Deutsche in Another Euro / Dollar Forecast Upgrade, But Stand by Euroglut Theory and Expect Declines

Deutsche Bank have once again revised higher their EUR to USD forecasts in an admission they have been too negative on the pair but they stand by the view that the euro must still fall according to their 'euroglut' theory.

The ‘Theme of the Week’ here at Pound Sterling Live is not the outcome of the Bank of England’s Inflation Report, rather it is the turn-around in consensus we are seeing with regards to the euro.

We reported mid-week that UniCredit have upgraded their forecasts for the euro and we followed this up with a summation of the growing consensus towards a higher shared currency based on a range of indicators.

Deutsche Bank have added to theme having told their clients that they too are upgrading their forecasts for the euro.

This is significant as Deutsche Bank have, alongside Scotiabank and Goldman Sachs, been notable euro bears with Deutsche at one stage forecasting a EUR/USD at parity in 2016 and 0.85 in 2017.

Such upgrades suggest that those who have long argued for a euro above 1.10 in 2016 have all but won the day as evidence suggests the euro is troubling the upside of the formidable base it has formed over the past 14 months.

This shifting stance on the euro suggests the ‘next big thing’ in the world of FX could be a rally in the euro.

Why Deutsche Bank Upgraded Their Euro Forecasts

Deutsche Bank cite two significant developments since the start of the year to justify their hike on the euro’s prospects.

First, the increasingly apparent limitations of central bank policy and the resulting ECB shift away from negative rates as a form of easing.

Second, rising Fed sensitivity to global developments, which has shifted the distribution of rate hikes away from the modal four anticipated at the start of the year to two.

The dynamic has seen the euro rally against the dollar towards the top of its long-held range at 1.1450 having hit lows in the 1.05’s in December 2015.

That being said, Deutsche stress that they remain EUR/USD bears expecting the next move outside of the well-defined 1.05-1.1450 range to be down.

The key underpinning of their euro-negative stance has for a long while been the ‘euroglut theory’ whereby Euroarea portfolio outflows keep the euro suppressed.

Core Europe’s (mostly Germany’s) vast savings are expected to be deployed overseas thanks to record-low interest rates at the European Central Bank, while American and Asian investors retreat from European assets.

Deutsche believe central bank policy divergence that sees currency flow from Europe to the US is likely to remain in play and stimulate a lower euro.

US Fed pricing is currently seen overshooting with the risks skewed towards at least one rate hike this year versus market pricing of one hike every twelve months.

The ECB also has materially greater scope to ease policy as evidenced by the significant risk premium embedded in European risk assets as well as the steepness of the GDP-weighted yield curve.

All the while, Deutsche point out the flow picture remains unabatedly negative, with continued large outflows from the Euroarea likely as the process of persistent portfolio re-allocation into foreign assets (the Euroglut phenomenon) continues.

US Dollar Peak Has Not Passed

A clear area of divergence in the FX analyst community concerns the argument around ‘peak dollar’ - HSBC and UniCredit are examples of two institutions who believe the dollar has hit its maximum.

Deutsche Bank disagree.

