How to Trade the Euro/Dollar Rate During Thursday's ECB Opening Statement and Q&A Session

- Written by: Gary Howes

Above: Richard Kelly, Head of Global Strategy at TD Securities

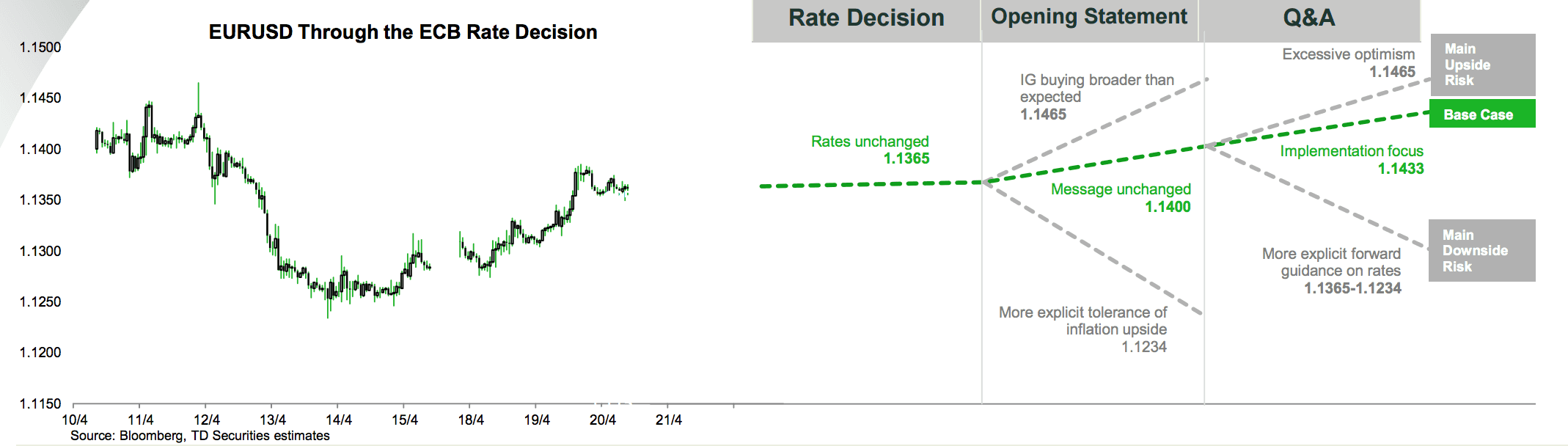

The base-case scenario is for the euro to rise through today's ECB event, but there are other probabilities that we should be aware of. Here is your ‘cheat-sheet’ to navigating the ECB decision and subsequent statement and Q&A session.

The European Central Bank’s policy meetings are always a treat for those currency traders on the hunt for volatility.

The March meeting was particularly juicy in this regard, however we would not expect the same degree of fireworks at the April meeting, due on Thursday.

Markets and economists are agreed in a 100% decision to keep rates and policy unchanged as the Bank needs more time and evidence of how the previous policy measures have impacted markets and the economy.

However, that is not to say there will be no moves in the euro exchange rate complex.

Indeed, the Opening Statement and President Draghi’s Q&A session promise to over movements.

These events are notoriously hard to anticipate.

Luckily, Richard Kelly, Head of Global Strategy at TD Securities in London has come up with his ‘cheat-sheet’ for trading the event:

The Opening Statement

80% Assured Base Case Scenario:

There are no major messages or phrasing that need to change relative to the March statement. Forward guidance is left unchanged and they reiterate the focus on implementing the March details.

- Reaction: EURUSD likely drifts higher to linger around 1.1400 given no dovish surprises.

15% Chance of Upside Risk:

The Governing Council provides further details on buying of investment grade corporate debt, scheduled to start around end-Q2, which suggests they are comfortable with significant purchases across the IG space, providing support to credit and equities at the expense of bunds.

- Reaction: EURUSD moves to 1.1465 (April high) as 1y1y Eonia could move 5bps higher.

5% Chance Downside Risk:

The Governing Council elevates to the Introductory statement the discussion from the March Q&A suggesting some tolerance for upside inflation to ensure average inflation close to but less than 2% over the medium term.

- Reaction: EURUSD can fall to support at 1.1234 (April low) as rates in Euribor reds/greens and Eonia 1y1y fall about 5bps.

The Q&A Session

80% Assured Base Case Scenario:

Draghi should continually reiterate the focus on implementing the significant measures agreed last time (IG credit purchases, TLTRO II) and progress being made in cleaning up the Italian banking sector.

He will likely keep to his refrain that the ECB will do more if needed, but we don’t expect him to avoid repeating his March message that the GC does not anticipate having to cut rates further.

- Reaction: EURUSD likely continues to drift higher towards 1.1433 (76.4% fibo from Sep high), with rates relatively unchanged.

10% Chance of an Upside Risk:

Draghi is more comfortable reiterating no intentions to cut rates further, focuses on how rapidly market conditions can change and have improved, or suggests scope for more IG buying than expected.

- Reaction: EURUSD moves to 1.1465 (April high) as 1y1y Eonia could move 5bps higher.

15% Chance Downside Risk:

There is a chance Draghi looks to deliver as soft a message as possible and avoids repeating no anticipation cutting further or adds more precision to their commitment not to raise rates until “well past” March 2017.

- Reaction: EURUSD falls back into a range between unchanged on the day, and as low as 1.1234 (April low) if he is especially explicit on “well past” which allows 1y1y Eonia to fall up to 5bps.