Euro Exchange Rate: No More Parity v Dollar as Wage Inflation Disappoints

Hopes for parity in the euro to dollar conversion have been dashed by a combination of euro 'short covering' and a complete discounting of a December interest rate rise this month.

After the ECB’s underwhelming actions announced on Thursday we have seen the agressive unwinding of EUR shorts which has lead the euro to dollar exchange rate rally back towards the 1.10 region.

"The trouble with predicting currency movements is the currency market is dominated by speculative trading which means that when expectations, such as an aggressive new round of quantitative easing from the ECB doesn’t materialise, the speculators who have 'bet' on such an expectation, all run for the exit at the same time," says Charles Purdy at Smart Currency Business.

This caused the euro to strengthen by over 3% against sterling yesterday afternoon and by 2% against the US dollar.

At the weekend the euro / dollar exchange rate is seen just above the 1.09 area as a better-than-expected US employment report reminds markets why the dollar is the currency to back longer-term.

As the balance sheets of the ECB and FOMC continue to diverge EUR gains will ultimately be contained once the post-ECB dust settles.

Excessive upside strength could ultimately be contained by the ECB which will be feeling it sent the euro in the wrong direction with their December policy changes; they may still try to convince us that the EUR remains far from a policy target but it appears they would be content for the EUR to remain comfortably on the cheap side of ‘fair value’.

The FOMC remains on course to begin tightening this December and many analysts believe the USD has reached a “mature phase in its uptrend”.

With these issues in play, Canadian Imperial Bank of Commerce's Jeremy Stretch expects EUR/USD to continue to consolidate in the broad 1.08-1.12 range.

“Without an additional deposit rate cut, a break of 2015 lows for EUR/USD looks increasingly tough to argue and expect discussions on parity to remain out of question.

“[Yesterday’s] close above the 1.0820 mark is technically significant and suggests that price action is increasingly likely to return to the familiar 1.08-1.12 range that it spent the better part of the summer in.

“For now it seems that any discussion of a return back towards 1.06 seems increasingly hard to countenance, without additional exogenous impetus.”

Commerzbank's Karen Jones is also of the opinion that the euro could maintain its recent advance:

"Having taken out the 1.0830/36 key near term resistance, there is scope for a further advance to the 1.1036 200 day ma and even the 1.1087/97 September low and 28th October high.

“Key resistance remains the 1.1261/40 2014-2015 downtrend and 55 week ma and while capped here the market will remain in a longer term down move.

“[Our recommended trade is to] reinstate small longs on dips to 1.0875, add 1.0825, stop 1.08. Partially cover 1.1035 and exit the remainder 1.1075.”

Meanwhile, professional trader Sean Lee at ForexTell sees an unstable short-term range now forming.

"A complacent EUR-short market got nastily burnt overnight and there will be more macro positions out there who will be nervous headed into the year end," says Lee, "in EUR/USD, I’d suggest a short-term volatile range between 1.0825/1.1050 whereas I still expect cable to be very toppy near 1.5250.

December Rate Rise Story Offers No More USD Upside

Meanwhile the dollar has found finding further upside traction increasingly hard to come by.

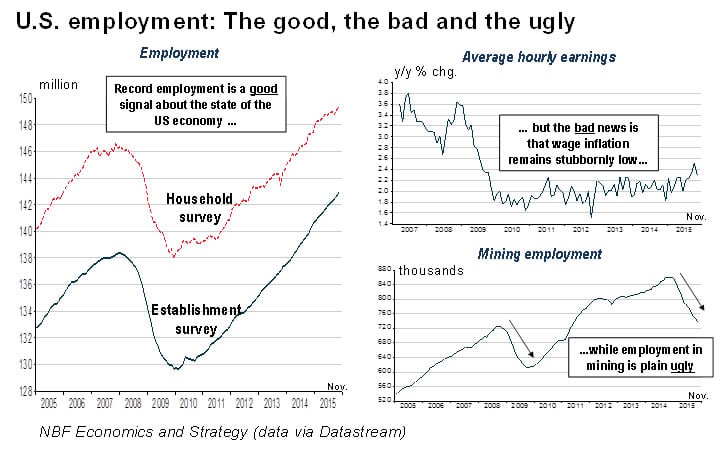

The Bureau of Labor Statistics reported today that US nonfarm payrolls rose another solid 211,000 in November, a poll of economists had placed expectations for the release at 200,000.

The numbers for the previous two months were revised up by a cumulative 35,000.

As a result, monthly job gains have averaged 218,000 over the past 3 months.

The jobless rate remained at an unchanged 5.0%, even as the participation rate rose by 0.1pp to 62.5% and average hourly earnings increased another 0.2%, following a 0.4% gain in October.

"Today’s employment report should have removed the final doubts about a rate hike at the December meeting. The clear message from the labor market to the Fed is: 'Just do it!'" says Dr. Harm Bandholz, Chief US Economist at UniCredit in New York.

Markets will now start focussing on the rate of subsequent interest rate rises, and a slow rate of change could be construed to be dollar negative as we try and predict likely currency market dynamics in 2016.

"The November payroll report surprised modestly to the upside, cementing a December hike. Front to intermediate yields look reasonable in the context of a gradual hiking cycle with downside risks," say Barclays in a briefing to clients.

Meanwhile Canada's NBF Economics and Strategy point out that one of the 'rare blemishes' in the data was the inability of wages to push higher.

The inability of wage inflation to grow is not a negative for the December rate rise, but for a currency market increasingly focussed on future rate rises, this could be a big deal and could explain why the dollar retreated following the wage report.