistance to the upside, with a monthly pivot posing a tough obstacle at 1.1352 and the trend-line a further barrier at roughly 1.1375.

A break above the trend-line would see the pair resurface and a move above 1.1390 lead to a probable continuation of the up-trend into fresh unhampered territory above, with the next target at 1.1450, followed potentially by 1.1500.