Euro Exchange Rate: The Big Squeeze Continues

- Written by: Gary Howes

The euro continues to be squeezed higher as markets continue to unwind their bets against the shared currency following the ECB’s underwhelming stimulus package announced in the previous week.

While some may feel that the euro should be lower there remain those with the opinion that the euro is trading where it should be.

“Going forward, there will be plenty of volatility as various rounds of profit taking will lead to pull-backs, but from a broader perspective we think the euro is back on a bumpy appreciating path towards fair value,” say UniCredit in a currency forecasts note to clients.

Consequently, the balance of risks to UniCredit’s 4Q16 forecast of 1.12 is now skewed to the upside. The euro is trading with a positive bias near-term as markets re-balance back towards levels where we were a month ago.

At the time of writing the euro to dollar exchange rate is trading at 1.0845 while the euro to pound exchange rate is at 0.7168.

Be aware that the above quotes are live inter-bank quotes, your bank will affix a discreationary spread when making payments. An independent can however get you closer to the market and deliver up to 5% more FX.

While the euro moves higher analysts also argue against relying on the upcoming Fed rate hike to propel the US dollar higher as they see too much of this already priced in.

Indeed, the argument on the US dollar is increasingly shifting to the trajectory of further rate cuts beyond September.

On balance we see the argument as being unsupportive of the dollar owing to the gentle slope of ascent in US interest rates.

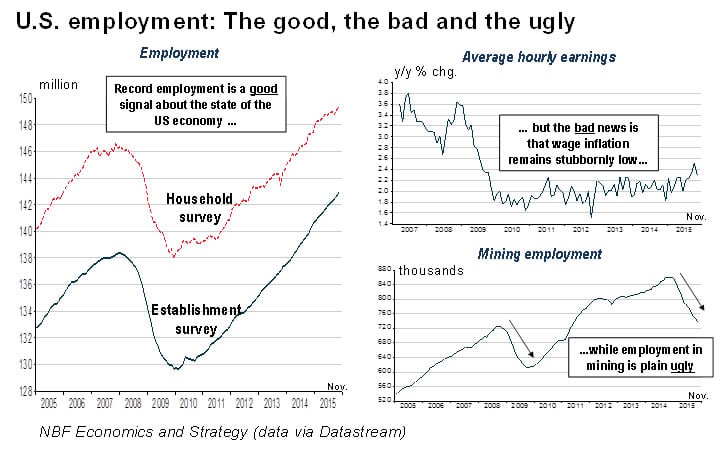

One curious element of the strong jobs report on Friday the 4th was the underwhelming growth in US wages. This may help explain a lack of upside impetus in USD following what should have been an all-out pro for the dollar.

The following was highlighted by NBF Economics and Strategy in the following chart continued in a briefing to clients this weekend:

In sum, the dynamics for the euro are looking increasingly bullish on a combination of a stubborn ECB and softer approach to future rate rises at the US Fed.

“There is a risk of more near-term short squeezes in EURUSD if the market decides to further reduce EUR shorts. We prefer to sit on the sidelines in EURUSD positions for now, but will continue to look for catalysts or better entry levels to re-engage in strategic short EURUSD positions,” says Dennis Tan at Barclays Bank in Singapore.

Barclays have advised they have closed their EURUSD short recommendation and see challenges to our 2015-end forecast of 1.03, although they maintain their 2016-end forecast at 0.95.

Should the euro to dollar exchange rate head towards the top of the longer-term sideways range around 1.12 the bank say they could consider going short again.

Technicals Will be Key

There is not much by way of data over coming days and currency markets could therefore turn to technical considerations.

"Most suggest the move in the EURUSD to near 1.10 should unwind further. Support lies at 1.0810 and 1.0760/55, while a move through the 1.10/1.11 region is needed confirm 1.0525 was another significant base and the range since March is extending," says a briefing from Lloyds Bank.

Looking at the euro/sterling Lloyds reckon that while EURGBP held important resistance around .7240/50 a decline through support at .7145 and then .7110 is needed to turn more bearish.