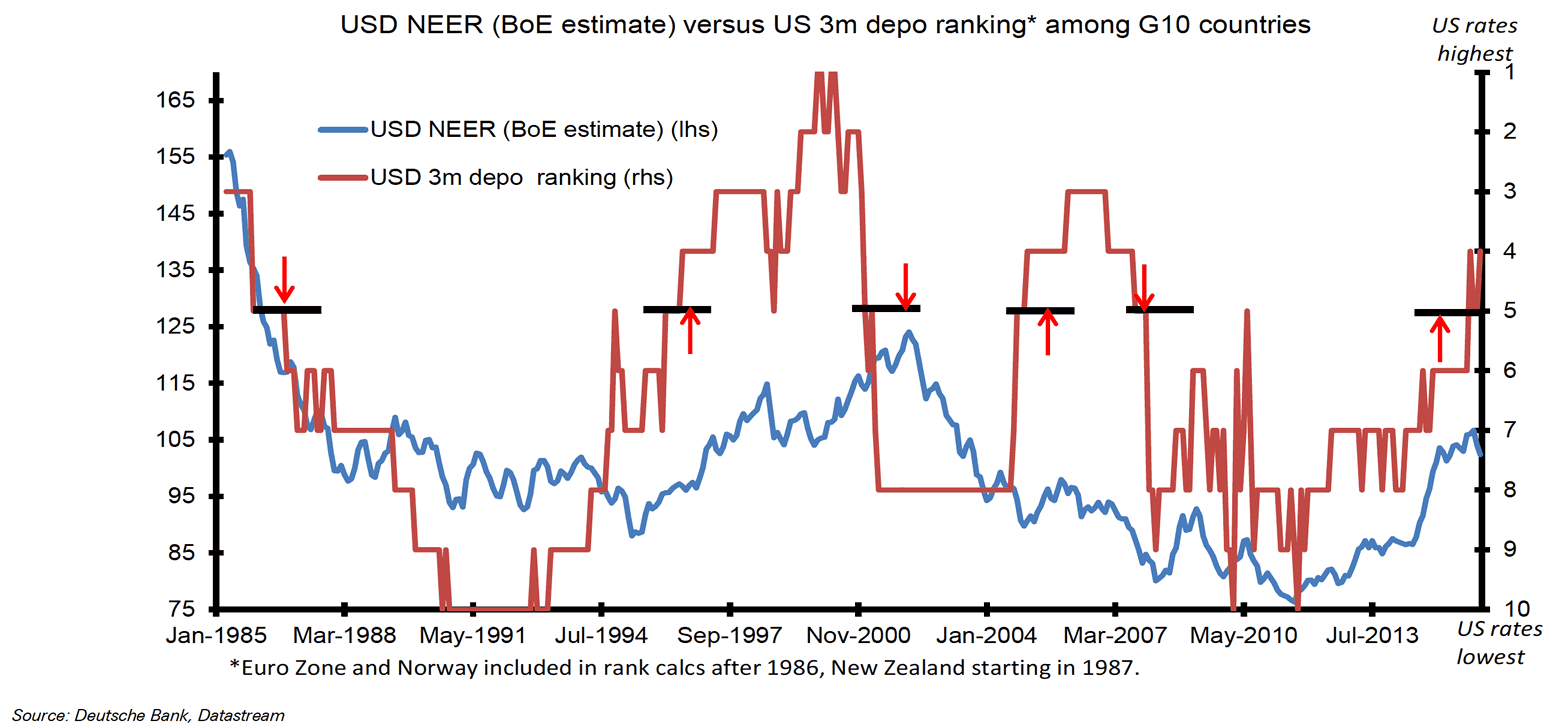

“We are not working on the basis that a medium-term USD top is already in place. For that to happen we would have to expect that ‘a Fed once/twice and done’ rate hiking cycle is the most likely scenario. The USD only peaks usually, when the US short-term interest rate ranking is sliding, rather than rising as it is currently,” says Deutsche Bank’s Alan Ruskin.

Above: USD interest rate ranking in G10. Deutsche say the USD usually only peaks when the ranking is sliding, rather than rising as it is now.

“As long as there are multiple Fed rate hikes in the offing, and the funds rate peak is above 1%, the USD will gradually reassert itself as the favourite G10 ‘high yielder’!”

Furthermore, historical precedent suggests the current period of appreciation has further to run:

The Smile Warns of Impending Dollar Strength

May has seen the US dollar recover from the lows attained in what has been a poor year for dollar bulls.

Driving the decline, argue Deutsche, is a favourable backdrop for global risk appetite that has set a negative environment for the USD while other currencies, such as the pound, have benefited.

Analyst Alan Ruskin and George Caravelos have explained the current dollar dynamics through a ‘smile’ framework which explains much of the USD’s correction lower:

The question being considered by the two analysts now is for how long can such a negative USD ‘smile’ persist?

There are already signs that the beneficiaries of this favourable risk environment, notably EM and commodity FX, have run out of upside momentum.

Saravelos and Ruskin cite the following dynamics to back their view that the dollar must advance:

On the fundamental side:

- the market has very little Fed tightening left to price out the curve, at least for 2016;

- China may have secured near-term growth, with the credit cycle resurgence, but at what long-term cost to growth?

- there is little conviction that the EM growth cycle is turning with the upturn in EM asset prices.

From a market technical perspective:

- USD longs have already been dramatically pared back and in some cases the market is still short USD;

- Valuations have deteriorated. In G10 currencies, the Aussie is now among the most expensive currencies, and Kiwi and CAD are no longer cheap.

- The correction in EM FX undervaluation has also already occurred. In our valuation rankings, expensive EM divides up fairly evenly between a group of currencies that are expensive, mostly in Asia ( HKD, CNY, SGD, IDR, PHP); and, currencies that are cheap (PLN, HUF, ZAR, TRY, MXN).

- Some asset classes, notably cyclically sensitive commodities like copper and most obviously iron ore, have likely overshot to the upside, also helped by China’s credit surge.

- The comeback in FX carry, often associated with a weaker USD, looks uninspired at best.

“We would be very surprised if the markets can come through Q4 unscathed, without falling on one side of ‘the smile’ - toward renewed pressure for a Fed tightening and/or increased China FX pressures,” says Ruskin.

Furthermore, the analyst argues that it is not obvious that we are about to move sharply toward “a Fed tightening dominated world,” the worst USD losses in a more benign risk environment have likely already occurred.

In addition, Deutsche expect the US elections will introduce a fresh source of risk and uncertainty as the market ponders renegotiating trade pacts in the face of an existing global trade recession.

Updated Forecast Targets

With euroglut still to play out, and risks on the horizon, the euro is forecast to fall to 1.11 by mid-year ahead of a decline to 1.08 in September and 1.05 by the end of 2016.

It is by the end of the first quarter of 2017 that we will see the euro-dollar fall below parity to 0.90.

This is likely to be the bottom and the currency pair is forecast to travel higher to 1.00 by 2018.