Euro-Dollar: Too Soon to "Pick a Top", Says ING & Spectra

- Written by: Gary Howes

Image © Adobe Images

The Euro's surge will fade, but it's too soon to call the short-term top, say analysts at ING and Spectra Markets.

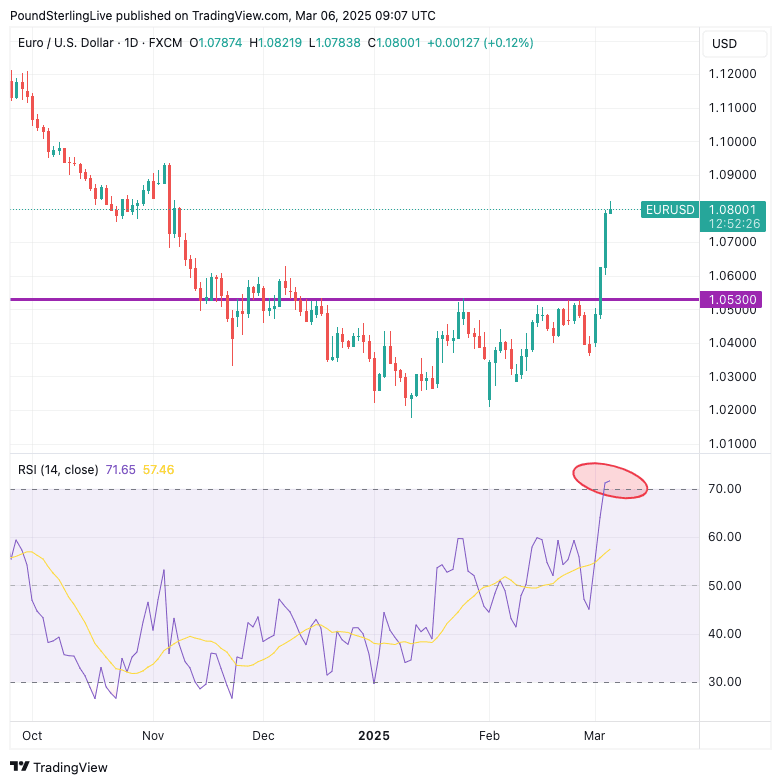

The Euro-to-Dollar exchange rate has risen a massive 4.0% this week, taking in 1.08 in early Thursday trade, leaving the pair technically overbought with the daily chart's Relative Strength Index at 71.

According to the lore of technical analysis, a reading above 70 signals an asset is overbought and due for a correction or consolidation.

"Yields and EUR/USD are now technically overbought so mean-reversion is a risk, but the repositioning of equity and bond portfolios means the price action may have further to adjust from a flow perspective," says Kenneth Broux, a strategist at Société Générale.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Francesco Pesole, FX strategist at ING Bank, points out that at the current level, the pair is only 1.2% overvalued according to his models, "and we'd be cautious to pick a top."

Of concern is a busy end to the week for currency markets that could yet offer further fuel to the rally.

To be sure, every day is an important one for financial markets under the Donald Trump presidency, but there is also the European Central Bank's interest rate decision to navigate and the U.S. labour market report due on Friday.

A soft U.S. job report is particularly worth watching as it could boost the idea that U.S. exceptionalism is fading. In 2024, it favoured the Dollar as the U.S. economy, yields and stock markets outperformed global peers.

"Markets are sinking their teeth on the repricing of U.S. exceptionalism relative to Europe," says Pesole.

Above: EURUSD overbought on the daily chart as per RSI (lower panel).

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Euro-Dollar's surge to 1.08 tracks "gargantuan moves in European yields," says Pesole.

Yields have risen this week amidst expectations for the issuance of significantly more debt in Germany and Europe to pay for investments in defence and infrastructure.

German yields spiked 30bp after the German fiscal announcement, the largest intraday move in 25 years.

Brent Donnelly, analyst and founder of Spectra Markets, says yields point to a much stronger Euro.

"There was a blockbuster announcement from Germany yesterday and stimulus is coming in the form of defense and infrastructure spending. The numbers are large and the announcement came much faster than people expected from the sclerotic European bureaucracy," says Donnelly.

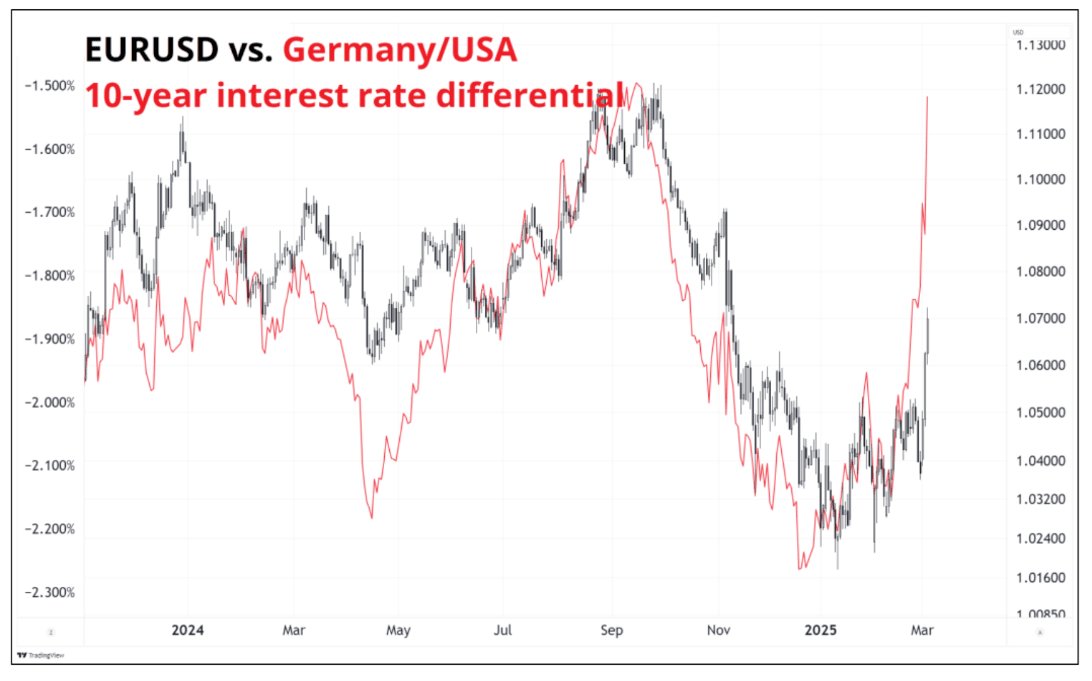

Image courtesy of Spectra Markets.

In a briefing to clients, Donnelly uses the above chart to show why yields matter for Euro-Dollar.

"Interest rate differentials, which were already pointing to way higher EURUSD for ages, have made another gigantic leg higher," he explains.

He says the chart shows interest rate differentials (the difference in bond yields in Germany and the U.S.) showed the way in Q4 2024 (red line moved first, then EURUSD dumped from 1.12 to 1.02).

"Now they moved first again. 1.10/1.12 should be the first stop," he says.